Capital One 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

111

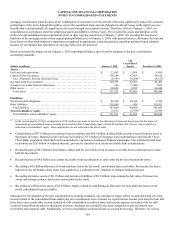

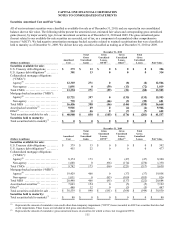

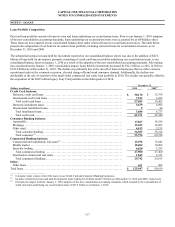

Securities Amortized Cost and Fair Value

All of our investment securities were classified as available-for-sale as of December 31, 2010, and are reported in our consolidated

balance sheet at fair value. The following tables present the amortized cost, estimated fair values and corresponding gross unrealized

gains (losses), by major security type, for our investment securities as of December 31, 2010 and 2009. The gross unrealized gains

(losses) related to our available-for-sale securities are recorded, net of tax, as a component of accumulated other comprehensive

income (“AOCI”). We had negative amortization mortgage backed securities related to retained securitizations that were classified as

held to maturity as of December 31, 2009. We did not have any securities classified as trading as of December 31, 2010 or 2009.

December 31, 2010

(Dollars in millions) Amortized

Cost

Total

Gross

Unrealized

Gains

Gross

Unrealized

Losses-

OTTI(1)

Gross

Unrealized

Losses-

Other(2)

Total

Gross

Unrealized

Losses Fair Value

Securities available for sale:

U.S. Treasury debt obligations ......... $ 373 $ 13 $ 0 $ 0 $ 0 $ 386

U.S. Agency debt obligations(3) ......... 301 13 0 0 0 314

Collateralized mortgage obligations

(“CMOs”):

Agency(4) ........................... 12,303 271 0 (8) (8) 12,566

Non-agency ........................ 1,091 0 (59) (13) (72) 1,019

Total CMOs .......................... 13,394 271 (59) (21) (80) 13,585

Mortgage-backed securities (“MBS”):

Agency(4) ........................... 15,721 397 0 (135) (135) 15,983

Non-agency ........................ 735 1 (46) (9) (55) 681

Total MBS ........................... 16,456 398 (46) (144) (190) 16,664

Asset-backed securities(5) .............. 9,901 69 0 (4) (4) 9,966

Other(6) ............................... 563 66 0 (7) (7) 622

Total securities available for sale ....... $ 40,988 $ 830 $ (105) $ (176) $ (281) $ 41,537

Securities held to maturity:

Total securities held to maturity(7) ...... $ 0 $ 0 $ 0 $ 0 $ 0 $ 0

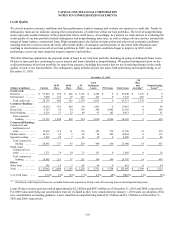

December 31, 2009

(Dollars in millions) Amortized

Cost

Total

Gross

Unrealized

Gains

Gross

Unrealized

Losses-

OTTI(1)

Gross

Unrealized

Losses-

Other(2)

Total

Gross

Unrealized

Losses Fair Value

Securities available for sale:

U.S. Treasury debt obligations ......... $ 379 $ 13 $ 0 $ 0 $ 0 $ 392

U.S. Agency debt obligations(3) ......... 455 22 0 0 0 477

Collateralized mortgage obligations

(“CMOs”):

Agency(4) ........................... 8,174 173 0 (47) (47) 8,300

Non-agency ........................ 1,608 0 (96) (174) (270) 1,338

Total CMOs .......................... 9,782 173 (96) (221) (317) 9,638

Mortgage-backed securities (“MBS”):

Agency(4) ........................... 19,429 466 0 (37) (37) 19,858

Non-agency ........................ 1,011 0 (85) (100) (185) 826

Total MBS ........................... 20,440 466 (85) (137) (222) 20,684

Asset-backed securities(5) .............. 7,043 154 0 (5) (5) 7,192

Other(6) ............................... 440 12 0 (5) (5) 447

Total securities available for sale ....... $ 38,539 $ 840 $ (181) $ (368) $ (549) $ 38,830

Securities held to maturity:

Total securities held to maturity(7) ...... $ 80 $ 0 $ 0 $ 0 $ 0 $ 80

________________________

(1) Represents the amount of cumulative non-credit other-than-temporary impairment (“OTTI”) losses recorded in AOCI on securities that also had

credit impairments. These losses are included in total gross unrealized losses.

(2) Represents the amount of cumulative gross unrealized losses on securities for which we have not recognized OTTI.