Capital One 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

105

longer recognize gains on loans transferred in a securitization transaction unless the transfer qualifies for sale accounting and meets

the criteria for deconsolidation under the new consolidation accounting standards.

On January 21, 2010, the Office of the Comptroller of the Currency (“OCC”) and the Federal Reserve Board (the “Federal Reserve”)

announced a final rule regarding capital requirements related to the adoption of new consolidation guidance which requires additional

capital in relation to our consolidated assets and any associated creation of loan loss reserves to be held. The rule allows for two

quarter deferral in implementing the capital requirements with a phase out of the deferral beginning in the third quarter of 2010 and

ending in the first quarter of 2011. We are utilizing this available deferral and the capital ratios reflect this treatment.

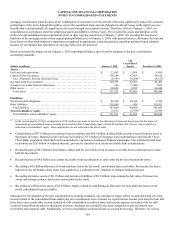

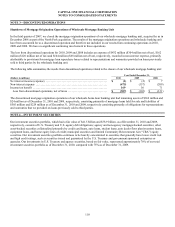

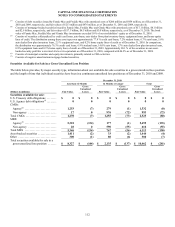

We recorded a cumulative effect adjustment of $2.9 billion in stockholders’ equity on January 1, 2010 from the adoption of the new

consolidation accounting standards. The table below summarizes the impact on certain regulatory capital ratios resulting from January

1, 2010 adoption of the new consolidation accounting standards:

January 1, 2010 December 31, 2009 Change

Tier 1 capital ..................................................... 9.93% 13.75% (3.82)%

Total capital ...................................................... 17.58 17.70 (0.12)

Tier 1 leverage .................................................... 5.84 10.28 (4.44)

Securitization of Loans

We primarily securitize credit card loans, auto loans, home loans and installment loans. Securitizations have historically been utilized

for liquidity and funding purposes. See “Note 7—Variable Interest Entities and Securitizations” and “Note 8—Goodwill and Other

Intangible Assets” for additional details. Loan securitization involves the transfer of a pool of loan receivables from our portfolio to a

trust from which the trust sells an undivided interest in the pool of loan receivables to third-party investors through the issuance of

debt securities. The debt securities are collateralized by the transferred receivables from our portfolio, and we receive proceeds from

the third-party investors in consideration for the loans transferred. We remove loans from our consolidated balance sheet when

securitizations qualify as sales to non-consolidated VIEs. Alternatively, when the transfer does not qualify as a sale but instead is

considered a secured borrowing or when the sale is to a consolidated VIE, the asset will remain on our consolidated financial

statements with an offsetting liability recognized for the amount of proceeds received.

Goodwill and Other Intangible Assets

Goodwill resulting from business combinations prior to January 1, 2009 represents the excess of the purchase price over the fair value

of the net assets of businesses acquired. Goodwill resulting from business combinations after January 1, 2009, is generally determined

as the excess of the fair value of the consideration transferred, plus the fair value of any noncontrolling interests in the acquiree, over

the fair value of the net assets acquired and liabilities assumed as of the acquisition date.

Goodwill and indefinite-lived intangible assets are not amortized. Rather, they are tested for impairment at least annually or more

frequently if events or changes in circumstances indicate that the asset might be impaired. Goodwill is the only intangible asset with

an indefinite life on our consolidated balance sheets. We have elected October 1 as the date to perform our annual goodwill

impairment test. Intangible assets with definite useful lives are amortized either on a straight-line or on an accelerated basis over their

estimated useful lives and evaluated for impairment whenever events or changes in circumstances indicate the carrying amount of the

assets may not be recoverable.

Other Assets

We report our investment in Federal Home Loan Bank (“FHLB”) stock, which totaled $269 million and $264 million as of

December 31, 2010 and 2009, respectively, and our investment in Federal Reserve stock, which totaled $861 million and $778

million, as of December 31, 2010 and 2009, respectively, in other assets on our consolidated balance sheets. We carry these

investments at cost and assess for other-than-temporary impairment in accordance with applicable accounting guidance for evaluating

impairment. We did not recognize any impairment on these investments in 2010 or 2009.

Mortgage Servicing Rights

Mortgage servicing rights (“MSRs”) are recorded at fair value when mortgage loans are sold or securitized in the secondary market

and the right to service these loans is retained for a fee. Changes in fair value are recognized in mortgage servicing and other income.

We continue to operate a mortgage servicing business and report the changes in the fair value of MSRs in earnings. To evaluate and

measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan type, note rate and investor