Capital One 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

157

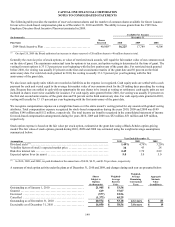

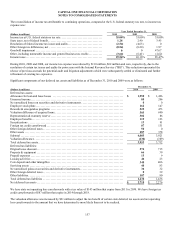

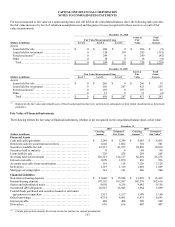

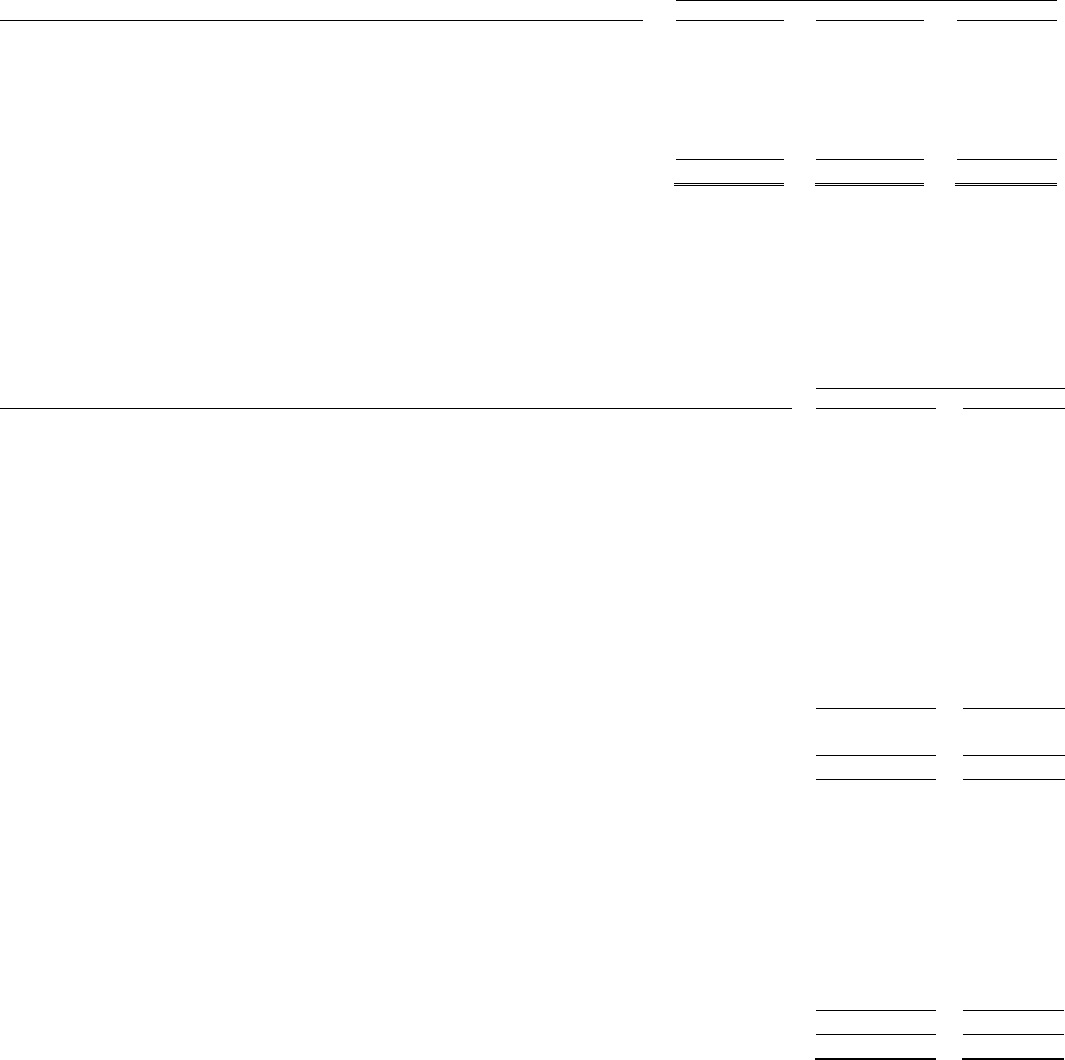

The reconciliation of income tax attributable to continuing operations, computed at the U.S. federal statutory tax rate, to income tax

expense was:

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Income tax at U.S. federal statutory tax rate .................................. 35.00% 35.00% 35.00%

State taxes, net of federal benefit ............................................ 1.28 2.40 3.45

Resolution of federal income tax issues and audits ............................ (2.54) (4.63) 0

Other foreign tax differences, net ........................................... (0.54) (0.20) 1.97

Goodwill impairment ...................................................... 0 0 47.67

Other, including nontaxable income and general business tax credits ........... (3.64) (6.41) (2.62)

Income taxes .............................................................. 29.56% 26.16% 85.47%

During 2010, 2009 and 2008, our income tax expense was reduced by $110 million, $62 million and zero, respectively, due to the

resolution of certain tax issues and audits for prior years with the Internal Revenue Service (“IRS”). This reduction represented the

release of previous accruals for potential audit and litigation adjustments which were subsequently settled or eliminated and further

refinement of existing tax exposures.

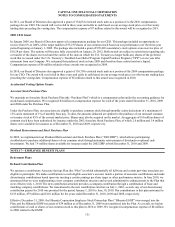

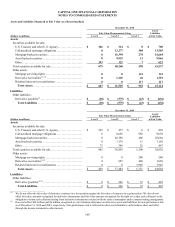

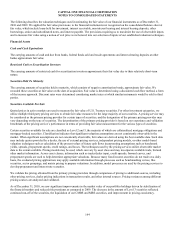

Significant components of our deferred tax assets and liabilities as of December 31, 2010 and 2009 were as follows:

December 31,

(Dollars in millions) 2010 2009

Deferred tax assets:

Allowance for loan and lease losses ......................................................... $ 1,950 $ 1,496

Unearned income ........................................................................... 85 206

N

et unrealized losses on securities and derivative instruments .................................. 0 0

Employee stock plans ....................................................................... 162 147

Rewards & sweepstakes programs ........................................................... 525 473

Valuation difference of acquired loans ........................................................ 503 690

Representation & warranty reserve ........................................................... 302 86

Employee benefits .......................................................................... 119 123

Securitizations ............................................................................. 13 91

Foreign tax credit carryforward .............................................................. 87 131

Other foreign deferred taxes ................................................................. 50 0

Other assets ................................................................................ 287 378

Subtotal ................................................................................... 4,083 3,821

Valuation allowance ........................................................................ (130) (109)

Total deferred tax assets ..................................................................... 3,953 3,712

Deferred tax liabilities:

Original issue discount ...................................................................... 574 715

Property & equipment ...................................................................... 66 39

Prepaid expenses ........................................................................... 13 9

Leasing activities ........................................................................... 46 23

Core deposit and other intangibles ........................................................... 348 406

Servicing assets ............................................................................ 48 83

N

et unrealized gains on securities and derivative instruments ................................... 36 32

Other foreign deferred taxes ................................................................. 0 39

Other liabilities ............................................................................. 107 90

Total deferred tax liabilities ................................................................. 1,238 1,436

N

et deferred tax assets ...................................................................... $ 2,715 $ 2,276

We have state net operating loss carryforwards with a tax value of $143 million that expire from 2011 to 2030. We have foreign tax

credit carryforwards of $87 million that expire in 2014 through 2018.

The valuation allowance was increased by $21 million to adjust the tax benefit of certain state deferred tax assets and net operating

loss carryforwards to the amount that we have determined is more likely than not to be realized.