Capital One 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

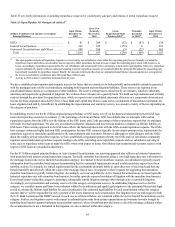

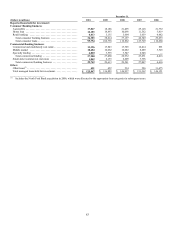

Contractual Obligations

In the normal course of business, we into various contractual obligations that may require future cash payments that affect our short-

and long-term liquidity and capital resource needs. Commitments for future cash expenditures primarily relate to deposits, debt

securities and other borrowings and operating leases. Table 34 provides aggregated information about the listed categories of our

contractual obligations as of December 31, 2010. The table includes information about undiscounted future cash payments due under

these contractual obligations, including the contractual maturity profile of deposits, debt securities and other borrowings reported on

our consolidated balance sheet and our operating leases at December 31, 2010. The timing of actual future payments may differ from

those presented due to a number of factors, including discretionary debt repurchases. The table excludes certain obligations such as

trade payables and trading liabilities, where the obligation is short-term or subject to valuation based on market factors. The table also

excludes the representation and warranty reserve of $816 million.

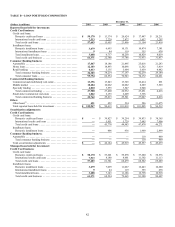

Table 34: Contractual Funding Obligations

December 31, 2010

(Dollars in millions) Up to

1 Year > 1 Year

to 3 Years > 3 Years

to 5 Years > 5 Years Total

Interest-bearing time deposits(1) ..................

.

$ 10,208 $ 8,763 $ 2,814 $ 449 $ 22,234

Senior and subordinated notes ...................

.

884 1,479 1,833 4,454 8,650

Other borrowings(2) .............................

.

12,222 7,534 4,377 9,013 33,146

Operating leases ...............................

.

159 297 257 785 1,498

Purchase obligations ...........................

.

224 93 6 15 338

Total obligations ...............................

.

$ 23,697 $ 18,166 $ 9,287 $ 14,716 $ 65,866

________________________

(1) Includes only those interest bearing deposits which have a contractual maturity date.

(2) Other borrowings includes secured borrowings for our on-balance sheet auto loan securitizations, junior subordinated capital securities and

debentures, FHLB advances, federal funds purchased and resale agreements and other short-term borrowings.

Covenants

In connection with the issuance of certain of our trust preferred securities, we entered into Replacement Capital Covenants (“RCCs”)

granting certain rights to the holders of “covered debt” which was defined in the RCCs as our 5.35% Subordinated Notes due May 1,

2014. The RCCs prohibited the repayment, redemption or purchase of the trust preferred securities except, with limited exceptions, to

the extent that we received specified amounts of proceeds from the sale of certain qualifying securities. We commenced a solicitation

of consents from the covered debtholders on November 29, 2010, to terminate the RCCs. The RCCs were terminated on December 10,

2010, the expiration date of the consent solicitation, at which time we had received the consent of holders of a majority of the

principal amount of the covered debt.

The terms of certain lease and credit facility agreements related to other borrowings and operating leases include several financial

covenants that require performance measures and equity ratios to be met. If these covenants are not met, there may be an acceleration

of the payment due dates noted in Table 32. As of December 31, 2010, we were not in default of any such covenants.

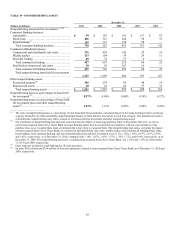

Capital

The level and composition of our equity capital are determined by multiple factors including our consolidated regulatory capital

requirements and an internal risk-based capital assessment, and may also be influenced by rating agency guidelines, subsidiary capital

requirements, the business environment, conditions in the financial markets and assessments of potential future losses due to adverse

changes in our business and market environments.

Capital Standards and Prompt Corrective Action

Bank holding companies and national banks are subject to capital adequacy standards adopted by the Federal Reserve and the OCC,

respectively. The capital adequacy standards set forth minimum risk-based and leverage capital requirements that are based on

quantitative and qualitative measures of their assets and off-balance sheet items. Under the capital adequacy standards, bank holding

companies and banks currently are required to maintain a total risk-based capital ratio of at least 8%, a Tier 1 risk-based capital ratio

of at least 4%, and a Tier 1 leverage capital ratio of at least 4% (3% for banks that meet certain specified criteria, including excellent

asset quality, high liquidity, low interest rate exposure and the highest regulatory rating).