Capital One 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

123

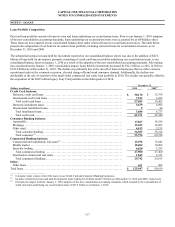

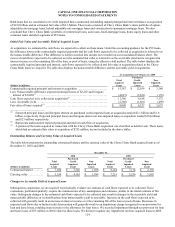

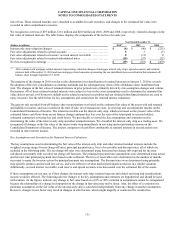

Impaired Loans and Troubled Debt Restructurings

A loan is considered impaired when, based on current information and events, it is probable that we will be unable to collect all

amounts due from the borrower in accordance with the original contractual terms of the loan. Loans with insignificant delays or

insignificant short falls in the amount of payments expected to be collected are not considered to be impaired. Loans defined as

individually impaired, based on applicable accounting guidance, include larger balance nonperforming loans and TDR loans. The

following table presents information about our impaired loans, excluding purchased credit-impaired loans, which are reported

separately and discussed below:

December 31, 2010

(Dollars in millions) With an

Allowance

Without

an

Allowance

Total

Recorded

Investment Related

Allowance

Net

Recorded

Investment

Unpaid

Principal

Balance

Average

Recorded

Investment

Interest

Income

Recognized

Credit card:

Domestic ............

.

$ 753 $ 0 $ 753 $ 253 $ 500 $ 739 $ 644 $ 76

International .........

.

160 0 160 133 27 154 128 0

Total credit card .....

.

913 0 913 386 527 893 772 76

Consumer:

Auto ................

.

0 0 0 0 0 0 0 0

Home loan ..........

.

57 0 57 1 56 57 28 1

Retail banking .......

.

23 17 40 1 39 51 46 1

Total consumer ......

.

80 17 97 2 95 108 74 2

Commercial:

Commercial and

multifamily real

estate .............

.

40 283 323 6 317 436 385 4

Middle market .......

.

25 95 120 7 113 156 109 1

Specialty lending ....

.

1 20 21 0 21 22 35 0

Total commercial

lending ............

.

66 398 464 13 451 614 529 5

Small-ticket

commercial real

estate .............

.

16 20 36 2 34 73 41 1

Total commercial ....

.

82 418 500 15 485 687 570 6

Other:

Other loans ..........

.

0 0 0 0 0 0 0 0

Total ................

.

$ 1,075 $ 435 $ 1,510 $ 403 $ 1,107 $ 1,688 $ 1,416 $ 84

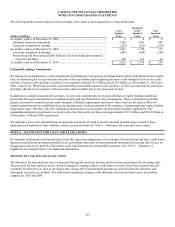

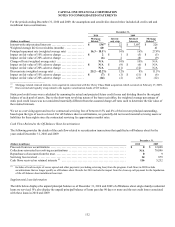

TDR loans accounted for $1.1 billion of impaired loans as of December 31, 2010. Consumer and commercial TDR loans classified as

performing totaled $79 million and $970 million, respectively, as of December 31, 2010.

We had $1.0 billion in total impaired loans as of December 31, 2009, consisting of impaired credit card and other consumer loans of

$323 million and impaired commercial loans of $724 million. TDR loans accounted for $280 million of the impaired loans as of

December 31, 2009. Consumer and commercial TDR loans classified as performing totaled $21 million and $239 million,

respectively, as of December 31, 2009. The average recorded investment in consumer and commercial impaired loans was $839

million and $686 million, respectively, in 2009. The recorded investment in impaired loans requiring an allowance was $512 million

as of December 31, 2009, and the related allowance was $131 million. Interest income recognized on impaired loans totaled $63

million in 2009.

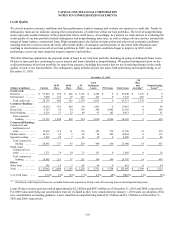

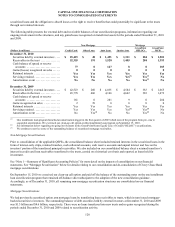

Purchased Credit Impaired Loans

In connection with the acquisition of Chevy Chase Bank on February 27, 2009, we acquired loans with a contractual outstanding

unpaid principal and interest balance at acquisition of $15.4 billion. We recorded these loans on our consolidated balance sheet at

estimated fair value at the date of acquisition of $9.0 billion. We concluded that the substantial majority of the loans we acquired from

Chevy Chase Bank were PCI loans. PCI loans are acquired loans with evidence of credit quality deterioration since origination for

which it is probable at the date of purchase that we will be unable to collect all contractually required payments. The Chevy Chase