Capital One 2010 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 1

CAPITAL ONE FINANCIAL CORPORATION (COF)

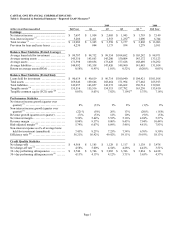

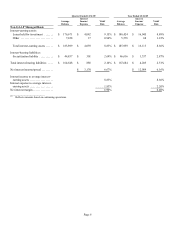

Table 1: Financial & Statistical Summary—Reported GAAP Measures(1)

2009 2008

(dollars in millions)(unaudited) Full Year Q4 Q3 Q2 Q1 (2) Full Year

Earnings

N

et interest income ......................... $ 7,697 $ 1,954 $ 2,005 $ 1,945 $ 1,793 $ 7,149

N

on-interest income (3) ....................... 5,286 1,411 1,553 1,232(4) 1,090 6,744

Total revenue (5) ............................. $ 12,983 $ 3,365 $ 3,558 $ 3,177 $ 2,883 $ 13,893

Provision for loan and lease losses ............ 4,230 844 1,173 934 1,279 5,101

Balance Sheet Statistics (Period Average)

Average loans held for investment ............ $ 99,787 $ 94,732 $ 99,354 $ 104,682 $ 103,242 $ 98,971

Average earning assets ...................... 145,310 143,663 145,280 150,804 145,172 133,123

Average assets .............................. 171,598 169,856 173,428 177,628 168,489 156,292

Average liabilities ........................... 144,992 143,338 147,426 149,960 141,485 131,014

Return on average assets (ROA) .............. 0.58% 0.95% 1.01% 0.52% (0.20)% 0.05%

Balance Sheet Statistics (Period End)

Loans held for investment ................... $ 90,619 $ 90,619 $ 96,714 $ 100,940 $ 104,921 $ 101,018

Total assets ................................. 169,646 169,646 168,464 171,994 177,462 165,913

Total liabilities .............................. 143,057 143,057 142,272 146,662 150,714 139,301

Tangible assets (A) ........................... 155,516 155,516 154,315 157,782 163,230 153,410

Tangible common equity (TCE) ratio (B) ...... 8.03% 8.03% 7.82% 7.10%(6) 5.75% 7.18%

Performance Statistics

N

et interest income growth (quarter over

quarter) (7) ................................ 8% (3)% 3% 8% (1)% 9%

N

on-interest income growth (quarter over

quarter) (7) ................................ (22) % (9)% 26% 13% (20)% (16)%

Revenue growth (quarter over quarter) ........ (7)% (5)% 12% 10% (9)% (5)%

N

et interest margin .......................... 5.30% 5.44% 5.52% 5.16% 4.94% 5.37%

Revenue margin ............................ 8.94% 9.37% 9.80% 8.43% 7.94% 10.44%

Risk-adjusted margin (C) ..................... 5.79% 6.07% 6.69% 5.46% 4.81% 7.83%

N

on-interest expense as a% of average loans

held for investment (annualized) ........... 7.43% 8.23% 7.25% 7.34% 6.76% 8.30%

Efficiency ratio (D) .......................... 56.21% 56.92% 49.92% 59.11% 59.93% 58.13%

Credit Quality Statistics

N

et charge-offs ............................. $ 4,568 $ 1,185 $ 1,128 $ 1,117 $ 1,138 $ 3,478

N

et charge-off rate (8) ........................ 4.58% 5.00% 4.54% 4.28% 4.41% 3.51%

30+ day performing delinquencies ............ $ 3,746 $ 3,746 $ 3,983 $ 3,746 $ 3,834 $ 4,418

30+ day performing delinquency rate (8) ....... 4.13% 4.13% 4.12% 3.71% 3.65% 4.37%