Capital One 2010 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

146

NOTE 12—STOCKHOLDERS’ EQUITY

Preferred Shares

On November 14, 2008, we entered into an agreement (the “Securities Purchase Agreement”) to issue 3,555,199 Fixed Rate

Cumulative Perpetual Preferred Shares, Series A, par value $0.01 per share (the “Series A Preferred Stock”), to the United States

Department of the Treasury (“U.S. Treasury”) as part of our participation in the Capital Purchase Program (the “CPP”), having a

liquidation amount per share equal to $1,000. The Series A Preferred Stock paid cumulative dividend at a rate of 5% per year for the

first five years and thereafter at a rate of 9% per year. In addition, we issued a warrant (the “Warrants”) to purchase 12,657,960 of our

common shares to the U.S. Treasury as part of the Securities Purchase Agreement. The Warrants have an exercise price of $42.13 per

share and expires ten years from the issuance date.

In 2009, we repurchased all 3,555,199 preferred shares at par, under the CPP for approximately $3.6 billion including accrued

dividends. With the repurchase, the remaining accretion of the discount of $462 million was accelerated and treated as dividend which

reduced income available to common stockholders. On December 9, 2009, the Warrants were sold by the U.S. Treasury for $11.75 per

warrant. The sale by the U.S. Treasury had no impact on our equity and the warrants remain outstanding and are included in paid in

capital.

Common Shares

Secondary Equity Offering

On May 11, 2009, we raised $1.5 billion through the issuance of 56,000,000 shares of common stock at $27.75 per share.

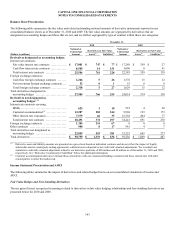

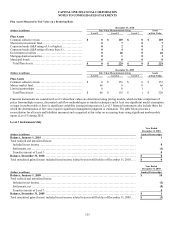

Accumulated Other Comprehensive Income (AOCI)

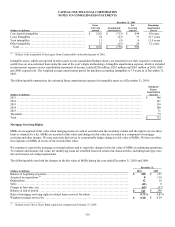

The following table presents the cumulative balances of accumulated other comprehensive income, net of deferred tax of $143

million, $67 million, and $522 million as of December 31, 2010, 2009 and 2008, respectively:

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

N

et unrealized gains (losses) on securities(1) ....................................

.

$ 333 $ 199 $ (797)

N

et unrecognized elements of defined benefit plans .............................

.

(29) (29) (42)

Foreign currency translation adjustments .......................................

.

(36) (26) (228)

Unrealized losses on cash flow hedging instruments .............................

.

(52) (60) (154)

Other-than-temporary impairment not recognized in earnings on securities ........

.

49 0 0

Initial application of measurement date provisions for postretirement benefits other

than pensions ..............................................................

.

(1) (1) (1)

Initial application from adoption of consolidation standards ......................

.

(16) 0 0

Total accumulated other comprehensive income (loss) ..........................

.

$ 248 $ 83 $ (1,222)

________________________

(1) Includes net unrealized gains (losses) on securities available for sale and retained subordinated notes. Unrealized losses not related to credit on

other-than-temporarily impaired securities of $105 million (net of income tax of $68 million) and $181 million (net of income tax of $117

million) was reported in other comprehensive income as of December 31, 2010 and 2009, respectively.

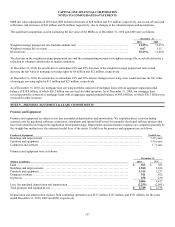

NOTE 13—REGULATORY AND CAPITAL ADEQUACY

Regulation and Capital Adequacy

Bank holding companies and national banks are subject to capital adequacy standards adopted by the Federal Reserve and the OCC,

respectively. The capital adequacy standards set forth minimum risk-based and leverage capital requirements that are based on

quantitative and qualitative measures of their assets and off-balance sheet items. Under the capital adequacy standards, bank holding

companies and banks currently are required to maintain a total risk-based capital ratio of at least 8%, a Tier 1 risk-based capital ratio

of at least 4%, and a Tier 1 leverage capital ratio of at least 4% (3% for banks that meet certain specified criteria, including excellent

asset quality, high liquidity, low interest rate exposure and the highest regulatory rating).