Capital One 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

99

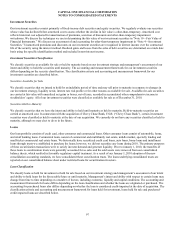

to-value ratio; the geographic location of the borrower or collateral and internal risk ratings. In connection with the acquisition of

Chevy Chase Bank on February 27, 2009, we concluded that the substantial majority of loans we acquired from Chevy Chase Bank

were PCI. See “Note 2—Acquisitions and Restructuring Activities” and “Note 5—Loans” for additional information.

In determining the fair value of purchased credit-impaired loans at acquisition, we first determine the contractually required payments

due, which represent the total undiscounted amount of all uncollected principal and interest payments, adjusted for the effect of

estimated prepayments. We then estimate the undiscounted cash flows we expect to collect. We incorporate several key assumptions

to estimate cash flows expected to be collected, including default rates, loss severities and the amount and timing of prepayments. We

calculate the fair value by discounting the estimated cash flows we expect to collect using an observable market rate of interest, when

available, adjusted for factors that a market participant would consider in determining fair value. Purchasers are permitted to aggregate

credit-impaired loans acquired in the same fiscal quarter into one or more pools if the loans have common risk characteristics. A pool

is then accounted for as a single asset with a single composite interest rate and an aggregate fair value and expected cash flows.

The difference between contractually required payments due and the cash flows expected to be collected at acquisition, considering

the impact of prepayments, is referred to as the nonaccretable difference. The nonaccretable difference, which is neither accreted into

income nor recorded on our consolidated balance sheet, reflects estimated future credit losses expected to be incurred over the life of

the loan. The excess of cash flows expected to be collected over the estimated fair value of purchased credit-impaired loans is referred

to as the accretable yield. This amount is not recorded on our consolidated balance sheet, but is accreted into interest income over the

remaining life of the loan, or pool of loans, using the effective yield method.

Subsequent to acquisition, we complete quarterly evaluations of expected cash flows. Decreases in expected cash flows attributable to

credit will generally result in an impairment charge to the provision for loan and lease losses and the establishment of an allowance for

loan and lease losses. Increases in expected cash flows will generally result in a reduction in any allowance for loan and lease losses

established subsequent to acquisition and an increase in the accretable yield through a reclassification from the nonaccretable

difference. The adjusted accretable yield is recognized in interest income over the remaining life of the loan, or pool of loans.

Disposals of loans, which may include sales of loans to third parties, receipt of payments in full or part by the borrower, and

foreclosure of the collateral result in removal of the loan from the purchased credit-impaired loan portfolio at its carrying amount.

Because the initial fair value of PCI loans recorded at acquisition includes an estimate of credit losses expected to be realized over the

remaining lives of the loans, we separately track and report PCI loans and exclude these loans from our delinquency and

nonperforming loan statistics. Even though substantially all of these loans are 90 days or more contractually past due, they are

considered to be accruing because the interest income on these loans relates to the establishment of an accretable yield that is accreted

into interest income over the estimated life of the purchased credit-impaired loans using the effective yield method.

For acquired loans that are not deemed impaired at acquisition, subsequent to acquisition we recognize the difference between the

initial fair value at acquisition and the undiscounted expected cash flows in interest income over the life of the loans using the

effective yield method.

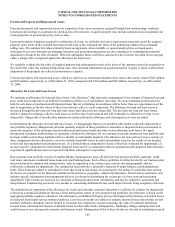

Loan Modifications and Restructurings

As part of our loss mitigation efforts, we may make loan modifications that are intended to minimize the economic loss and to avoid

the need for foreclosure or repossession of collateral. We may provide short-term (three to twelve months) or long-term (greater than

twelve months) modifications to a borrower experiencing financial difficulty to improve long-term loan performance and

collectability. Our modifications typically include a reduction in the borrower’s initial monthly or quarterly principal and interest

payment through an extension of the loan term, a reduction in the interest rate, or a combination of both. For credit card loan

agreements, such modifications may include canceling the customer’s available line of credit on the credit card, reducing the interest

rate on the card, and placing the customer on a fixed payment plan not exceeding 60 months. These modifications may result in our

receiving the full amount due, or certain installments due, under the loan over a period of time that is longer than the period of time

originally provided for under the terms of the loan. In some cases, we may curtail the amount of principal owed by the borrower.

A loan modification in which a concession is granted to a borrower experiencing financial difficulty is accounted for as a troubled

debt restructuring (“TDR”). We describe our accounting for and measurement of impairment on restructured loans below under

“Impaired Loans.” See “Note 5—Loans” for additional information on our loan modifications and restructurings.

Delinquent and Nonperforming Loans

The entire balance of a loan is considered contractually delinquent if the minimum required payment is not received by the first

statement cycle date equal to or following the due date specified on the customer’s billing statement. Delinquency is reported on loans