Capital One 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

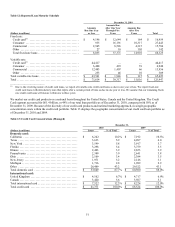

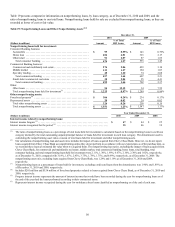

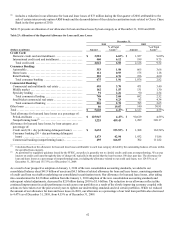

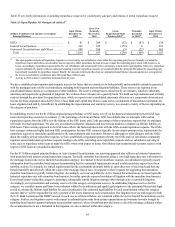

Table 22: Summary of Reported Allowance for Loan and Lease Losses

December 31,

(Dollars in millions) 2010 2009 2008

Balance at beginning of period, as reported ............................................... $ 4,127 $ 4,524 $ 2,963

Impact from January 1, 2010 adoption of new consolidation accounting standards ............... 4,317(1)

—

—

Balance at beginning of period, as adjusted ............................................... $ 8,444 $ 4,524 $ 2,963

Provision for loan and lease losses ...................................................... 3,907 4,230 5,101

Charge-offs:

Credit Card business:

Domestic credit card and installment ................................................ (6,020) (3,050) (2,244)

International credit card and installment ............................................. (761) (284) (255)

Total credit card ............................................................... (6,781) (3,334) (2,499)

Consumer Banking business:

Automobile ..................................................................... (672) (1,110) (1,236)

Home loans ..................................................................... (97) (87) (38)

Retail banking .................................................................. (129) (160) (122)

Total consumer banking ........................................................ (898) (1,357) (1,396)

Commercial Banking business:

Commercial and multifamily real estate .............................................. (207) (208) (47)

Middle market .................................................................. (101) (53) (22)

Specialty lending ................................................................ (36) (49) (10)

Total commercial lending ....................................................... (344) (310) (79)

Small-ticket commercial real estate ................................................. (100) (134) (8)

Total commercial banking ....................................................... (444) (444) (87)

Other loans ....................................................................... (115) (207) (169)

Total charge-offs .................................................................... (8,238) (5,342) (4,151)

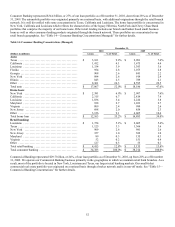

Recoveries:

Credit Card business:

Domestic credit card and installment ................................................ 1,113 447 425

International credit card and installment ............................................. 169 52 65

Total credit card ............................................................... 1,282 499 490

Consumer Banking business:

Automobile ..................................................................... 215 238 158

Home loans ..................................................................... 4 3 1

Retail banking .................................................................. 24 22 19

Total consumer banking ........................................................ 243 263 178

Commercial Banking business:

Commercial and multifamily real estate .............................................. 20 2 1

Middle market .................................................................. 24 3 2

Specialty lending ................................................................ 8 3 1

Total commercial lending ....................................................... 52 8 4

Small-ticket commercial real estate ................................................. 2 2

—

Total commercial banking ....................................................... 54 10 4

Other loans ....................................................................... 8 2 1

Total recoveries ..................................................................... 1,587 774 673

N

et charge-offs ...................................................................... (6,651) (4,568) (3,478)

Impact from acquisitions, sales and other changes

(

2

)

........................................ (72) (59) (62)

Balance at end of period .............................................................. $ 5,628 $ 4,127 $ 4,524

Allowance for loan and lease losses as a percentage of loans held for investment ................ 4.47% 4.55% 4.48%

Allowance for loan and lease losses by geographic distribution:

Domestic ......................................................................... $ 5,168 $ 3,928 $ 4,331

International ...................................................................... 460 199 193

Total allowance for loan and lease losses ................................................. $ 5,628 $ 4,127 $ 4,524

Allowance for loan and lease losses by loan category:

Domestic card ..................................................................... $ 3,581 $ 1,927 $ 2,544

International card .................................................................. 460 199 193

Consumer banking ................................................................. 675 1,076 1,314

Commercial banking ............................................................... 826 785 301

Other ............................................................................ 86 140 172

Allowance for loan and lease losses ..................................................... $ 5,628 $ 4,127 $ 4,524

________________________

(1) Includes an adjustment of $53 million made in the second quarter of 2010 for the impact as of January 1, 2010 of impairment on consolidated

loans accounted for as TDRs.