Capital One 2010 Annual Report Download - page 186

Download and view the complete annual report

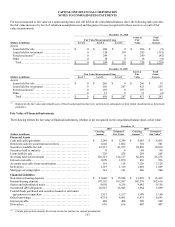

Please find page 186 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

166

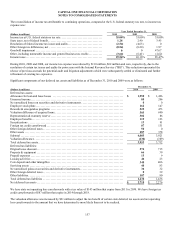

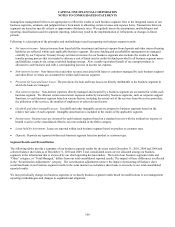

Financial liabilities

Interest Bearing Deposits

The fair value of other interest-bearing deposits was determined based on discounted expected cash flows using discount rates

consistent with current market rates for similar products with similar remaining terms.

Non-Interest Bearing Deposits

The carrying amount of non-interest bearing deposits approximates fair value.

Senior and Subordinated Notes

We engage multiple third party pricing services in order to estimate the fair value of senior and subordinated notes. The pricing

service utilizes a pricing model that incorporates available trade, bid and other market information. It also incorporates spread

assumptions, volatility assumptions and relevant credit information into the pricing models.

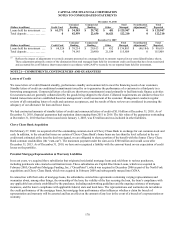

Securitized Debt Obligations

We utilized multiple third party pricing services to obtain fair value measures for the large majority of our securitized debt

obligations. The techniques used by the pricing services utilize observable market data to the extent available; and pricing models

may be used which incorporate available trade, bid and other market information as described in the above section. We used internal

pricing models, discounted cash flow models or similar techniques to estimate the fair value of certain securitization trusts where third

party pricing was not available.

Other Borrowings

The carrying amount of federal funds purchased and repurchase agreements, FHLB advances, and other short-term borrowings

approximates fair value. The fair value of junior subordinated borrowings was estimated using the same methodology as described for

senior and subordinated notes. The fair value of other borrowings was determined based on trade information for bonds with similar

duration and credit quality, adjusted to incorporate any relevant credit information of the issuer. The increase in fair value of other

borrowings above carrying values at December 31, 2010 was primarily due to interest rate spreads across the industry and the

discounts in secondary trading activity exhibited in the junior subordinated borrowings during the second quarter of 2010.

Interest Payable

The carrying amount of interest payable approximates the fair value of this liability due to its relatively short-term nature.

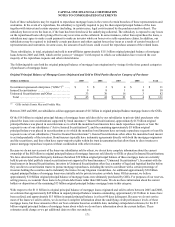

Derivative Liabilities

Most of our derivatives are not exchange traded, but instead traded in over the counter markets where quoted market prices are not

readily available. The fair value of those derivatives, derived using models that use primarily market observable inputs, such as

interest rate yield curves, credit curves, option volatility and currency rates, are classified as Level 2. Any derivative fair value

measurements using significant assumptions that are unobservable are classified as Level 3, which include interest rate swaps whose

remaining terms do not correlate with market observable interest rate yield curves. The impact of counterparty non-performance risk is

considered when measuring the fair value of derivative assets. These derivatives are included in other liabilities on the consolidated

balance sheets.

We validate the pricing obtained from the internal models through comparison of pricing to additional sources, including external

valuation agents and other internal sources. Pricing variances among different pricing sources are analyzed and validated.

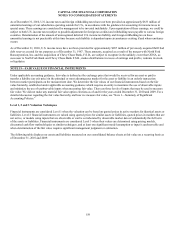

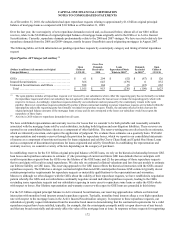

Commitments to extend credit and letters of credit

These financial instruments are generally not sold or traded. The fair value of the financial guarantees outstanding and included in

other liabilities as of December 31, 2010 and 2009 that have been issued since January 1, 2003 was $3 million. The estimated fair

values of extensions of credit and letters of credit are not readily available. However, the fair value of commitments to extend credit

and letters of credit is based on fees currently charged to enter into similar agreements with comparable credit risks and the current

creditworthiness of the counterparties. Commitments to extend credit issued by us are generally short-term in nature and, if drawn