Capital One 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

126

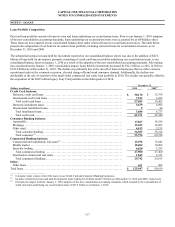

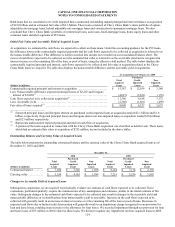

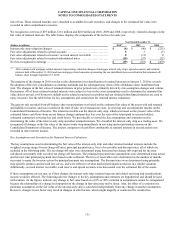

Consumer Unfunded

Lending

(Dollars in millions) Credit

Card Auto

Home

Loan

Retail

Banking

Total

Consumer Commercial Other(1) Total

Allowance Reserve

Commercial

Combined

Total

Balance as of December 31, 2008 .... $ 2,737 $ 1,102 $ 61 $ 151 $ 1,314 $ 301 $ 172 $ 4,524 $ 0 $ 4,524

Provision for loan and lease losses . .. 2,198 435 198 223 856 919 172 4,145 85 4,230

Charge-offs ......................... (3,334) (1,110) (87) (160) (1,357) (444) (207) (5,342) 0 (5,342)

Recoveries .......................... 499 238 3 22 263 10 2 774 0 774

N

et charge-offs ...................... (2,835) (872) (84) (138) (1,094) (434) (205) (4,568) 0 4,568

Other changes(2) .................... 26 0 0 0 0 (1) 1 26 (85) (59)

Balance as of December 31, 2009 .... $ 2,126 $ 665 $ 175 $ 236 $ 1,076 $ 785 $ 140 $ 4,127 0 4,127

Impact from January 1, 2010 adoption

of new consolidation accounting

standards(3) ........................ 4,244 0 73 0 73 0 0 4,317 0 4,317

Balance as of January 1, 2010 ........ 6,370 665 248 236 1,149 785 140 8,444 0 8,444

Provision for loan and lease losses .... 3,182 145 30 66 241 417 55 3,895 12 3,907

Charge-offs .......................... (6,781) (672) (97) (129) (898) (444) (115) (8,238) 0 (8,238)

Recoveries .......................... 1,282 215 4 24 243 54 8 1,587 0 1,587

N

et charge-offs ...................... (5,499) (457) (93) (105) (655) (390) (107) (6,651) 0 (6,651)

Other changes(2) .................... (12) 0 (73) 13 (60) 14 (2) (60) (12) (72)

Balance as of December 31, 2010 ..... $ 4,041 $ 353 $ 112 $ 210 $ 675 $ 826 $ 86 $ 5,628 $ 0 $ 5,628

________________________

(1) Other consists of our discontinued GreenPoint mortgage operations loan portfolio and our community redevelopment loan portfolio.

(2) Represents the net impact on the allowance and lease losses attributable to acquisitions, sales and other.

(3) Represents the cumulative effect adjustment on the allowance for loan and lease losses from the January 1, 2010 adoption of the new

consolidation accounting standards. Includes an adjustment of $53 million made in the second quarter of 2010 for the impact as of January 1,

2010 of impairment on consolidated loans accounted for as TDRs. See “Note 2—Acquisitions and Restructuring Activities.”

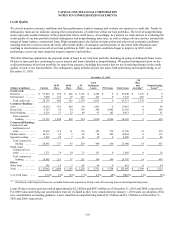

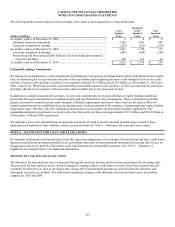

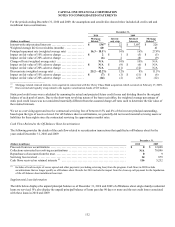

Components of Allowance for Loan and Lease Losses by Impairment Methodology

The table below presents the components of our allowance for loan and lease losses, by loan category and impairment methodology,

and the recorded investment of the related loans as of December 31, 2010:

December 31, 2010

Consumer

(Dollars in millions) Credit

Card Auto

Home

Loan

Retail

Banking

Total

Consumer Commercial Other Total

Allowance for loan and lease losses by

impairment methodology:

Collectively evaluated for impairment . . $ 3,655 $ 353 $ 81 $ 209 $ 643 $ 808 $ 86 $ 5,192

Individually evaluated for impairment . . 386 0 1 1 2 15 0 403

Purchased credit impaired loans ........ 0 0 30 0 30 3 0 33

Total allowance for loan and lease losses $ 4,041 $ 353 $ 112 $ 210 $ 675 $ 826 $ 86 $ 5,628

Held-for-investment loans by

impairment methodology:

Collectively evaluated for impairment . . $ 60,458 $ 17,867 $ 7,154 $ 4,271 $ 29,292 $ 28,682 $ 451 $118,883

Individually evaluated for impairment . . 913 0 57 40 97 500 0 1,510

Purchased credit impaired loans ......... 0 0 4,892 102 4,994 560 0 5,554

Total held-for-investment loans ........ $ 61,371 $ 17,867 $ 12,103 $ 4,413 $ 34,383 $ 29,742 $ 451 $125,947

Allowance as a percentage of period-end

held-for-investment loans ............ 6.58% 1.98% 0.93% 4.76% 1.96% 2.78% 19.07% 4.47%