Capital One 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Operational Risk: is the risk of loss, adverse customer experience, or negative regulatory or reputation impact resulting from failed or

inadequate processes, associate capabilities or systems, or exposure to external events. The Chief Compliance Officer is the

accountable executive for establishment of risk management standards and for governance and monitoring of operational risk at a

corporate level. Division Presidents have primary accountability for management of operational risk within their business areas.

While most operational risks are managed and controlled by business areas, the Operational Risk Management Program establishes

requirements and control processes that assure certain consistent practices in the management of operational risk, and provides

transparency to the corporate operational risk profile. Our Operational Risk Management Program also includes two primary

additional functions. Operational Risk Reporting involves independent assessments of the control and sustainability of key business

processes at a corporate and business area level, and such assessments are provided to the Chief Risk Officer, management’s Risk

Management Committee, and the Audit and Risk Committee of the Board. The Operational Risk Capital function, in conjunction with

the corporate capital process managed by Global Finance, establishes necessary operational risk capital levels to assure resiliency

against extreme operational risk event scenarios.

Operational Risk results and trends are reported to the Risk Management Committee and the Audit and Risk Committee of the Board.

Compliance Risk: is the risk of financial loss due to regulatory fines or penalties, restriction or suspension of business, or cost of

mandatory corrective action as a result of failing to adhere to applicable laws, regulations, principles and supervisory guidance as well

as our own internal standards intended to adhere to these laws and regulations. Division Presidents are the accountable executives for

compliance risk and are responsible for building and maintaining compliance processes. With the Chief Compliance Officer, Division

Presidents are jointly accountable for ensuring the Compliance Management Program requirements are met for their division.

We ensure compliance by maintaining an effective Compliance Management Program consisting of sound policies, systems,

processes, and reports. The Compliance Management Program provides management with guidance, training, and monitoring to

provide reasonable assurance of our compliance with internal and external compliance requirements. Additionally, management and

the Corporate Compliance department jointly and separately conduct on-going monitoring and assess the state of compliance. The

assessment provides the basis for performance reporting to management and the Board, allows business areas to determine if their

compliance performance is acceptable, and confirms effective compliance controls are in place. Business areas embed compliance

requirements and controls into their business policies, standards, processes and procedures. They regularly monitor and report on the

efficiency of their compliance controls. Corporate Compliance, jointly working with the business, defines and validates a standard

compliance monitoring and reporting methodology. Compliance results and trends are reported to management’s Risk Management

Committee and the Audit and Risk Committee of the Board.

Legal Risk: is the risk of material adverse impact due to: (i) new and changed laws and regulations; (ii) new interpretations of law;

(iii) the drafting, interpretation and enforceability of contracts; (iv) adverse decisions or consequences arising from litigation or

regulatory scrutiny; (v) the establishment, management and governance of our legal entity structure; and (vi) the failure to seek or

follow appropriate legal counsel when needed. Our General Counsel is the accountable executive for monitoring and controlling legal

risk.

Our Legal Department serves as our control against legal risk by providing legal evaluation and guidance to the enterprise and

business areas. This evaluation and guidance is based on the assessment of legal counsel of the type and degree of legal risk associated

with the internal business area practices and activities and of the controls the business has in place to mitigate legal risks. Legal risk is

governed by and defined in our Legal Risk Policy.

LIQUIDITY AND CAPITAL MANAGEMENT

Liquidity

We have established liquidity guidelines that are intended to ensure that we have sufficient asset-based liquidity to withstand the

potential impact of deposit attrition or diminished liquidity in the funding markets. Our guidelines include maintaining an adequate

liquidity reserve to cover our potential funding requirements and diversified funding sources to avoid over-dependence on volatile,

less reliable funding markets. Our liquidity reserves consist of cash and cash equivalents, unencumbered available-for-sale securities

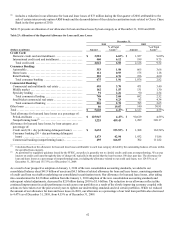

and undrawn committed securitization borrowing facilities. Table 28 below presents the composition of our liquidity reserves as of

December 31, 2010 and 2009. Our liquidity reserves decreased by $1.5 billion during 2010 to $37.0 billion as of December 31, 2010.