Capital One 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

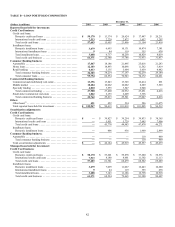

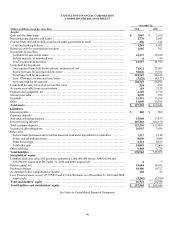

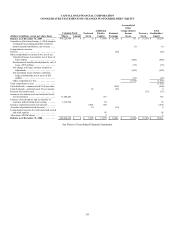

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED BALANCE SHEETS

December 31,

(Dollars in millions, except per share data) 2010 2009

Assets:

Cash and due from banks ....................................................................

.

$ 2,067 $ 3,100

Interest-bearing deposits with banks ..........................................................

.

2,776 5,043

Federal funds sold and securities purchased under agreements to resell ..........................

.

406 542

Cash and cash equivalents .................................................................

.

5,249 8,685

Restricted cash for securitization investors ....................................................

.

1,602 501

Investment in securities:

Available for sale, at fair value .............................................................

.

41,537 38,830

Held to maturity, at amortized cost .........................................................

.

0 80

Total investment in securities ..............................................................

.

41,537 38,910

Loans held for investment:

Unsecuritized loans held for investment, at amortized cost ....................................

.

71,921 75,097

Restricted loans for securitization investors .................................................

.

54,026 15,522

Total loans held for investment .............................................................

.

125,947 90,619

Less: Allowance for loan and lease losses ...................................................

.

(5,628) (4,127)

Net loans held for investment ..............................................................

.

120,319 86,492

Loans held for sale, at lower-of-cost-or-fair value ..............................................

.

228 268

Accounts receivable from securitizations ......................................................

.

118 7,128

Premises and equipment, net .................................................................

.

2,749 2,736

Interest receivable ...........................................................................

.

1,070 936

Goodwill ...................................................................................

.

13,591 13,596

Other ......................................................................................

.

11,040 10,394

Total assets ................................................................................

.

$ 197,503 $ 169,646

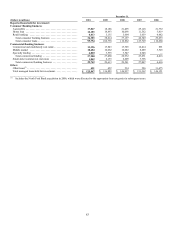

Liabilities:

Interest payable .............................................................................

.

$ 488 $ 509

Customer deposits

N

on-interest bearing deposits ................................................................

.

15,048 13,439

Interest bearing deposits .....................................................................

.

107,162 102,370

Total customer deposits .....................................................................

.

122,210 115,809

Securitized debt obligations ..................................................................

.

26,915 3,954

Other debt:

Federal funds purchased and securities loaned or sold under agreements to repurchase ..........

.

1,517 1,140

Senior and subordinated notes ..............................................................

.

8,650 9,045

Other borrowings .........................................................................

.

4,714 6,875

Total other debt ...........................................................................

.

14,881 17,060

Other liabilities .............................................................................

.

6,468 5,724

Total liabilities .............................................................................

.

170,962 143,056

Stockholders’ equity:

Common stock, par value $.01 per share; authorized 1,000,000,000 shares; 504,801,064 and

502,394,396 issued as of December 31, 2010 and 2009, respectively ..........................

.

5 5

Paid-in capital, net ..........................................................................

.

19,084 18,955

Retained earnings ...........................................................................

.

10,406 10,727

Accumulated other comprehensive income 248 83

Less: Treasury stock, at cost; 47,787,697 and 47,224,200 shares as of December 31, 2010 and 2009,

respectively ..............................................................................

.

(3,202) (3,180)

Total stockholders’ equity ..................................................................

.

26,541 26,590

Total liabilities and stockholders’ equity ....................................................

.

$ 197,503 $ 169,646

See Notes to Consolidated Financial Statements.