Capital One 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

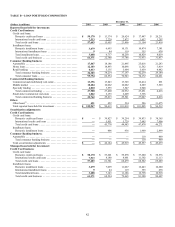

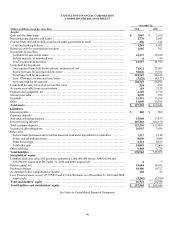

TABLE C—DELINQUENCIES

December 31,

2010(2) 2009(2) 2008 2007 2006

(Dollars in millions) Loans

% of

Total

Loans Loans

% of

Total

Loans Loans

% of

Total

Loans Loans

% of

Total

Loans Loans

% of

Total

Loans

Reported:(1)

Loans held for

investment ........ $ 125,947 100.00 % $ 90,619 100.00% $ 101,018 100.00% $ 101,805 100.00 % $ 96,512 100.00%

Delinquent loans:

30-59 days ....... $ 1,968 1.56 % $ 1,908 2.10% $ 2,325 2.30% $ 2,052 2.02 % $ 1,512 1.57%

60-89 days ....... 1,064 0.84 985 1.09 1,094 1.08 869 0.86 563 0.58

90-119 days ...... 559 0.44 356 0.39 410 0.41 290 0.28 210 0.22

120-149 days ..... 446 0.35 190 0.21 230 0.23 195 0.19 167 0.17

150 or more days .. 393 0.31 164 0.18 194 0.19 155 0.15 114 0.12

Total ............ $ 4,430 3.52 % $ 3,603 3.98% $ 4,253 4.21% $ 3,561 3.50 % $ 2,566 2.66%

By geographic area:

Domestic ......... $ 3,998 3.38 % $ 3,460 3.82% $ 4,107 4.07% $ 3,433 3.37 % $ 2,461 2.55%

International ...... 432 5.75 143 6.28 146 4.89 128 3.20 105 2.74

Total ............ $ 4,430 3.52 % $ 3,603 3.98% $ 4,253 4.21% $ 3,561 3.50 % $ 2,566 2.66%

Managed:(1)

Loans held for

investment ........ $ 125,947 100.00 % $ 136,803 100.00% $ 146,937 100.00% $ 151,362 100.00 % $ 146,151 100.00%

Delinquent loans:

30-59 days ....... $ 1,968 1.56 % $ 2,623 1.92% $ 2,987 2.03% $ 2,738 1.81 % $ 2,130 1.46%

60-89 days ....... 1,064 0.84 1,576 1.15 1,582 1.08 1,343 0.89 946 0.65

90-119 days ...... 559 0.44 895 0.65 817 0.60 681 0.45 521 0.41

120-149 days ..... 446 0.35 660 0.48 569 0.39 513 0.34 412 0.28

150 or more days .. 393 0.31 568 0.42 476 0.32 429 0.28 323 0.22

Total ............ $ 4,430 3.52 % $ 6,322 4.62% $ 6,431 4.38% $ 5,704 3.77 % $ 4,332 2.96%

By geographic area:

Domestic ......... $ 3,998 3.38 % $ 5,783 4.23% $ 5,915 4.03% $ 5,112 3.34 % $ 3,743 3.18%

International ...... 432 5.75 539 6.55 516 5.92 592 5.08 589 5.02

Total ............ $ 4,430 3.52 % $ 6,322 4.62% $ 6,431 4.38% $ 5,704 3.77 % $ 4,332 2.96%

________________________

(1) Includes credit card loans that continue to accrue finance charges and fees until charged-off at 180 days. The amounts reported for credit card

loans are net of billed finance charges and fees that we do not expect to collect. In accordance with our finance charge and fee revenue

recognition policy, amounts billed but not included in revenue totaled $950 million, $2.1 billion, $1.9 billion, $1.1 billion and $0.9 billion in

2010, 2009, 2008, 2007 and 2006, respectively.

(2) The Chevy Chase Bank acquired loan portfolio is included in loans held for investment, but excluded from delinquent loans as these loans are

considered performing in accordance with our expectations as of the purchase date, as we recorded these loans at estimated fair value when we

acquired them. As of December 31, 2010 and 2009, the acquired loan portfolio’s contractual 30 to 89 day delinquencies total $199 million and

$294 million, respectively. For loans 90+ days past due, see Table D—Nonperforming Assets.