Capital One 2010 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

173

documentation, monoline bond insurers typically initiate litigation. Accordingly, our reserves for the Active Insured Securitization

category are not based upon the historical repurchase rate with monoline bond insurers, but rather upon the expected resolution of

litigation with the monoline bond insurers. Every bond insurer within this category is pursuing a substantially similar litigation

strategy either through active or probable litigation. Accordingly, our representation and warranty reserves for this category are

litigation reserves. In establishing litigation reserves for this category, we consider current and future losses inherent within the

securitization and apply legal judgment to the anticipated factual and legal record to estimate the lifetime legal liability for each

securitization. Our estimated legal liability for each securitization within this category assumes that we will be responsible for only a

portion of the losses inherent in each securitization. Our litigation reserves with respect to both the U.S. Bank Lawsuit and the DBSP

Lawsuit, in each case as discussed below, are contained within the Active Insured Securitization reserve category. Further, our

litigation reserves with respect to indemnification risks from certain representation and warranty lawsuits brought by monoline bond

insurers against third-party securitizations sponsors, where GreenPoint provided some or all of the mortgage collateral within the

securitization but is not a defendant in the litigation, are also contained within this category.

For the $5 billion original principal balance of mortgage loans in the Inactive Insured Securitizations category and the $82 billion

original principal balance of mortgage loans in the Uninsured Securitizations and other whole loans sales category, we establish

reserves by relying on our historical repurchase rates to estimate repurchase liabilities for these categories over the next twelve (12)

months. We do not believe we can estimate repurchase liability for these categories for a period longer than 12 months because of the

relatively sporadic nature of repurchase requests from these categories. Although we have not seen any significant activity from new

counterparties from these categories, there has been a recent uptick in negotiation intensity from some counterparties who had

submitted repurchase claims in earlier quarters with respect to whole loans. In addition, some Uninsured Securitization investors from

this category have not made repurchase requests or filed representation and warranty lawsuits, but instead have filed class actions

under federal and state securities laws against investment banks and securitization sponsors. Although we face some indemnity risks

from these litigations, we have not established reserves with respect to these indemnity risks because we do not consider them to be

both probable and reasonably estimable liabilities.

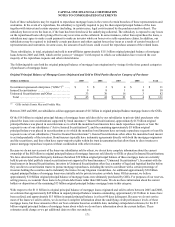

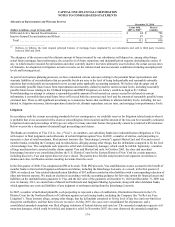

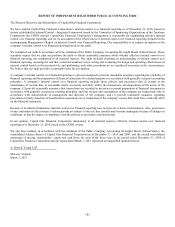

The aggregate reserves for all three subsidiaries were $816 million as of December 31, 2010 as compared with $238 million as of

December 31, 2009. We recorded a total provision for repurchase losses for our representation and warranty repurchase exposure of

$636 million for the year ended December 31, 2010. During 2010, we had settlements of repurchase requests totaling $58 million that

were charged against the reserve. The table below summarizes changes in our representation and warranty reserves for the twelve

months ended December 31, 2010 and 2009.

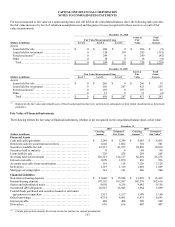

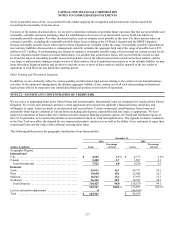

Changes in Representation and Warranty Reserves

Year Ended December 31,

(Dollars in millions) 2010 2009

Representation and warranty repurchase reserve, beginning of period(1) ..........................

.

$ 238 $ 140

Provision for repurchase losses(2) .............................................................

.

636(3) 181

N

et realized losses ..........................................................................

.

(58) (83)

Representation and warranty repurchase reserve, end of period(1) ................................

.

$ 816 $ 238

________________________

(1) Reported in our consolidated balance sheets as a component of other liabilities.

(2) The portion of the provision for mortgage repurchase claims recognized in our consolidated statements of income as a component of non-

interest income totaled $204 million and $19 million for the twelve months ended December 31, 2010 and 2009. The portion of the provision for

mortgage repurchase claims recognized in our consolidated statements of income as a component of discontinued operations totaled $432

million and $162 million, pre-tax, for the twelve months ended December 31, 2010 and 2009.

(3) Includes increases to the representation and warranty reserves in the first and second quarter of 2010 due primarily to counterparty activity and

our ability to extend the timeframe over which we estimate our repurchase liability for mortgage loans sold by our subsidiaries to GSEs and

those mortgage loans placed into Active Insured Securitizations for the full life of the mortgage loans sold by our subsidiaries for groups of

loans for which we believe repurchases are probable. More specifically, of the $636 million increase in representation and warranty reserves for

the twelve months ended December 31, 2010, approximately $407 million resulted from our ability to extend repurchase liability estimates to

the life of the loan effective in the second quarter of 2010. The remaining $229 million related primarily to changing counterparty activity in the

form of updated estimates around active and probable litigation, most of which occurred in the first quarter of 2010.

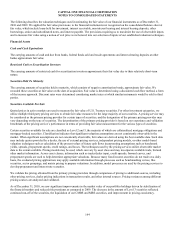

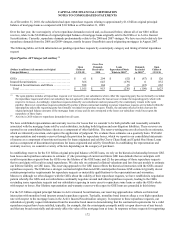

As indicated in the table below, almost all of the reserves relate to the $11 billion in original principal balance of mortgage loans sold

directly to the GSEs and to the $13 billion in mortgage loans sold to purchasers who placed them into Active Insured Securitizations.