Capital One 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

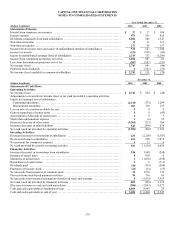

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

169

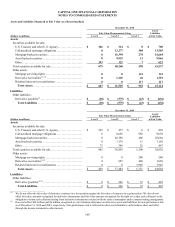

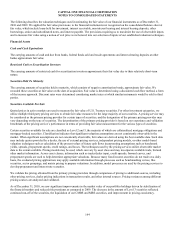

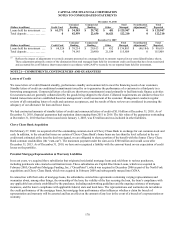

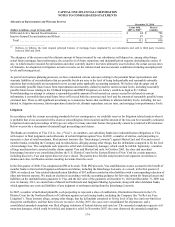

Year Ended December 31, 2010

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Other(1)

Total

Managed

Securitization

Adjustments(1)

Total

Reported

N

et interest income (expense) .............. $ 7,894 $ 3,727 $ 1,292 $ (452) $ 12,461 $ (4) $ 12,457

N

on-interest income (expense) ............. 2,720 870 181 (55) 3,716 (2) 3,714

Total revenue ........................... 10,614 4,597 1,473 (507) 16,177 (6) 16,171

Provision for loan and lease losses .......... 3,188 241 429 55 3,913 (6) 3,907

N

on-interest expense:

Core deposit intangible amortization ...... 0 144 55 0 199 0 199

Other non-interest expense .............. 3,951 2,806 741 237 7,735 0 7,735

Total non-interest expense ................. 3,951 2,950 796 237 7,934 0 7,934

Income (loss) from continuing operations

before income taxes .................... 3,475 1,406 248 (799) 4,330 0 4,330

Income tax provision (benefit) ............. 1,201 501 88 (510) 1,280 0 1,280

Income (loss) from continuing operations, net

of tax ................................ $ 2,274 $ 905 $ 160 $ (289) $ 3,050 $ 0 $ 3,050

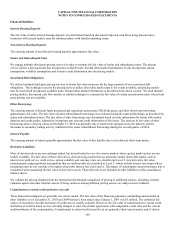

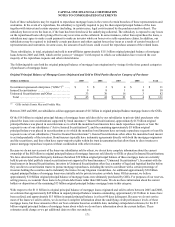

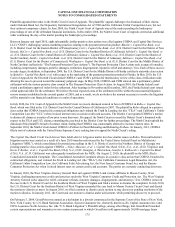

Year Ended December 31, 2009

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Other(1)

Total

Managed

Securitization

Adjustments(1)

Total

Reported

N

et interest income ...................... $ 7,542 $ 3,231 $ 1,144 $ 172 $ 12,089 $ (4,392) $ 7,697

N

on-interest income ...................... 3,747 755 172 73 4,747 539 5,286

Total revenue ........................... 11,289 3,986 1,316 245 16,836 (3,853) 12,983

Provision for loan and lease losses .......... 6,051 876 983 173 8,083 (3,853) 4,230

N

on-interest expense:

Restructuring expense

(

3

)

................. 0 0 0 119 119 0 119

Core deposit intangible amortization ...... 0 169 43 0 212 0 212

Other non-interest expense .............. 3,738 2,565 618 165 7,086 0 7,086

Total non-interest expense ................. 3,738 2,734 661 284 7,417 0 7,417

Income (loss) from continuing operations before

income taxes .......................... 1,500 376 (328) (212) 1,336 0 1,336

Income tax provision (benefit) ............. 522 132 (115) (190) 349 0 349

Income (loss) from continuing operations, net o

f

tax .................................. $ 978 $ 244 $ (213) $ (22) $ 987 $ 0 $ 987

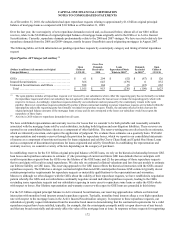

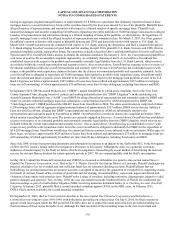

Year Ended December 31, 2008

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Other

Total

Managed

Securitization

Adjustments(2)

Total

Reported

N

et interest income ....................... $ 7,464 $ 2,988 $ 962 $ 8 $ 11,422 $ (4,273) $ 7,149

N

on-interest income ....................... 4,678 729 144 (134) 5,417 1,327 6,744

Total revenue ............................ 12,142 3,717 1,106 (126) 16,839 (2,946) 13,893

Provision for loan and lease losses ........... 6,108 1,534 234 171 8,047 (2,946) 5,101

N

on-interest expense:

Restructuring expense(3) ................. 0 0 0 134 134 0 134

Goodwill impairment .................... 0 811 0 0 811 0 811

Other non-interest expense ............... 4,393 2,453 481 (62) 7,265 0 7,265

Total non-interest expense .................. 4,393 3,264 481 72 8,210 0 8,210

Income (loss) from continuing operations before

income taxes ........................... 1,641 (1,081) 391 (369) 582 0 582

Income tax provision (benefit) .............. 574 (101) 137 (113) 497 0 497

Income (loss) from continuing operations, net o

f

tax ................................... $ 1,067 $ (980) $ 254 $ (256) $ 85 $ 0 $ 85

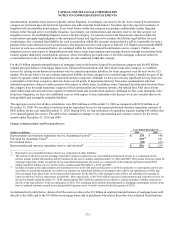

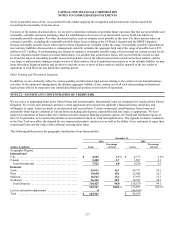

________________________

(1) The significant increase in the loss from continuing operations reported in the “Other” category in 2010 compared to 2009 was primarily

attributable to an increase in the provision for repurchase losses, an increase in the residual expense from our funds transfer pricing allocation

process and a reduced benefit from the sale of securities.

(2) Reflects the impact of adjustments to reconcile our total business segment results, which are presented on a managed basis, to our reported

GAAP results. These adjustments primarily consist of: (i) the reclassification of finance charges, past due fees, other interest income and interest

expense amounts included in non-interest income for management reporting purposes to net interest income for GAAP reporting purposes and

(ii) the reclassification of net charge-offs included in non-interest income for management reporting purposes to the provision for loan and lease

losses for GAAP reporting purposes.

(3) In 2009, we completed the restructuring of our operations, which was initiated in 2007 to reduce expenses and improve our competitive

cost position.