Capital One 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

133

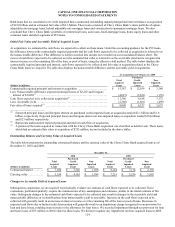

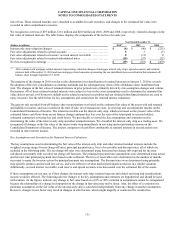

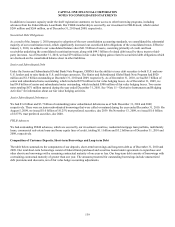

December 31,

(Dollars in millions) 2010 2009

Total principal amount of loans ............................................................... $ 1,396 $ 4,642

Principal amount of loans past due 90 days or more ............................................. $ 257 $ 1,247

N

et credit losses ............................................................................. $ 136 $ 217

Other VIEs

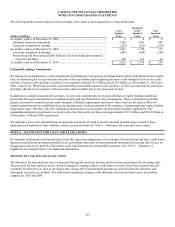

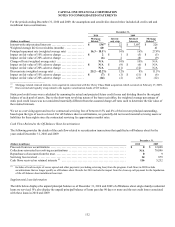

Affordable Housing Entities

As part of our community reinvestment initiatives, we invest in private investment funds that make equity investments in multi-family

affordable housing properties. We receive affordable housing tax credits for these investments. The activities of these entities are

financed with a combination of invested equity capital and debt. As a result of the new consolidation guidance, certain investment

funds are no longer considered to be VIEs and are not included in the December 31, 2010 balances. For those investment funds

considered to be VIEs, we are not required to consolidate if we do not have the power to direct the activities that most significantly

impact the economic performance of those entities. We record our interests in these unconsolidated VIEs in loans held for investment,

other assets and other liabilities. As of December 31, 2010 and 2009 our interests consisted of assets of approximately $1.7 billion and

$1.4 billion, respectively. Our maximum exposure to these entities is limited to our variable interests in the entities and is $1.7 million

as of December 31, 2010. The creditors of the VIEs have no recourse to our general credit and we do not provide additional financial

or other support during the period that we were not previously contractually required to provide. The total assets of the unconsolidated

investment funds that were VIEs at December 31, 2010 and 2009 were approximately $7.5 billion and $7.3 billion, respectively. The

remaining investment funds where we have the power to direct activities that most significantly impact the economic performance

were consolidated as of January 1, 2010; the net consolidation impact to retained earnings was $3 million.

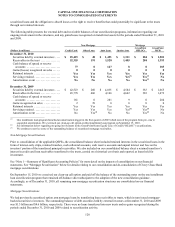

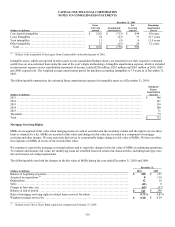

Entities that Provide Capital to Low-Income and Rural Communities

We hold variable interests in entities (“Investor Entities”) that invest in community development entities (“CDEs”) that provide debt

financing to businesses and non-profit entities in low-income and rural communities. Investments of the consolidated Investor Entities

are also our variable interests. The activities of the Investor Entities are financed with a combination of invested equity capital and

debt. The activities of the CDEs are financed solely with invested equity capital. We receive federal and state tax credits for these

investments. We consolidate the VIEs in which we have the power to direct the activities that most significantly impact the VIE’s

economic performance and the obligation to absorb losses or right to receive benefits that could be potentially significant to the VIE.

The assets of the VIEs that we consolidated at December 31, 2010 and 2009 were approximately $230 million and $155 million,

respectively. The assets and liabilities of these consolidated VIEs were recorded in cash, loans held for investment, interest receivable,

other assets and other liabilities. The total assets of the VIEs that we held an interest in but were not required to consolidate at

December 31, 2010 and 2009 were approximately $7.5 billion and $7.3 billion, respectively. We record our interests in these

unconsolidated VIEs in loans held for investment and other assets. As of December 31, 2010 and 2009 our interests consisted of assets

of approximately $6 million and $58 million, respectively. Our maximum exposure to these entities is limited to our variable interests

in the entities and is $6 million as of December 31, 2010. The creditors of the VIEs have no recourse to our general credit. We have

not provided additional financial or other support during the period that we were not previously contractually required to provide.

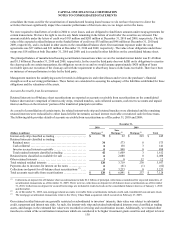

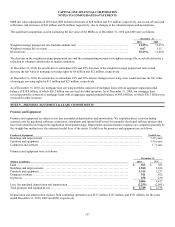

Other

We also have a variable interest in a trust that has a royalty interest in certain oil and gas properties. The activities of the trust are

financed solely with debt. The total assets of the trust at December 31, 2010 and 2009 were $395 million and $430 million,

respectively. We are not required to consolidate the trust because we do not have the power to direct the activities of the trust that

most significantly impacts the trust’s economic performance. We record our interest in the trust in loans held for investment. As of

December 31, 2010 and 2009 our interests consisted of assets of approximately $174 million and $203 million, respectively. Our

maximum exposure to the trust is limited to our variable interest and is $174 million as of December 31, 2010. The creditors of the

trust have no recourse to our general credit. We have not provided additional financial or other support during the period that we were

not previously contractually required to provide.