Capital One 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

159

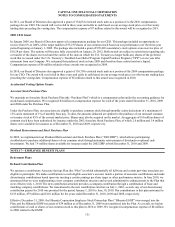

As of December 31, 2010, U.S. income taxes and foreign withholding taxes have not been provided on approximately $633 million of

unremitted earnings of our subsidiaries operating outside the U.S., in accordance with the guidance for accounting for income taxes in

special areas. These earnings are considered by management to be invested indefinitely. Upon repatriation of these earnings, we could be

subject to both U.S. income taxes (subject to possible adjustment for foreign tax credits) and withholding taxes payable to various foreign

countries. Determination of the amount of unrecognized deferred U.S. income tax liability and foreign withholding tax on these

unremitted earnings is not practicable at this time because such liability is dependent upon circumstances existing if and when remittance

occurs.

As of December 31, 2010, U.S. income taxes have not been provided for approximately $287 million of previously acquired thrift bad

debt reserves created for tax purposes as of December 31, 1987. These amounts, acquired as a result of the merger with North Fork

Bancorporation, Inc. and the acquisition of Chevy Chase Bank, F.S.B., are subject to recapture in the unlikely event that CONA, as

successor to North Fork Bank and Chevy Chase Bank F.S.B., makes distributions in excess of earnings and profits, redeems its stock,

or liquidates.

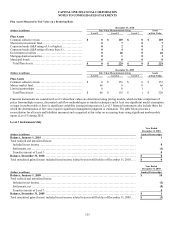

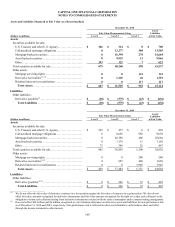

NOTE 19—FAIR VALUE OF FINANCIAL INSTRUMENTS

Under applicable accounting guidance, fair value is defined as the exchange price that would be received for an asset or paid to

transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction

between market participants on the measurement date. We determine the fair values of our financial instruments based on the fair

value hierarchy established under applicable accounting guidance which requires an entity to maximize the use of observable inputs

and minimize the use of unobservable inputs when measuring fair value. There are three levels of inputs that may be used to measure

fair value. We did not make any material fair value option elections as of and for the years ended December 31, 2010 and 2009. For a

detailed discussion regarding the fair value hierarchy and how we measure fair value, see “Note 1—Summary of Significant

Accounting Policies.”

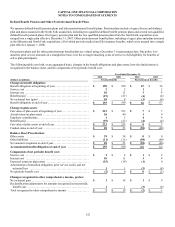

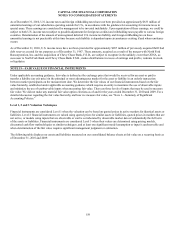

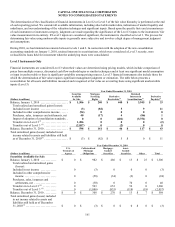

Level 1, 2 and 3 Valuation Techniques

Financial instruments are considered Level 1 when the valuation can be based on quoted prices in active markets for identical assets or

liabilities. Level 2 financial instruments are valued using quoted prices for similar assets or liabilities, quoted prices in markets that are

not active, or models using inputs that are observable or can be corroborated by observable market data of substantially the full term

of the assets or liabilities. Financial instruments are considered Level 3 when their values are determined using pricing models,

discounted cash flow methodologies or similar techniques, and at least one significant model assumption or input is unobservable and

when determination of the fair value requires significant management judgment or estimation.

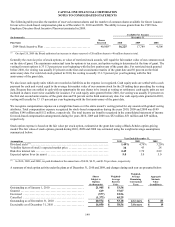

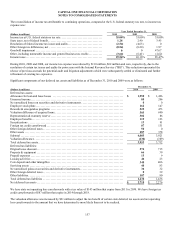

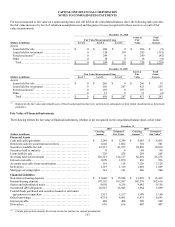

The following table displays our assets and liabilities measured on our consolidated balance sheets at fair value on a recurring basis as

of December 31, 2010 and 2009: