Capital One 2010 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

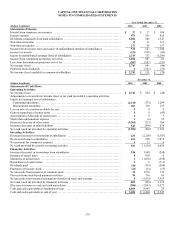

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

179

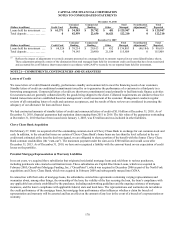

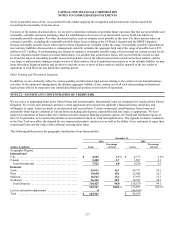

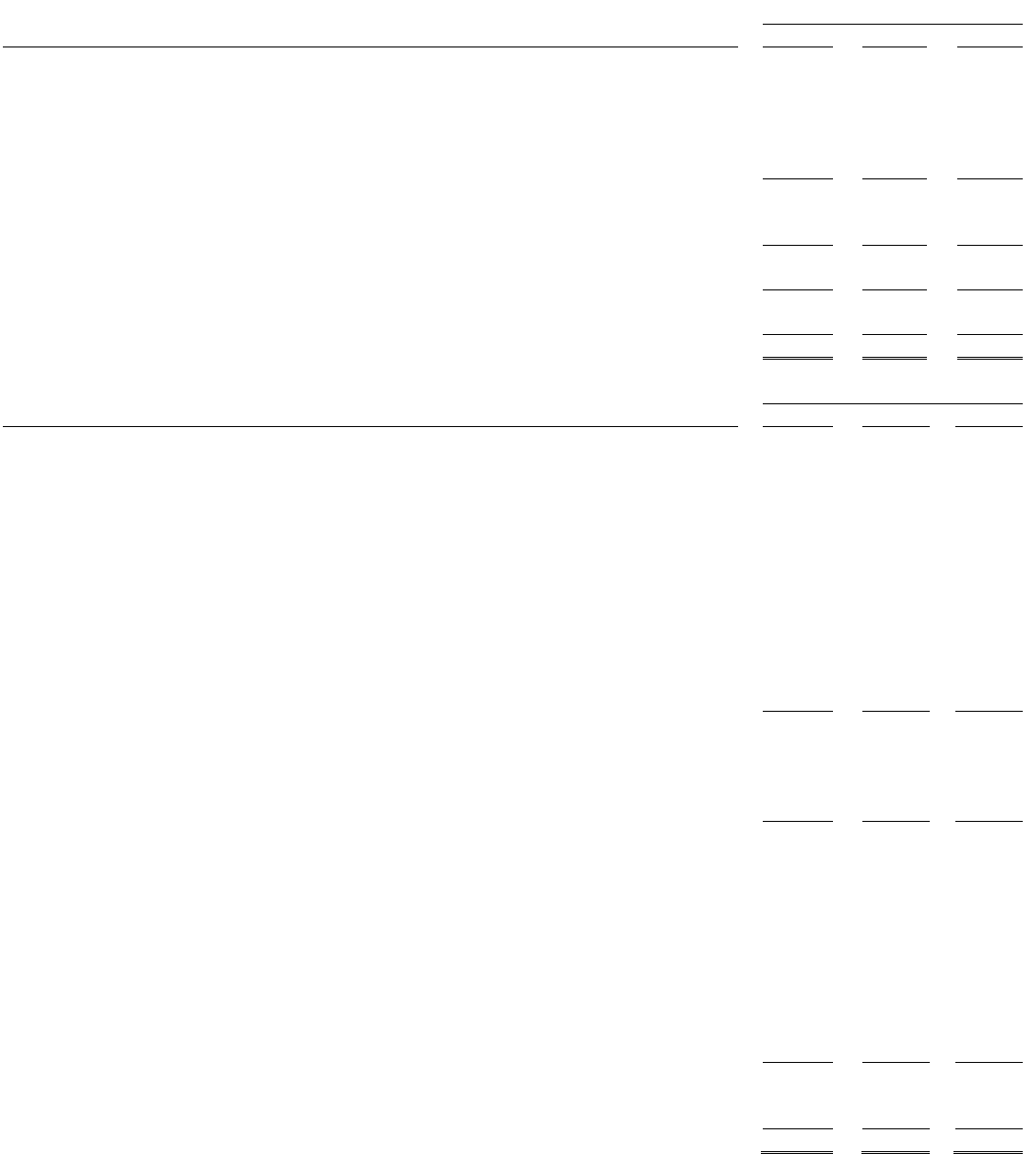

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Statements of Income

Interest from temporary investments ...................................................... $ 27 $ 37 $ 184

Interest expense ......................................................................... 479 336 425

Dividends, principally from bank subsidiaries .............................................. 1,200 500 1,547

N

on-interest income ..................................................................... 35 32 111

N

on-interest expense ..................................................................... 273 90 137

Income before income taxes and equity in undistributed earnings of subsidiaries .............. 510 143 1,280

Income tax benefit ....................................................................... (221) (109) (94)

Equity in undistributed earnings (loss) of subsidiaries ....................................... 2,319 735 (1,289)

Income from continuing operations, net of tax .............................................. 3,050 987 85

Loss from discontinued operations, net of tax .............................................. (307) (103) (131)

N

et income (loss) ........................................................................ 2,743 884 (46)

Preferred stock dividends ................................................................. 0 (564) (33)

N

et income (loss) available to common stockholders ....................................... $ 2,743 $ 320 $ (79)

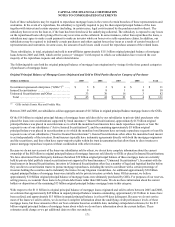

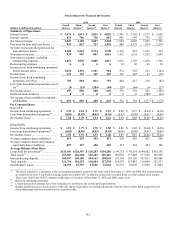

December 31,

(Dollars in millions) 2010 2009 2008

Statements of Cash Flows

Operating Activities:

N

et income (loss) ........................................................................ $ 2,743 $ 884 $ (46)

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Equity in (earnings) loss of subsidiaries:

Continuing operations .................................................................. (2,319) (735) 1,289

Discontinued operations ................................................................ 307 103 131

Loss on sale of securities available for sale ................................................. 0 0 9

Gain on repurchase of senior notes ........................................................ 0 0 (43)

Amortization of discount of senior notes ................................................... 0 0 3

Stock plan compensation expense ......................................................... 3 (6) 59

(Increase) decrease in other assets ......................................................... (3,261) (115) 106

Increase (decrease) in other liabilities ..................................................... 543 (399) 674

N

et cash (used in) provided by operating activities ......................................... (1,984) (268) 2,182

Investing Activities:

Decrease (increase) in investment in subsidiaries ........................................... 433 (2,250) (1,385)

Decrease in loans to subsidiaries .......................................................... 164 689 5,415

N

et payment for companies acquire

d

...................................................... 0 31 0

N

et cash provided by (used in) investing activities .......................................... 597 (1,530) 4,030

Financing Activities:

Increase (decrease) in borrowings from subsidiaries ........................................ 390 1,988 (268)

Issuance of senior notes .................................................................. 0 995 0

Maturities of senior notes ................................................................ 0 (1,030) (550)

Repurchases of senior notes .............................................................. 0 0 (713)

Dividends paid .......................................................................... (91) (319) (568)

Purchases of treasury stock ............................................................... (22) (14) (13)

N

et proceeds from issuances of common stock ............................................. 30 1,536 772

Proceeds from stock-based payment activities .............................................. 96 116 95

N

et proceeds from issuance/redemption of preferred stock and warrants ...................... 0 (3,555) 3,555

N

et cash (used in) provided by financing activities ......................................... 403 (283) 2,310

(Decrease) increase in cash and cash equivalents ........................................... (984) (2,081) 8,522

Cash and cash equivalents at beginning of year ............................................. 6,466 8,547 25

Cash and cash equivalents at end of year ................................................... $ 5,482 $ 6,466 $ 8,547