Capital One 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

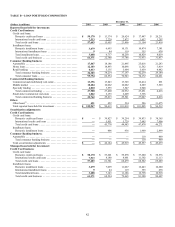

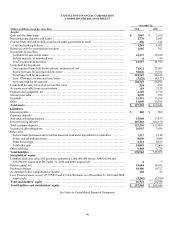

TABLE D—NONPERFORMING ASSETS

December 31,

(Dollars in millions) 2010 2009 2008 2007 2006

N

onperforming loans held for investment: (1) (2)

Consumer Banking business:

Automobile ..................................

.

$ 99 $ 143 $ 165 $ 157 $ 87

Home loan ..................................

.

486 323 104 98 55

Retail banking(3) .............................

.

145 121 150 58

—

Total consumer banking business ............

.

730 587 419 313 142

Commercial Banking business:

Commercial and multifamily real estate ........

.

276 429 142 29 14

Middle market ...............................

.

133 104 39 29 11

Specialty lending ............................

.

48 74 37 6

—

Total commercial lending ...................

.

457 607 218 64 25

Small-ticket commercial real estate ............

.

38 95 167 16

—

Total commercial banking business ..........

.

495 702 385 80 25

Total nonperforming loans held for investment

.........................................

.

1,225 1,289 804 393 167

Other nonperforming assets:

Foreclosed property(4) ........................

.

306 234 89 48 16

Repossessed assets ...........................

.

20 24 66 57 31

Total nonperforming assets .................

.

$ 1,551 $ 1,547 $ 959 $ 498 $ 214

N

onperforming loans as a percentage of loans held

for investment(2) ..............................

.

0.97% 0.94% 0.80% 0.39% 0.17%

N

onperforming assets as a percentage of loans held

for investment plus total other nonperforming

assets(2) ......................................

.

1.23% 1.13% 0.95% 0.49% 0.22%

________________________

(1) The ratio of nonperforming loans as a percentage of total loans held for investment is calculated based on the nonperforming loans in each loan

category divided by the total outstanding unpaid principal balance of loans held for investment in each loan category. The denominator used in

calculating the nonperforming asset ratios consists of total loans held for investment and other nonperforming assets.

(2) Our calculation of nonperforming loan and asset ratios includes the impact of loans acquired from Chevy Chase Bank. However, we do not

report loans acquired from Chevy Chase Bank as nonperforming unless they do not perform in accordance with our expectations as of the

purchase date, as we recorded these loans at estimated fair value when we acquired them. The nonperforming loan ratios, excluding the impact

of loans acquired from Chevy Chase Bank, for commercial and multifamily real estate, middle market, total commercial banking, home loans,

retail banking, total consumer banking, and total nonperforming loans held for investment were 2.11%, 1.30%, 1.69%, 6.67%, 2.16%, 2.30%

and 1.02%, respectively, as of December 31, 2010, compared with 3.18%, 1.07%, 2.43%, 3.75%, 1.78%, 1.75%, and 0.99%, respectively, as of

December 31, 2009. The nonperforming asset ratio, excluding loans acquired from Chevy Chase Bank, was 1.29% and 1.19% as of December

31, 2010 and 2009, respectively.

(3) Other loans are included in retail banking for all years presented.

(4) Includes $201 million and $154 million of foreclosed properties related to loans acquired from Chevy Chase Bank, as of December 31, 2010 and

2009, respectively.