Capital One 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

148

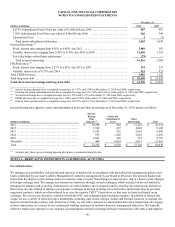

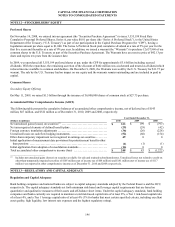

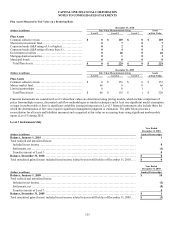

NOTE 14—EARNINGS PER COMMON SHARE

The following table sets forth the computation of basic and diluted earnings per common share:

Year Ended December 31,

(Dollars and Shares in millions, except per share data) 2010 2009 2008

Numerator:

Income from continuing operations, net of tax ..................................

.

$ 3,050 $ 987 $ 85

Loss from discontinued operations, net of tax ...................................

.

(307) (103) (131)

N

et income (loss) ............................................................

.

2,743 884 (46)

Preferred stock dividends and accretion of discount .............................

.

0 (564) (33)

N

et income (loss) available to common stockholders ............................

.

$ 2,743 $ 320 $ (79)

Denominator:

Denominator for basic earnings per share-Weighted-average shares ..............

.

452 428 376

Effect of dilutive securities (1) :

Stock options ..............................................................

.

1 0 0

Contingently issuable shares ................................................

.

0 0 0

Restricted stock and units ...................................................

.

3 3 2

Dilutive potential common shares .............................................

.

4 3 2

Denominator for diluted earnings per share-Adjusted weighted-average shares ....

.

456 431 378

Basic earnings per share

Income from continuing operations ............................................

.

$ 6.74 $ 0.99 $ 0.14

Loss from discontinued operations .............................................

.

(0.67) (0.24) (0.35)

N

et income (loss) ............................................................

.

$ 6.07 $ 0.75 $ (0.21)

Diluted earnings per share

Income from continuing operations ............................................

.

$ 6.68 $ 0.98 $ 0.14

Loss from discontinued operations .............................................

.

(0.67) (0.24) (0.35)

N

et income (loss) ............................................................

.

$ 6.01 $ 0.74 $ (0.21)

________________________

(1) Excluded from the computation of diluted earnings per share was 26.8 million, 34.8 million and 27.7 million of awards, options or warrants,

during 2010, 2009 and 2008, respectively, because their inclusion would be antidilutive.

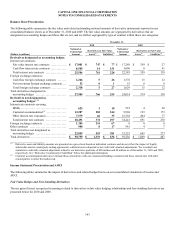

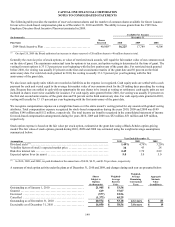

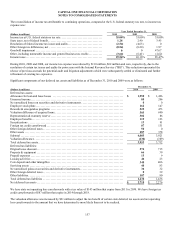

NOTE 15—OTHER NON-INTEREST EXPENSE

The following table represents the components of non-interest expense for 2010, 2009 and 2008:

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Professional services .........................................................

.

$ 916 $ 796 $ 806

Collections ..................................................................

.

596 599 569

Fraud losses .................................................................

.

80 86 106

Bankcard association assessments .............................................

.

221 215 195

Core deposit intangible amortization ...........................................

.

203 216 191

Other .......................................................................

.

667 629 1,102

Total ........................................................................

.

$ 2,683 $ 2,541 $ 2,969

NOTE 16—STOCK-BASED COMPENSATION PLAN

Stock Plans

We have one active stock-based employee compensation plan. Under the plan, we reserve common shares for issuance in various

forms including incentive stock options, nonstatutory stock options, stock appreciation rights, restricted stock awards, restricted stock

units, and performance share units.