Capital One 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

115

Other-Than-Temporary Impairment

We evaluate all securities in an unrealized loss position at least quarterly, and more often as market conditions require, to assess

whether the impairment is other-than-temporary. Our OTTI assessment is a subjective process requiring the use of judgments and

assumptions. Accordingly, we consider a number of qualitative and quantitative criteria in our assessment, including the extent and

duration of the impairment; recent events specific to the issuer and/or industry to which the issuer belongs; the payment structure of

the security; external credit ratings and the failure of the issuer to make scheduled interest or principal payments; the value of

underlying collateral; and current market conditions.

Effective April 1, 2009, we adopted new accounting guidance that changed our method for assessing, measuring and recognizing

OTTI. Under this guidance, if we determine that impairment on our debt securities is other-than-temporary and we have made the

decision to sell the security or it is more likely than not that we will be required to sell the security prior to recovery of its amortized

cost basis, we recognize the entire portion of the impairment in earnings. If we have not made a decision to sell the security and we do

not expect that we will be required to sell the security prior to recovery of the amortized cost basis, we recognize only the credit

component of OTTI in earnings. The remaining unrealized loss due to factors other than credit, or the non-credit component, is

recorded in AOCI. We determine the credit component based on the difference between the security’s amortized cost basis and the

present value of its expected future cash flows, discounted based on the purchase yield. The non-credit component represents the

difference between the security’s fair value and the present value of expected future cash flows. Prior to the adoption of this new

accounting guidance, the entire unrealized loss amount related to a security that was determined to be other-than-temporarily impaired

was recognized in earnings.

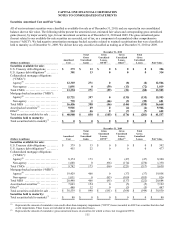

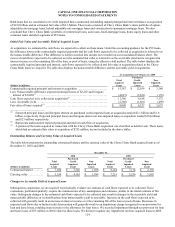

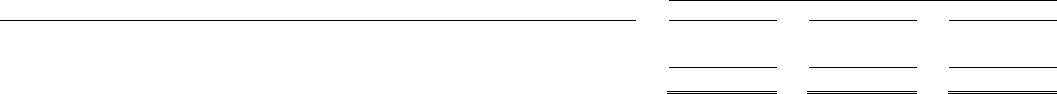

The following table summarizes other-than-temporary impairment losses on debt securities recognized in earnings in 2010, 2009 and 2008.

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Total OTTI losses ........................................................ $ 128 $ 287 $ 11

Less: Non-credit component of OTTI losses recorded in AOCI ............... (63) (255) 0

N

et OTTI losses recognized in earnings .................................... $ 65 $ 32 $ 11

As indicated in the table above, we recorded credit related losses in earnings totaling $65 million and $32 million in 2010 and 2009,

respectively. The cumulative non-credit related portion of OTTI on these securities recorded in AOCI totaled $105 million and $181

million in 2010 and 2009, respectively. We estimate the portion of loss attributable to credit using a discounted cash flow model, and

we estimate the expected cash flows from the underlying collateral using industry-standard third party modeling tools. These tools

take into consideration security specific delinquencies, product specific delinquency roll rates and expected severities. Key

assumptions used in estimating the expected cash flows include default rates, loss severity and prepayment rates. Assumptions used

can vary widely based on the collateral underlying the securities and are influenced by factors such as collateral type, loan interest

rate, geographical location of the borrower, and borrower characteristics.

We believe the gross unrealized losses related to all other securities of $176 million and $368 million as of December 31, 2010 and

2009, respectively, are attributable to issuer specific credit spreads and changes in market interest rates and asset spreads. We

therefore do not expect to incur any credit losses related to these securities. In addition, we have no intent to sell these securities with

unrealized losses and it is not more likely than not that we will be required to sell these securities prior to recovery of the amortized

cost. Accordingly, we have concluded that the impairment on these securities is not other-than-temporary.