Capital One 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

Under prompt corrective action capital regulations, a bank is considered to be well capitalized if it maintains a total risk-based capital

ratio of at least 10% (200 basis points higher than the above minimum capital standard), a Tier 1 risk-based capital ratio of at least 6%,

a Tier 1 leverage capital ratio of at least 5% and not be subject to any supervisory agreement, order, or directive to meet and maintain

a specific capital level for any capital reserve. A bank is considered to be adequately capitalized if it meets the above minimum capital

ratios and does not otherwise meet the well capitalized definition. Currently, prompt corrective action capital requirements do not

apply to bank holding companies.

In addition to disclosing our regulatory capital ratios, we also disclose Tier 1 common equity and TCE ratios, which are non-GAAP

measures widely used by investors, analysts, rating agencies and bank regulatory agencies to assess the capital position of financial

services companies. There is currently no mandated minimum or “well capitalized” standard for Tier 1 common equity; instead the

risk-based capital rules state voting common stockholders’ equity should be the dominant element within Tier 1 common equity.

Management reviews our Tier 1 common equity and TCE ratios, along with other measures of capital, as part of its financial analyses

and discloses these non-GAAP capital measures because of current interest in such information on the part of market participants.

Please see “Financial Highlights” under “Executive Summary and Business Outlook” for more information on our TCE ratio. Table

35 provides the details of the calculation of our capital ratios, including a reconciliation of the total stockholders’ equity reported in

our consolidated balance sheets to Tier 1 common equity.

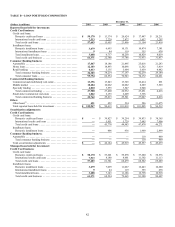

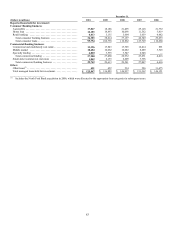

Table 35: Risk-Based Capital Components

December 31,

(Dollars in millions) 2010 2009

Total stockholders’ equity ...................................................................

.

$ 26,541 $ 26,590

Less: Net unrealized (gains) on available-for sale-securities recorded in AOCI(1) ..................

.

(368) (200)

Net losses on cash flow hedges recorded in AOCI(1) .......................................

.

86 92

Disallowed goodwill and other intangible assets ..........................................

.

(13,953) (14,125)

Disallowed deferred tax assets ..........................................................

.

(1,150)

—

Other .................................................................................

.

(2) (10)

Tier 1 common equity ......................................................................

.

11,154 12,347

Plus: Tier 1 restricted core capital items(2) .....................................................

.

3,636 3,642

Tier 1 risk-based capital ...................................................................

.

14,790 15,989

Plus: Long-term debt qualifying as Tier 2 capital ..............................................

.

2,827 3,018

Qualifying allowance for loan and lease losses ...........................................

.

3,748 1,581

Other Tier 2 components ...............................................................

.

29 4

Tier 2 risk-based capital ...................................................................

.

6,604 4,603

Total risk-based capital ....................................................................

.

$ 21,394 $ 20,592

Risk-weighted assets(3) ......................................................................

.

$ 127,043 $ 116,309

________________________

(1) Amounts presented are net of tax.

(2) Consists primarily of trust preferred securities.

(3) Under regulatory guidelines for risk-based capital, on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet

items are assigned to one of several broad risk categories according to the obligor or, if relevant, the guarantor or the nature of any collateral.

The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. The resulting weighted

values from each of the risk categories are aggregated for determining total risk-weighted assets.

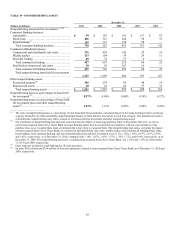

Table 36 provides a comparison of our capital ratios under the Federal Reserve’s capital adequacy standards; and the capital ratios of

the Banks under the OCC’s capital adequacy standards as of December 31, 2010 and 2009. As of December 31, 2010, we exceeded

minimum capital requirements and would meet the “well-capitalized” ratio levels specified under prompt corrective action for total

risk-based capital and Tier 1 risk-based capital under Federal Reserve capital standards for bank holding companies. As of December

31, 2010, the Banks also exceeded minimum regulatory requirements under the OCC’s applicable capital adequacy guidelines and

were “well-capitalized” under prompt corrective action requirements.