Capital One 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

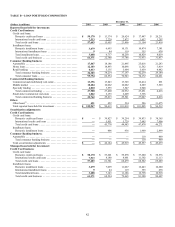

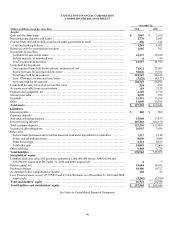

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31,

(Dollars in millions, except per share data) 2010 2009 2008

Interest income:

Loans held for investment, including past-due fees ..............................

.

$ 13,934 $ 8,757 $ 9,460

Investment securities .........................................................

.

1,342 1,610 1,224

Other .......................................................................

.

77 297 428

Total interest income .......................................................

.

15,353 10,664 11,112

Interest expense:

Deposits ....................................................................

.

1,465 2,093 2,512

Securitized debt obligations ...................................................

.

809 282 550

Senior and subordinated notes .................................................

.

276 260 445

Other borrowings ............................................................

.

346 332 456

Total interest expense ......................................................

.

2,896 2,967 3,963

Net interest income ........................................................

.

12,457 7,697 7,149

Provision for loan and lease losses .............................................

.

3,907 4,230 5,101

Net interest income after provision for loan and lease losses ...................

.

8,550 3,467 2,048

Non-interest income:

Servicing and securitizations ..................................................

.

7 2,280 3,385

Service charges and other customer-related fees ................................

.

2,073 1,997 2,232

Interchange fees .............................................................

.

1,340 502 562

Total other-than-temporary losses .............................................

.

(128) (287) (11)

Less: Non-credit component of other-than-temporary losses recorded in AOCI ....

.

63 255 0

N

et othe

r

-than-temporary impairment losses recognized in earnings ..............

.

(65) (32) (11)

Other .......................................................................

.

359 539 576

Total non-interest income ...................................................

.

3,714 5,286 6,744

Non-interest expense:

Salaries and associate benefits .................................................

.

2,594 2,478 2,336

Marketing ...................................................................

.

958 588 1,118

Communications and data processing ..........................................

.

693 740 756

Supplies and equipment ......................................................

.

520 500 520

Occupancy ..................................................................

.

486 451 377

Restructuring expense(1) ......................................................

.

0 119 134

Other .......................................................................

.

2,683 2,541 2,969

Total non-interest expense ..................................................

.

7,934 7,417 8,210

Income from continuing operations before income taxes .........................

.

4,330 1,336 582

Income tax provision .........................................................

.

1,280 349 497

Income from continuing operations, net of tax ................................

.

3,050 987 85

Loss from discontinued operations, net of tax ...................................

.

(307) (103) (131)

Net income ................................................................

.

2,743 884 (46)

Preferred stock dividends .....................................................

.

0 (564) (33)

N

et income (loss) available to common stockholders ............................

.

$ 2,743 $ 320 $ (79)

Basic earnings per common share:

Income from continuing operations ............................................

.

$ 6.74 $ 0.99 $ 0.14

Loss from discontinued operations .............................................

.

(0.67) (0.24) (0.35)

Net income (loss) per basic common share ...................................

.

$ 6.07 $ 0.75 $ (0.21)

Diluted earnings per common share:

Income from continuing operations ............................................

.

$ 6.68 $ 0.98 $ 0.14

Loss from discontinued operations .............................................

.

(0.67) (0.24) (0.35)

Net income (loss) per diluted common share .................................

.

$ 6.01 $ 0.74 $ (0.21)

Dividends paid per common share .............................................

.

$ 0.20 $ 0.53 $ 1.50

________________________

(1) In 2009, we completed the restructuring of operations that was initiated in 2007 to reduce expenses and improve our competitive cost position.

See Notes to Consolidated Financial Statements.