Capital One 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

135

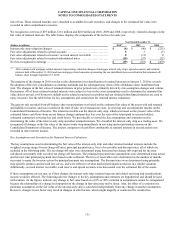

Based on the comparison of fair value to carrying amount, as calculated using the methodology summarized above, fair value

exceeded the carrying amount for all reporting units as of our annual testing date. Therefore, the goodwill of our reporting units was

considered not impaired, and the second step of impairment testing was unnecessary. However, assuming all other factors were held

constant, a 34% decline in the fair value of the Domestic Card reporting unit, a 14% decline in the fair value of the International Card

reporting unit, a 37% decline in the fair value of the Auto Finance reporting unit, a 21% decline in the fair value of the other

Consumer Banking and a 30% decline in the fair value of the other Commercial Banking reporting unit reporting unit would have

caused the carrying amount for those reporting units to be in excess of fair value which would require the second step to be performed.

As part of our annual impairment test, we assessed our market capitalization based on the average market price relative to the

aggregate fair value of our reporting units and determined that any excess fair value in our reporting units at that time could be

attributed to a reasonable control premium compared to historical control premiums seen in the industry. During 2009, the lack of

liquidity in the financial markets and the continued economic deterioration led to a decline in market capitalization resulting in

significantly higher control premiums than what had been seen historically. Throughout 2010, our capitalization rate increased

resulting in a decline in our implied control premium. We will continue to regularly monitor our market capitalization in 2011, overall

economic conditions and other events or circumstances that may result in an impairment of goodwill in the future.

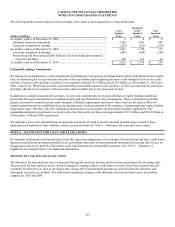

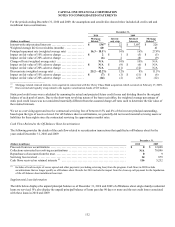

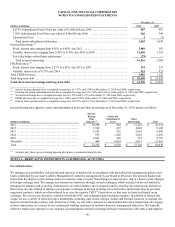

The following table provides a summary of goodwill as of December 31, 2010 and 2009:

(Dollars in millions)

Total Company National

Lending Local

Banking Credit

Card Consumer Commercial Other Total

Balance as of December 31, 2009 ... $ 0 $ 0 $ 4,693 $ 4,585 $ 4,318 $ 0 $ 13,596

Other adjustments .................... 0 0 (3) (2) 0 0 (5)

Balance as of December 31, 2010 ... $ 0 $ 0 $ 4,690 $ 4,583 $ 4,318 $ 0 $ 13,591

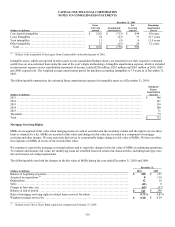

(Dollars in millions)

Total Company

National

Lending

Local

Banking

Credit

Card Consumer Commercial Other (1) Total

Balance as of December 31, 2008 ...... $ 5,303 $ 6,661 $ 0 $ 0 $ 0 $ 0 $ 11,964

Other adjustments .................... 9 0 1 0 (3) 0 7

Acquisition .......................... 0 0 0 0 0 1,625 1,625

Segment reorganization ............... (5,312) (6,661) 4,692 4,585 4,321 (1,625) 0

Balance as of December 31, 2009 . . . $ 0 $ 0 $ 4,693 $ 4,585 $ 4,318 $ 0 $ 13,596

________________________

(1) Goodwill attributed to the Chevy Chase Bank acquisition was initially recorded in the “Other” category until the segment reorganization.

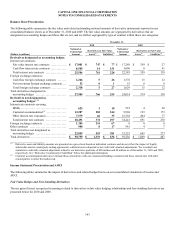

Other Intangible Assets

In connection with the acquisition of Chevy Chase Bank, we recorded intangible assets of $278 million that consisted of core deposit

intangibles, trust intangibles, lease intangibles, and other intangibles, which are subject to amortization. The core deposit and trust

intangibles reflect the estimated value of deposit and trust relationships. The lease intangibles reflect the difference between the

contractual obligation under current lease contracts and the fair market value of the lease contracts at the acquisition date. The

purchased credit card relationship reflects the difference between the purchase price and the fair value of the credit card loans acquired

in the Sony acquisition. The other intangible items relate to customer lists and brokerage relationships.

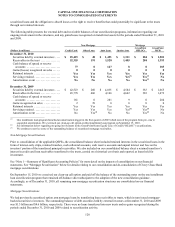

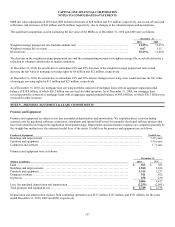

The following table summarizes our intangible assets subject to amortization:

December 31, 2010

(Dollars in millions)

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

Remaining

Amortization

Period

Core deposit intangibles ....................................... $ 1,562 $ (912) $ 650 7.0 years

Lease intangibles ............................................ 54 (28) 26 21.7 years

Purchased credit card relationship intangible(1) .................. 47 (5) 42 6.1 years

Trust intangibles ............................................. 11 (5) 6 12.9 years

Other intangibles ............................................. 35 (26) 9 3.3 years

Total ...................................................... $ 1,709 $ (976) $ 733