Capital One 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

106

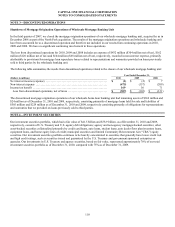

servicing requirements. We determine the fair value of MSRs based on the present value of the estimated future cash flows of net

servicing income. We use assumptions in the valuation model that market participants use when estimating future net servicing

income, including prepayment speeds, discount rates, default rates, cost to service, escrow account earnings, contractual servicing fee

income, ancillary income and late fees. This model is highly sensitive to changes in certain assumptions. Different anticipated

prepayment speeds, in particular, can result in substantial changes in the estimated fair value of MSRs. If actual prepayment

experience differs from the anticipated rates used in the model, this difference could result in a material change in the value of our

MSRs.

MSRs, which are included in other assets on our consolidated balance sheets, totaled $141 million and $240 million as of

December 31, 2010 and 2009, respectively. Our acquisition of Chevy Chase Bank resulted in additional mortgage servicing rights of

$110 million as of the acquisition date. See “Note 8—Goodwill and Other Intangible Assets” and “Note 7—Variable Interest Entities

and Securitizations” for additional information.

Upon adoption of the accounting consolidation guidance, certain mortgage loans that had been securitized and accounted for as a sale

were subject to consolidation and accounted for as a secured borrowing. Accordingly, effective January 1, 2010, mortgage

securitization trusts that contain approximately $1.6 billion of mortgage loans and related debt securities issued to third party investors

were consolidated and the retained interests and mortgage servicing rights related to these newly consolidated trusts were eliminated

in consolidation. See “Note 1—Summary of Significant Accounting Policies” and ”Note 8—Goodwill and Other Intangible Assets”

for additional information.

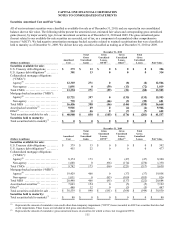

Fair Value

Fair value is defined as the price that would be received for an asset or paid to transfer a liability in an orderly transaction between

market participants on the measurement date (also referred to as an exit price). The fair value accounting guidance provides a three-

level fair value hierarchy for classifying financial instruments. This hierarchy is based on whether the inputs to the valuation

techniques used to measure fair value are observable or unobservable. Fair value measurement of a financial asset or liability is

assigned to a level based on the lowest level of any input that is significant to the fair value measurement in its entirety. The three

levels of the fair value hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets or liabilities.

Level 3: Unobservable inputs.

Under the fair value accounting guidance, an entity has the irrevocable option to elect, on a contract-by-contract basis, to measure

certain financial assets and liabilities at fair value at inception of the contract and thereafter, with any changes in fair value recorded in

current earnings. We did not make any material fair value option elections as of and for the years ended December 31, 2010 and 2009.

See “Note 19—Fair Value of Financial Instruments” for additional information.

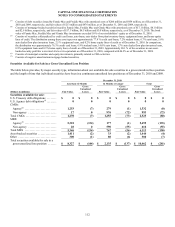

Representation and Warranty Reserve

In connection with their sales of mortgage loans, our subsidiaries entered into agreements containing varying representations and

warranties about, among other things, the ownership of the loan, the validity of the lien securing the loan, the loan’s compliance with

any applicable loan criteria established by the purchaser, including underwriting guidelines and the ongoing existence of mortgage

insurance, and the loan’s compliance with applicable federal, state and local laws. We may be required to repurchase the mortgage

loan, indemnify the investor or insurer, or reimburse the investor for credit losses incurred on the loan in the event of a material breach

of contractual representations or warranties.

We have established representation and warranty reserves for losses that we consider to be both probable and reasonably estimable

associated with the mortgage loans sold by each subsidiary, including both litigation and non-litigation liabilities. The reserve-setting

process relies heavily on estimates, which are inherently uncertain, and requires the application of judgment. In establishing the

representation and warranty reserves, we consider a variety of factors, depending on the category of purchaser and rely on historical

data. We evaluate these estimates on a quarterly basis. Losses incurred on loans that we are required to either repurchase or make

payments to the investor under the indemnification provisions are charged against the reserve. The representation and warranty reserve

is included in other liabilities. Changes to the representation and warranty reserve related to GreenPoint are reported as discontinued

operations for all periods presented. See “Note 21—Commitments, Contingencies and Guarantees” for additional information related

to our representation and warranty reserve.