Capital One 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

110

NOTE 3—DISCONTINUED OPERATIONS

Shutdown of Mortgage Origination Operations of Wholesale Mortgage Banking Unit

In the third quarter of 2007, we closed the mortgage origination operations of our wholesale mortgage banking unit, acquired by us in

December 2006 as part of the North Fork acquisition. The results of the mortgage origination operations and wholesale banking unit

have been accounted for as a discontinued operation and therefore not included in our results from continuing operations in 2010,

2009 and 2008. We have no significant continuing involvement in these operations.

The loss from discontinued operations for 2010, 2009 and 2008 includes an expense of $432 million ($304 million net of tax), $162

million ($120 million net of tax) and $104 million ($68 million net of tax), respectively, recorded in non-interest expense, primarily

attributable to provisions for mortgage loan repurchase losses related to representations and warranties provided on loans previously

sold to third parties by the wholesale banking unit.

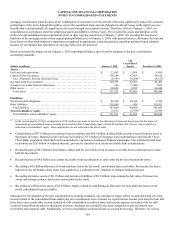

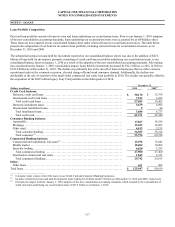

The following table summarizes the results from discontinued operations related to the closure of our wholesale mortgage banking unit:

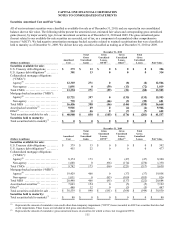

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

N

et interest income (expense) .................................................

.

$ (1) $ (2) $ 7

N

on-interest expense .........................................................

.

(475) (157) (209)

Income tax benefit ...........................................................

.

169 56 71

Loss from discontinued operations, net of taxes ...............................

.

$ (307) $ (103) $ (131)

The discontinued mortgage origination operations of our wholesale home loan banking unit had remaining assets of $362 million and

$24 million as of December 31, 2010 and 2009, respectively, consisting primarily of mortgage loans held for sale and liabilities of

$585 million and $229 million as of December 31, 2010 and 2009, respectively consisting primarily of obligations for representations

and warranties that we provided on loans previously sold to third parties.

NOTE 4—INVESTMENT SECURITIES

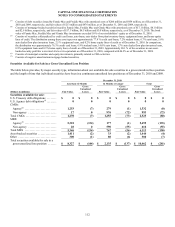

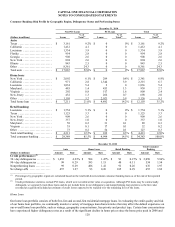

Our investment securities portfolio, which had a fair value of $41.5 billion and $38.9 billion, as of December 31, 2010 and 2009,

respectively, consists of U.S. Treasury and U.S. agency debt obligations; agency and non-agency mortgage-backed securities; other

asset-backed securities collateralized primarily by credit card loans, auto loans, student loans, auto dealer floor plan inventory loans,

equipment loans, and home equity lines of credit; municipal securities and limited Community Reinvestment Act (“CRA”) equity

securities. Our investment securities portfolio continues to be heavily concentrated in securities that generally have lower credit risk

and high credit ratings, such as securities issued and guaranteed by the U.S. Treasury and government sponsored enterprises or

agencies. Our investments in U.S. Treasury and agency securities, based on fair value, represented approximately 70% of our total

investment securities portfolio as of December 31, 2010, compared with 75% as of December 31, 2009.