Capital One 2010 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

156

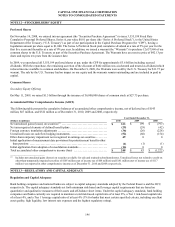

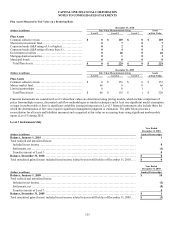

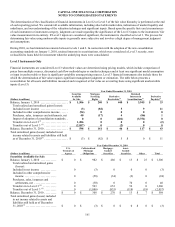

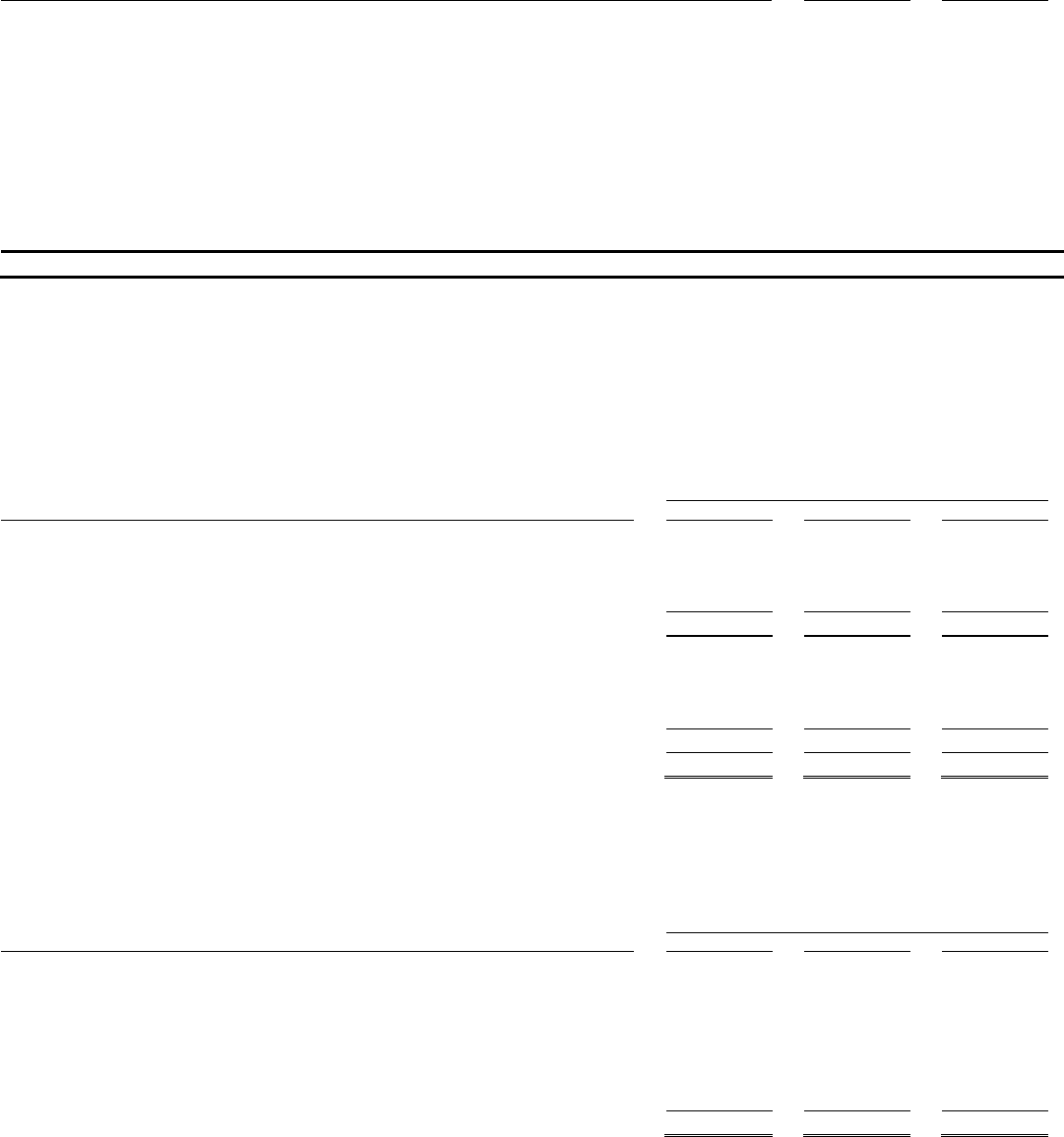

Expected future benefit payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

(Dollars in millions) Pension

Benefits Postretirement

Benefits

2011 ...................................................................................... $ 14 $ 4

2012 ...................................................................................... 14 4

2013 ...................................................................................... 13 5

2014 ...................................................................................... 14 5

2015 ...................................................................................... 13 5

2016 - 2020 ............................................................................... 63 26

In 2011, $1 million in contributions are expected to be made to the pension plans, and $2 million in contributions are expected to be

made to other postretirement benefits plans. In addition, the estimated payment for 2010 net benefits of $2 million will be paid from

the postretirement benefit plan’s assets early in 2011.

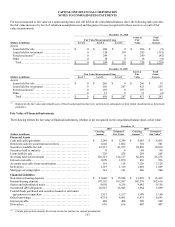

NOTE 18—INCOME TAXES

We account for income taxes in accordance with the accounting guidance prescribed by the FASB, recognizing the current and

deferred tax consequences of all transactions that have been recognized in the consolidated financial statements using the provisions of

enacted tax laws. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis

of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected

to reverse. Valuation allowances are recorded to reduce deferred tax assets to an amount that is more likely than not to be realized.

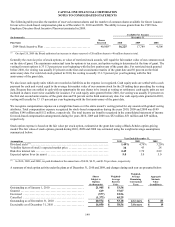

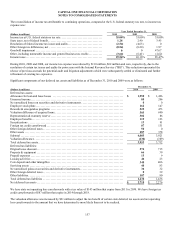

Significant components of the provision for income taxes attributable to continuing operations were as follows:

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Current income tax provision:

Federal taxes .............................................................. $ (152) $ 278 $ 1,069

State taxes ................................................................ 31 35 53

International taxes ......................................................... 122 22 32

Total current provision ..................................................... $ 1 $ 335 $ 1,154

Deferred income tax provision:

Federal taxes .............................................................. $ 1,121 $ 9 $ (644)

State taxes ................................................................ 87 (6) (3)

International taxes ......................................................... 71 11 (10)

Total deferred provision (benefit) ........................................... $ 1,279 $ 14 $ (657)

Total income tax provision ................................................. $ 1,280 $ 349 $ 497

Income tax benefits of $2 million, $793 million and $32 million in 2010, 2009 and 2008, respectively, were allocated directly to

reduce goodwill from acquisitions.

Income tax provision (benefit) reported in stockholders’ equity was as follows:

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Foreign currency translation gains (losses) ................................... $ 6 $ (9) $ 7

N

e

t

unrealized securities gains (losses) ...................................... 48 521 (421)

Other-than-temporary impairment on securities .............................. 27 0 0

N

et unrealized derivative gains ............................................. 5 61 28

Adoption of new consolidation accounting standards ......................... (1,642) 0 0

Employee stock plans ...................................................... 10 16 11

Employee retirement plans ................................................. 0 7 (55)

Total income tax provision (benefit) ......................................... $ (1,546) $ 596 $ (430)