Capital One 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

117

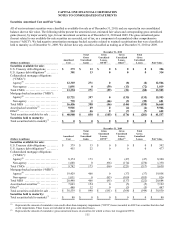

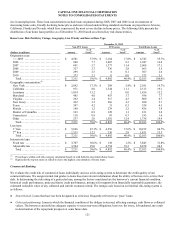

NOTE 5—LOANS

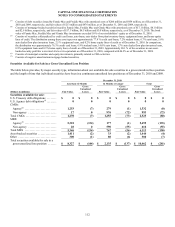

Loan Portfolio Composition

Our total loan portfolio consists of loans we own and loans underlying our securitization trusts. Prior to our January 1, 2010 adoption

of the new consolidation accounting standards, loans underlying our securitization trusts were accounted for as off-balance sheet.

These loans are now reported on our consolidated balance sheet under restricted loans for securitization investors. The table below

presents the composition of our held-for investment loan portfolio, including restricted loans for securitization investors, as of

December 31, 2010 and 2009.

The substantial increase in loans held for investment reported on our consolidated balance sheets was due to the addition of $47.6

billion of loans held for investment, primarily consisting of credit card loan receivables underlying our securitization trusts, to our

consolidated balance sheet on January 1, 2010 as a result of the adoption of the new consolidation accounting standards. After taking

into consideration the January 1, 2010 consolidation impact, loans held for investment decreased by $12.2 billion, or 10%, in 2010 to

$125.9 billion as of December 31, 2010. The decline was primarily due to the run-off of loans in businesses that we either exited or

repositioned early in the economic recession, elevated charge-offs and weak consumer demand. Additionally, the decline was

attributable to the sale of a portion of the small-ticket commercial real estate loan portfolio in 2010. The decline was partially offset by

the acquisition of the $807 million legacy Sony Card portfolio in the third quarter of 2010.

December 31,

(Dollars in millions) 2010 2009(3)

Credit Card business:

Domestic credit card loans ............................................................... $ 50,170 $ 13,374

International credit card loans ............................................................ 7,513 2,229

Total credit card loans ................................................................. 57,683 15,603

Domestic installment loans ............................................................... 3,679 6,693

International installment loans ............................................................ 9 44

Total installment loans ................................................................. 3,688 6,737

Total credit card ....................................................................... 61,371 22,340

Consumer Banking business:

Automobile ............................................................................. 17,867 18,186

Mortgage ............................................................................... 12,103 14,893

Other retail .............................................................................. 4,413 5,135

Total consumer banking ................................................................ 34,383 38,214

Total consumer(1) ...................................................................... 95,754 60,554

Commercial Banking business:

Commercial and multifamily real estate(2) .................................................. 13,396 13,843

Middle market .......................................................................... 10,484 10,062

Specialty lending ........................................................................ 4,020 3,555

Total commercial lending .............................................................. 27,900 27,460

Small-ticket commercial real estate ....................................................... 1,842 2,153

Total commercial banking .............................................................. 29,742 29,613

Other:

Other loans ............................................................................. 451 452

Total loans ................................................................................ $ 125,947 $ 90,619

________________________

(1) Consumer loans consist of all of the loans in our Credit Card and Consumer Banking businesses.

(2) Includes construction loans and land development loans totaling $2.4 billion and $2.5 billion as of December 31, 2010 and 2009, respectively.

(3) Excludes the impact from the January 1, 2010 adoption of the new consolidation accounting standards, which resulted in the consolidation of

credit card loans underlying our securitization trusts of $47.6 billion as of January 1, 2010.