Capital One 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

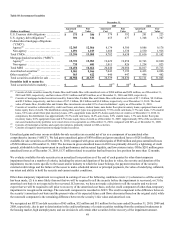

40

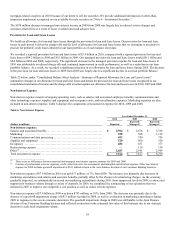

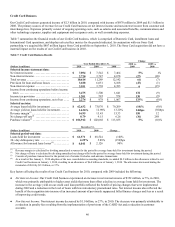

Credit Card Business

Our Credit Card business generated income of $2.3 billion in 2010, compared with income of $978 million in 2009 and $1.1 billion in

2008. The primary sources of revenue for our Credit Card business are net interest income and non-interest income from customer and

interchange fees. Expenses primarily consist of ongoing operating costs, such as salaries and associated benefits, communications and

other technology expenses, supplies and equipment and occupancy costs, as well as marketing expenses.

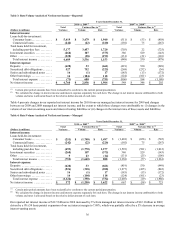

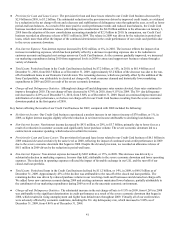

Table 7 summarizes the financial results of our Credit Card business, which is comprised of Domestic Card, installment loans and

International Card operations, and displays selected key metrics for the periods indicated. In conjunction with our Sony Card

partnership, we acquired the $807 million legacy Sony Card portfolio on September 1, 2010. The Sony Card acquisition did not have a

material impact on the results of our Credit Card business in 2010.

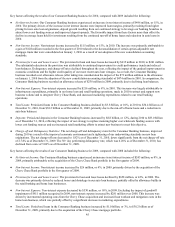

Table 7: Credit Card Business Results

Change

Year Ended December 31, 2010 vs.

2009

2009 vs.

2008

(Dollars in millions) 2010 2009 2008

Selected income statement data:

N

et interest income ...........................

.

$ 7,894 $ 7,542 $ 7,464 5% 1%

N

on-interest income ...........................

.

2,720 3,747 4,678 (27) (20)

Total revenue .................................

.

10,614 11,289 12,142 (6) (7)

Provision for loan and lease losses ..............

.

3,188 6,051 6,108 (47) (1)

N

on-interest expense ..........................

.

3,951 3,738 4,393 6 (15)

Income from continuing operations before income

taxes .......................................

.

3,475 1,500 1,641 132 (9)

Income tax provision ..........................

.

1,201 522 574 130 (9)

Income from continuing operations, net of tax . . .

.

$ 2,274 $ 978 $ 1,067 133% (8)%

Selected metrics:

Average loans held for investment ..............

.

$ 62,632 $ 73,076 $ 79,209 (14)% (8)%

Average yield on loans held for investment ......

.

14.36% 12.90% 13.20% 146bps (30)bps

Revenue margin(1) .............................

.

16.95 15.45 15.33 150 12

N

et charge-off rate(2) ..........................

.

8.79 9.15 6.26 (36) 289

Purchase volume(3) ............................

.

$ 106,912 $ 102,068 $ 113,835 5% (10)%

December 31,

(Dollars in millions) 2010 2009 Change

Selected period-end data:

Loans held for investment .....................

.

$ 61,371 $ 68,524 (10)%

30+ day delinquency rate ......................

.

4.29% 5.88% (159)bps

Allowance for loan and lease losses(4) ...........

.

$ 4,041 $ 2,126 90%

________________________

(1) Revenue margin is calculated by dividing annualized revenues for the period by average loans held for investment during the period.

(2) Net charge-off rate is calculated by dividing annualized net charge-offs for the period by average loans held for investment during the period.

(3) Consists of purchase transactions for the period, net of returns. Excludes cash advance transactions.

(4) As a result of the January 1, 2010 adoption of the new consolidation accounting standards, we added $4.2 billion to the allowance related to our

Credit Card business on January 1, 2010, resulting in an allowance of $6.4 billion as of January 1, 2010. The allowance decreased during the

remainder of 2010 by $2.3 billion, or 37%.

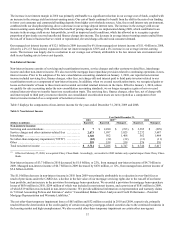

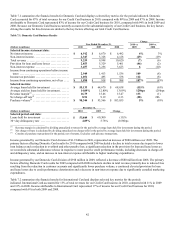

Key factors affecting the results of our Credit Card business for 2010, compared with 2009 included the following:

● Net Interest Income: Our Credit Card business experienced an increase in net interest income of $352 million, or 5%, in 2010,

which was primarily attributable to higher asset yields that more than offset a decline in average loans held for investment. The

increase in the average yield on our credit card loan portfolio reflected the benefit of pricing changes that were implemented

during 2009 and a reduction in the level of loans with low introductory promotional rates. Net interest income also reflected the

benefit of the recognition into income of an increased amount of previously suppressed billed finance charges and fees as a result

of improving credit trends.

● Non-Interest Income: Non-interest income decreased by $1.0 billion, or 27%, in 2010. The decrease was primarily attributable to

a reduction in penalty fees resulting from the implementation of provisions of the CARD Act and a reduction in customer

accounts.