Capital One 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

113

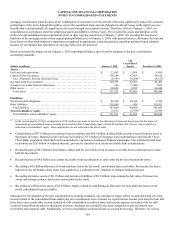

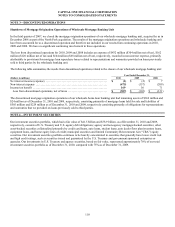

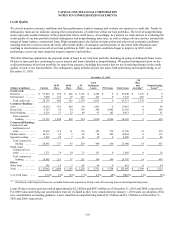

December 31, 2009

Less than 12 Months 12 Months or Longer Total

(Dollars in millions) Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

Securities available for sale:

U.S. Treasury debt obligations ........ $ 0 $ 0 $ 0 $ 0 $ 0 $ 0

U.S. Agency debt obligations(1) ........ 27 0 0 0 27 0

CMOs: ..............................

Agency(2) .......................... 2,188 (38) 689 (9) 2,877 (47)

Non-agency ....................... 3 (1) 1,313 (269) 1,316 (270)

Total CMOs ......................... 2,191 (39) 2,002 (278) 4,193 (317)

MBS:

Agency(2) .......................... 2,520 (30) 325 (7) 2,845 (37)

Non-agency ....................... 0 0 810 (185) 810 (185)

Total MBS .......................... 2,520 (30) 1,135 (192) 3,655 (222)

Asset-backed securities ............... 490 (1) 56 (4) 546 (5)

Other ............................... 30 0 115 (5) 145 (5)

Total securities available for sale in a

gross unrealized loss position ....... $ 5,258 $ (70) $ 3,308 $ (479) $ 8,566 $ (549)

________________________

(1) Consists of debt securities issued by Fannie Mae and Freddie Mac.

(2) Consists of mortgage-related securities issued by Fannie Mae, Freddie Mac and Ginnie Mae.

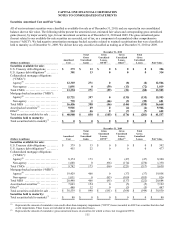

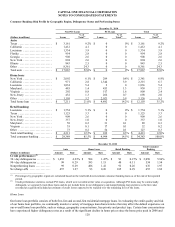

The gross unrealized losses on our available-for-sale securities of $281 million as of December 31, 2010 relate to approximately 340

individual securities. Our investments in non-agency CMOs, non-agency residential MBS and asset-backed securities accounted for

$131 million, or 47%, of total gross unrealized losses as of December 31, 2010. Of the $281 million gross unrealized losses as of

December 31, 2010, $137 million related to securities that had been in a loss position for more than 12 months. As discussed in more

detail below, we conduct periodic reviews of all securities with unrealized losses to assess whether the impairment is other-than-

temporary. Based on our assessments, we have recorded OTTI for a portion of our non-agency CMO, non-agency residential MBS

and asset-backed securities, which is discussed in more detail later in this footnote.

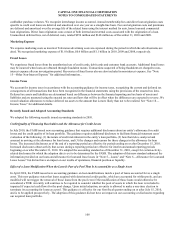

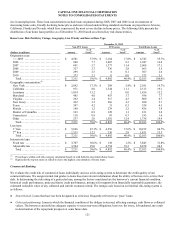

Maturities and Yields of Securities Available for Sale

The following table summarizes the remaining scheduled contractual maturities, assuming no prepayments, of our investment

securities as of December 31, 2010.

December 31, 2010

(Dollars in millions)

Amortized

Cost Fair Value

Due in 1 year or less .......................................................................

.

$ 2,963 $ 2,980

Due after 1 year through 5 years ............................................................

.

7,127 7,198

Due after 5 years through 10 years ..........................................................

.

1,100 1,129

Due after 10 years(1) .......................................................................

.

29,798 30,230

Total ...................................................................................

.

$ 40,988 $ 41,537

________________________

(1) Investments with no stated maturities, which consist of equity securities, are included with contractual maturities due after 10 years.