Capital One 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

128

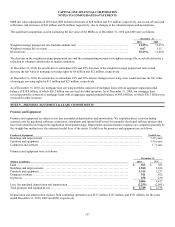

securitized loans and the obligation to absorb losses or the right to receive benefits that could potentially be significant to the trusts

through our retained interests.

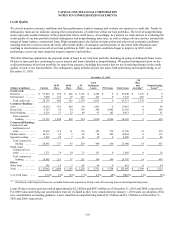

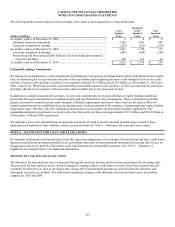

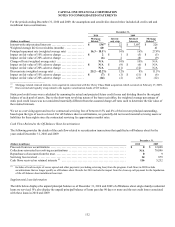

The following table presents the external debt and receivable balances of our securitization programs, information regarding our

ongoing involvement in the structures, and any gains/losses recognized on transferred assets for the periods ended December 31, 2010

and 2009.

Non-Mortgage Mortgage

(Dollars in millions) Credit Card Other Loan Auto Loan Option Arm GreenPoint

HELOCs GreenPoint

MFH

December 31, 2010

Securities held by external investors .... $ 25,415 $ 48 $ 1,453 $ 1,311 $ 284 $ 1,501

Receivables in the trust ................ 52,355 191 1,528 1,405 284 1,393

Cash balance of spread or reserve

accounts ........................... 77 0 147 8 0 183

Gains/(losses) recognized on sales ...... 0 0 0 0 0 0

Retained interests ..................... Yes Yes Yes Yes Yes Yes

Servicing retained ..................... Yes Yes Yes Yes(3) Yes(3) No

Amortization event .................... No No No No Yes(2) No

December 31, 2009

Securities held by external investors .... $ 42,523 $ 260 $ 4,035 $ 4,584 $ 383 $ 1,665

Receivables in the trust................. 45,778 406 4,166 4,642 383 1,672

Cash balance of spread or reserve

accounts ........................... 161 0 281 9 0 204

Gains recognized on sales ............. 2 39 0 0 0 0

Retained interests ..................... Yes Yes Yes Yes Yes Yes

Servicing retained ..................... Yes Yes Yes Yes(3) Yes(3) No

Amortization event .................... No Yes(1) No No Yes(2) No

________________________

(1) One installment loan program breached an amortization trigger in the first quarter of 2009 which moved the program from pro- rata to

sequential amortization. We exercised our clean-up call option on this installment loan program on September 15, 2010.

(2) See information below regarding on-going involvement in the GreenPoint Home Equity Line of Credit (“HELOC”) securitizations.

(3) We continue to service some of the outstanding balance of securitized mortgage receivables.

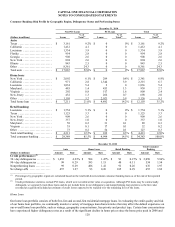

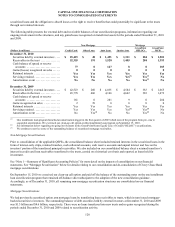

Non-Mortgage Securitizations

Prior to consolidation of the applicable QSPEs, the consolidated balance sheet included retained interests in the securitized loans in the

form of interest-only strips, retained tranches, cash collateral accounts, cash reserve accounts and unpaid interest and fees on the

investors’ portion of the transferred principal receivables. We also included on our consolidated balance sheet a retained transferor’s

interest in credit card loan receivables transferred to the trusts, carried on a historical cost basis and reported as loans held for

investment.

See “Note 1—Summary of Significant Accounting Policies” for more detail on the impacts of consolidation on our financial

statements. See “Mortgage Securitization” below for details relating to our consolidation and de-consolidation of Chevy Chase Bank

mortgage securitizations.

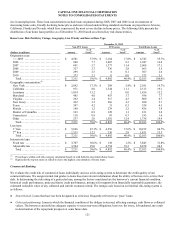

On September 15, 2010 we exercised our clean-up call option and paid off the balance of the outstanding notes on the one installment

loan securitization program that remained off-balance sheet subsequent to the adoption of the new consolidation guidance.

Accordingly, as of December 31, 2010, all remaining non-mortgage securitization structures are consolidated on our financial

statements.

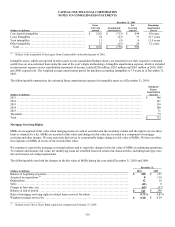

Mortgage Securitizations

We had previously securitized option arm mortgage loans by transferring loan receivables to trusts, which in turn issued mortgage-

backed securities to investors. The outstanding balance of debt securities held by external investors at December 31, 2010 and 2009

was $1.3 billion and $4.6 billion, respectively. There were no loans transferred into new trusts and no gains recognized during the

periods ended December 31, 2010 and 2009 related to securitization activity.