Capital One 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

124

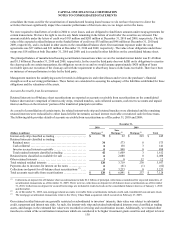

Bank loans that we concluded were credit impaired had a contractual outstanding unpaid principal and interest balance at acquisition

of $12.0 billion and an estimated fair value of $6.3 billion. These loans consisted of Chevy Chase Bank’s entire portfolio of option-

adjustable rate mortgage loans, hybrid adjustable-rate mortgage loans and construction-to-permanent mortgage loans. We also

concluded that Chevy Chase Bank’s portfolio of commercial loans, auto loans, fixed-mortgage loans, home equity loans and other

consumer loans included segments of PCI loans.

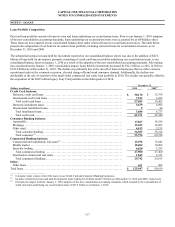

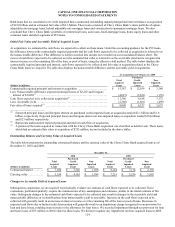

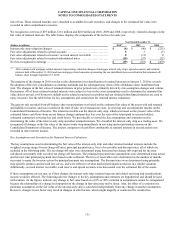

Initial Fair Value and Accretable Yield of Acquired Loans

At acquisition, we estimated the cash flows we expected to collect on these loans. Under the accounting guidance for the PCI loans,

the difference between the contractually required payments and the cash flows expected to be collected at acquisition is referred to as

the nonaccretable difference. This difference is neither accreted into income nor recorded on our consolidated balance sheet. The

excess of cash flows expected to be collected over the estimated fair value is referred to as the accretable yield and is recognized in

interest income over the remaining life of the loan, or pool of loans, using the effective yield method. The table below displays the

contractually required principal and interest, cash flows expected to be collected and fair value at acquisition related to the Chevy

Chase Bank loans we acquired. The table also displays the nonaccretable difference and the accretable yield at acquisition.

At Acquisition on February 27, 2009

(Dollars in millions)

Total

Acquired

Loans

Purchased

Credit-

Impaired

Loans

Non-

Impaired

Loans

Contractually required principal and interest at acquisition ........................ $ 15,387 $ 12,039 $ 3,348

Less: Nonaccretable difference (expected principal losses of $2,207 and foregone

interest of $1,820)(1) ......................................................... (4,027) (3,851) (176)

Cash flows expected to be collected at acquisition(2) .............................. 11,360 8,188 3,172

Less: Accretable yield ......................................................... (2,360) (1,861) (499)

Fair value of loans acquired(3) .................................................. $ 9,000 $ 6,327 $ 2,673

________________________

(1) Expected principal losses and foregone interest on purchased credit-impaired loans at acquisition totaled $2.1 billion and $1.8

billion, respectively. Expected principal losses and foregone interest on non-impaired loans at acquisition totaled $154 million

and $23 million, respectively.

(2) Represents undiscounted expected principal and interest cash flows at acquisition.

(3) A portion of the loans acquired in connection with the Chevy Chase Bank acquisition was classified as held for sale. These loans,

which had an estimated fair value at acquisition of $235 million, are not included in the above tables.

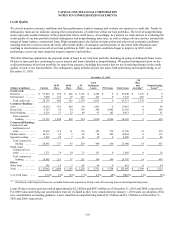

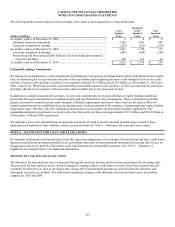

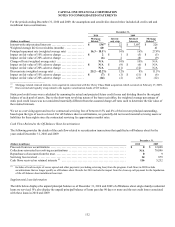

Outstanding Balance and Carrying Value of Acquired Loans

The table below presents the outstanding contractual balance and the carrying value of the Chevy Chase Bank acquired loans as of

December 31, 2010 and 2009:

December 31,

2010 2009

(Dollars in millions)

Total

Acquired

Loans

Purchased

Credit

Impaired

Loans

Non-

Impaired

Loans

Total

Acquired

Loans

Purchased

Credit-

Impaired

Loans

Non-

Impaired

Loans

Contractual balance ......

.

$ 7,054 $ 5,546 $ 1,508 $ 9,264 $ 7,114 $ 2,150

Carrying value ...........

.

$ 5,554 $ 4,165 $ 1,389 $ 7,251 $ 5,256 $ 1,995

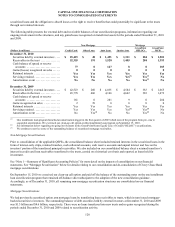

Changes in Accretable Yield of Acquired Loans

Subsequent to acquisition, we are required to periodically evaluate our estimate of cash flows expected to be collected. These

evaluations, performed quarterly, require the continued use of key assumptions and estimates, similar to the initial estimate of fair

value. Subsequent changes in the estimated cash flows expected to be collected may result in changes in the accretable yield and

nonaccretable difference or reclassifications from nonaccretable yield to accretable. Increases in the cash flows expected to be

collected will generally result in an increase in interest income over the remaining life of the loan or pool of loans. Decreases in

expected cash flows due to further credit deterioration will generally result in an impairment charge recognized in our provision for

loan and lease losses, resulting in an increase to the allowance for loan losses. We recorded impairment through our provision for loan

and lease losses of $33 million in 2010 related to these loans. We did not recognize any impairment on these acquired loans in 2009.