Capital One 2010 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 7

CAPITAL ONE FINANCIAL CORPORATION (COF)

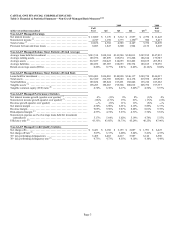

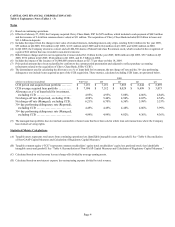

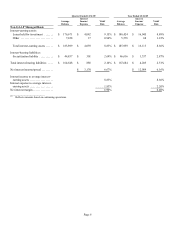

Table 6: Reconciliation of Non-GAAP Capital Measures and Calculation of Regulatory Capital Measures

In addition to disclosing required regulatory measures, the Company also reports certain non-GAAP capital measures that

management uses in assessing its capital adequacy. These non-GAAP measures include average tangible common equity, tangible

common equity (TCE), TCE ratio, Tier 1 common equity and Tier 1 common equity ratio. The table below provides the details of the

calculation of each of these measures. While these non-GAAP capital measures are widely used by investors, analysts and bank

regulatory agencies to assess the capital position of financial services companies, they may not be comparable to similarly titled

measures reported by other companies.

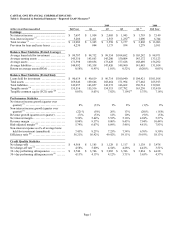

(dollars in millions)(unaudited)

2010

Q4

2010

Q3

2010

Q2

2010

Q1

2009

Q4

Average Equity to Non-GAAP Average Tangible Common Equity

Average total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 26,255 $ 25,307 $ 24,526 $ 23,681 $ 26,518

Less: Average preferred stock ....................................................

—

—

—

—

—

Less: Average intangible assets

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,008) (14,003) (14,039) (14,075) (14,105)

Average tangible common equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,247 $ 11,304 $ 10,487 $ 9,606 $ 12,413

Stockholders Equity to Non-GAAP Tangible Common Equity

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 26,541 $ 26,061 $ 25,270 $ 24,374 $ 26,589

Less: Preferred stock .............................................................

—

—

—

—

—

Less: Intangible assets

(1)

......................................................... (13,983) (14,024) (14,011) (14,044) (14,106)

Tangible common equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,558 $ 12,037 $ 11,259 $ 10,330 $ 12,483

Total Assets to Tangible Assets

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $197,503 $ 196,933 $ 197,489 $ 200,707 $ 169,646

Less: Assets from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (362) (5) (4) (16) (24)

Total assets from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197,141 196,928 197,485 200,691 169,622

Less: Intangible assets

(1)

......................................................... (13,983) (14,024) (14,011) (14,044) (14,106)

Tangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $183,158 $ 182,904 $ 183,474 $ 186,647 $ 155,516

Non-GAAP TCE Ratio

Tangible common equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,558 $ 12,037 $ 11,259 $ 10,330 $ 12,483

Tangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $183,158 $ 182,904 $ 183,474 $ 186,647 $ 155,516

TCE ratio

(2)

...................................................................... 6.86% 6.58% 6.14% 5.53% 8.03%

Non-GAAP Managed Basis TCE Ratio

Total reported assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $197,503 $ 196,933 $ 197,489 $ 200,707 $ 169,646

Plus: Securitization adjustment

(3)

.................................................

—

—

—

—

42,767

Total managed assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $197,503 $ 196,933 $ 197,489 $ 200,707 $ 212,413

Less: Assets from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (362) (5) (4) (16) (24)

Total assets from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197,141 196,928 197,485 200,691 212,389

Less: Intangible assets

(1)

......................................................... (13,983) (14,024) (14,011) (14,044) (14,106)

Managed tangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $183,158 $ 182,904 $ 183,474 $ 186,647 $ 198,283

Tangible common equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,558 $ 12,037 $ 11,259 $ 10,330 $ 12,483

Managed tangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $183,158 $ 182,904 $ 183,474 $ 186,647 $ 198,283

Managed TCE ratio

(2)

............................................................ 6.86% 6.58% 6.14% 5.53% 6.30%

Non-GAAP Tier 1 Common Equity and Regulatory Capital Ratios

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 26,541 $ 26,061 $ 25,270 $ 24,374 $ 26,589

Less: Net unrealized (gains) losses on AFS securities recorded in AOCI

(4)

. . . . . . . . (368) (580) (661) (319) (200)

Net (gains) losses on cash flow hedges recorded in AOCI(4) . . . . . . . . . . . . . . . . 86 79 73 80 92

Disallowed goodwill and other intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,953) (13,993) (14,023) (14,078) (14,125)

Disallowed deferred tax assets ............................................ (1,150) (1,324) (1,977) (2,183)

—

Other ..................................................................... (2) (2) (2) (1) (9)

Tier 1 common equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,154 $ 10,241 $ 8,680 $ 7,873 $ 12,347

Plus: Tier 1 restricted core capital items

(

5

)

......................................... 3,636 3,636 3,637 3,638 3,642

Tier 1 capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,790 $ 13,877 $ 12,317 $ 11,511 $ 15,989

Plus: Long-term debt qualifying as Tier 2 capital 2,827 2,827 2,898 3,018 3,018

Qualifying allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,748 3,726 5,836 5,802 1,581

Other Tier 2 components .................................................. 29 24 25 4 4

Tier 2 capital ..................................................................... $ 6,604 $ 6,577 $ 8,759 $ 8,824 $ 4,603

Total risk-based capital

(6)

......................................................... $ 21,394 $ 20,454 $ 21,076 $ 20,335 $ 20,592

Risk-weighted assets

(

7

)

........................................................... $127,043 $ 124,726 $ 124,038 $ 120,330 $ 116,309

Tier 1 common equity ratio

(8)

.................................................... 8.78%

(11)

8.21% 7.00% 6.54% 10.62%

Tier 1 risk-based capital ratio

(9)

.................................................. 11.64%

(11)

11.13% 9.93% 9.57% 13.75%

Total risk-based capital ratio

(10)

.................................................. 16.84%

(11)

16.40% 16.99% 16.90% 17.70%