Capital One 2010 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

140

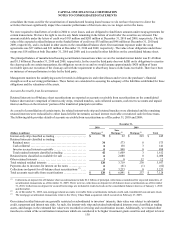

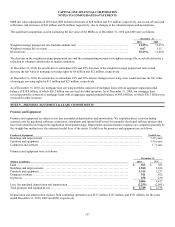

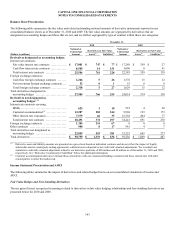

December 31,

(Dollars in millions) 2010 2009

Deposits:

N

on-interest bearing deposits .................................................................. $ 15,048 $ 13,439

Interest-bearing deposits (1) .................................................................... 107,162 102,370

Total deposits ................................................................................ $ 122,210 $ 115,809

Short-term borrowings:

Senior and subordinated notes

Bank notes:

5.75% Senior Fixed Notes par value of $516,722 due 2010 ..................................... $ 0 $ 517

9.25% Subordinated Fixed Notes par value of $150,000 due 2010 .............................. 0 154

Fair value hedge-related basis adjustments .................................................... 0 8

Corporation notes:

5.70% Senior Fixed Notes par value of $854,451 due 2011 ..................................... 854 0

Fair value hedge-related basis adjustments .................................................... 30 0

Total senior and subordinated notes ............................................................ 884 679

Other borrowings

Secured borrowings (3)

Fixed, interest rates ranging from 3.20% to 5.76%, due 2011 to 2012 ........................... 4,075 433

Variable, interest rates ranging from 0.27% to 2.62%, due 2011 to 2012 ......................... 6,545 1,242

Total secured borrowings .................................................................. 10,620 1,675

FHLB advances (4)

Fixed, interest rates ranging from 2.69% to 7.22%, due 2010 to 2011 ........................... 78 2,081

Federal funds purchased and resale agreements due 2011 (5) ...................................... 1,517 1,140

Other short-term borrowings ................................................................... 7 1

Total other short-term borrowings .............................................................. 12,222 4,897

Total short-term borrowings ................................................................... $ 13,106 $ 5,576

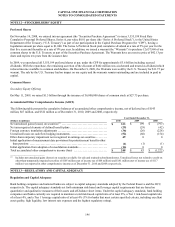

Long-term debt:

Senior and subordinated notes

Bank notes:

5.125% Senior Fixed Notes par value of $274,696 due 2014 .................................... $ 275 $ 275

6.50% Subordinated Fixed Notes par value of $500,000 due 2013 .............................. 499 499

8.80% Subordinated Fixed Notes par value of $1,500,000 due 2019 ............................. 1,500 1,500

Fair value hedge-related basis adjustments .................................................... 154 43

Corporation notes:

5.70% Senior Fixed Notes par value of $854,451 due 2011 ..................................... 0 854

4.80% Senior Fixed Notes par value of $282,335 due 2012 ..................................... 282 282

6.25% Senior Fixed Notes par value of $277,665 due 2013 ..................................... 277 277

7.375% Senior Fixed Notes par value of $1,000,000 due 2014 .................................. 996 996

5.50% Senior Fixed Notes par value of $375,005 due 2015 ..................................... 375 375

5.25% Senior Fixed Notes par value of $226,290 due 2017 ..................................... 226 226

6.75% Senior Fixed Notes par value of $1,341,045 due 2017 ................................... 1,338 1,338

5.875% Subordinated Fixed Notes par value of $350,000 due 2012 ............................. 353 355

5.35% Subordinated Fixed Notes par value of $100,000 due 2014 .............................. 99 99

6.15% Subordinated Fixed Notes par value of $1,000,000 due 2016 ............................. 998 998

Fair value hedge-related basis adjustments .................................................... 394 249

Total senior and subordinated notes ............................................................ 7,766 8,366

Other borrowings

Junior subordinated debentures

8.00% Subordinated Fixed Notes par value of $103,093 due 2027 .............................. 109 109

8.17% Subordinated Fixed Notes par value of $46,547 due 2028 ................................ 49 49

3.339% Subordinated Floating Notes par value of $10,310 due 2033 (2) .......................... 11 11

7.686% Subordinated Fixed Notes par value of $651,000 due 2036 651 651

6.745% Subordinated Fixed Notes par value of $500,010 due 2037 ............................. 500 500

10.25% Subordinated Fixed Notes par value of $1,000,010 due 2039 ............................ 988 988