Capital One 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

96

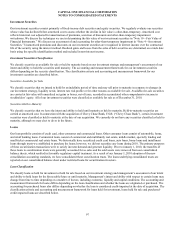

Investments in entities where we do not have a controlling financial interest but we have significant influence over the entity’s

financial and operating decisions (generally defined as owning a voting interest of 20% to 50%) are accounted for under the equity

method. If we own less than 20% of a voting interest entity, we generally carry the investment at cost, except marketable equity

securities, which we carry at fair value with changes in fair value included in accumulated other comprehensive income. We typically

report investments accounted for under the equity or cost method in other assets on our consolidated balance sheets, and include our

share of income or loss in other non-interest income in our consolidated statements of income.

Variable Interest Entities (“VIEs”)

VIEs are entities that lack one or more of the characteristics of a voting interest entity. Either the entity does not have sufficient equity

at risk to finance its activities without additional subordinated financial support from other parties or the equity investors do not have

the characteristics of a controlling financial interest. The entity that has a controlling financial interest in a VIE is referred to as the

primary beneficiary and is required to consolidate the VIE.

Prior to January 1, 2010, the primary beneficiary was the entity that would absorb a majority of the economic risks and rewards of the

VIE based on an analysis of projected probability-weighted cash flows. On January 1, 2010, we implemented new consolidation

accounting guidance that amended several key consolidation provisions related to VIEs. The new guidance eliminated the concept of

qualified special purpose entities (“QSPEs”), which were previously exempt from consolidation, and introduced a new framework for

determining the primary beneficiary of a VIE. Under the new guidance, the primary beneficiary is the entity that has (i) the power to

direct the activities of a VIE that most significantly impact the entity’s economic performance and (ii) the obligation to absorb losses

or the right to receive benefits that could be potentially significant to the VIE. The new consolidation guidance also requires

companies to continually reassess whether they are the primary beneficiary of a VIE, whereas the previous rules only required

reconsideration upon the occurrence of certain triggering events. We discuss the impact from the adoption of the new consolidation

accounting guidance below under “Special Purpose Entities and Variable Interest Entities.”

In determining whether we are the primary beneficiary of a VIE, we consider both qualitative and quantitative factors regarding the

nature, size and form of our involvement with the VIE, such as our role in establishing the VIE and our ongoing rights and

responsibilities; our economic interests, including debt and equity investments, servicing fees, and other arrangements deemed to be

variable interests in the VIE; the design of the VIE, including the capitalization structure, subordination of interests, payment priority,

relative share of interests held across various classes within the VIE’s capital structure and the reasons why the interests are held by

us.

We perform on-going reassessments of whether entities previously evaluated under the majority voting-interest framework have

become VIEs, based on certain events, and are therefore subject to the VIE consolidation framework and whether changes in the facts

and circumstances regarding our involvement with a VIE result in a change in our consolidation conclusion regarding the VIE to

change. Our reassessment process considers whether we have acquired or divested the power to direct the activities of the VIE through

changes in governing documents or other circumstances. The reassessment also considers whether we have acquired or disposed of a

financial interest that could be significant to the VIE, or whether an interest in the VIE has become significant or is no longer

significant. The consolidation status of the VIEs with which we are involved may change as a result of such reassessments.

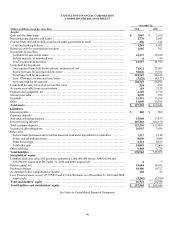

Cash and Cash Equivalents

Cash and cash equivalents include cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at

other banks, all of which, if applicable, have stated maturities of three months or less when acquired. Cash payments for interest

expense totaled $2.9 billion, $3.1 billion and $4.0 billion in 2010, 2009 and 2008, respectively. Cash payments for income taxes

totaled $0.3 billion, $0.4 billion and $1.2 billion in 2010, 2009 and 2008, respectively.

Resale and Repurchase Agreements

Securities purchased under agreements to resell and securities sold under agreements to repurchase, principally U.S. government and

agency obligations, are generally not accounted for as sales but as collateralized financing transactions and recorded at the amounts at

which the securities were acquired or sold, plus accrued interest. We receive securities purchased under agreements to resell, make

delivery of securities sold under agreements to repurchase, continually monitor the market value of these securities and deliver or

obtain additional collateral as appropriate.