Capital One 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

150

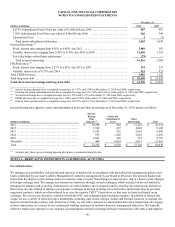

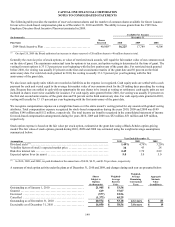

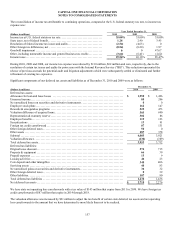

Shares

Subject to

Options

(in thousands)

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(in millions)

Outstanding as of January 1, 2009 .........................

.

23,827 $ 59.18

Granted .................................................

.

3,556 18.23

Exercised ...............................................

.

(356) 26.57

Cancelled ...............................................

.

(5,122) 56.72

Outstanding as of December 31, 2009 .....................

.

21,905 $ 53.58 5.4 years $ 73

Exercisable as of December 31, 2009 ......................

.

13,486 $ 60.25 3.7 years $ 4

As of December 31, 2010, the number of shares, weighted average exercise price, aggregate intrinsic value and weighted average remaining

contractual terms of stock options vested and expected to vest approximate amounts for stock options outstanding. The weighted-average fair

value of options granted during the years 2010, 2009 and 2008 was $11.78, $4.56 and $9.94, respectively. Cash proceeds from the exercise of

stock options were $13 million, $9 million, and $71 million for 2010, 2009 and 2008, respectively. Tax benefits realized from the exercise of

stock options were $4 million, $1 million and $9 million for 2010, 2009 and 2008, respectively. The total intrinsic value of stock options

exercised during the years 2010, 2009 and 2008 was $11 million, $4 million, and $27 million, respectively.

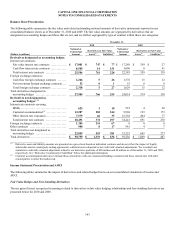

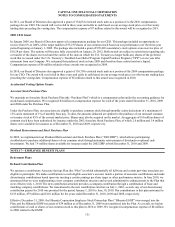

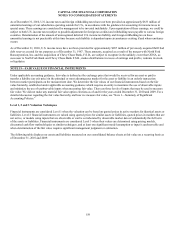

A summary of 2010 activity for restricted stock awards and units is presented below:

Shares

(in thousands)

Weighted-

Average

Grant Date

Fair Value

Unvested as of January 1, 2010 ............................................................. 5,769 $ 29.91

Granted .................................................................................. 1,595 36.83

Vested ................................................................................... (1,645) 35.79

Cancelled ................................................................................ (375) 28.68

Unvested as of December 31, 2010 ......................................................... 5,344 $ 30.29

The weighted-average grant date fair value of restricted stock granted for 2010, 2009 and 2008 was $36.83, $17.58 and $49.33,

respectively. The total fair value of restricted stock vesting was $62 million, $41 million and $34 million in 2010, 2009 and 2008,

respectively. We expect to recognize the unrecognized compensation cost for unvested restricted awards of $50 million as of

December 31, 2010 over the next three years.

Cash equity units vesting in 2010, 2009, and 2008 resulted in cash payments to associates of $48 million, $10 million, and $30

million, respectively. These cash payments reflect the number of units vesting based on our stock price as of or for some defined

period prior to the vest date. We expect to recognize the unrecognized compensation cost for unvested cash equity units of $54 million

as of December 31, 2010, which calculated based on the average quarterly stock price, over the next 3 years.

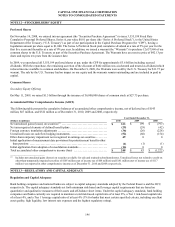

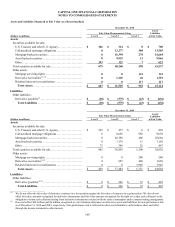

2011 CEO Grant

In January 2011, our Board of Directors approved a compensation package for our CEO. This package included an opportunity to receive

from 0% to 200% of the target number of 82,851 shares of our common stock based on our performance over the three-year period

beginning on January 1, 2011. The package also included a grant of 608,366 nonstatutory stock options at an exercise price of $48.28 per

share. The options will become fully exercisable on January 26, 2014. Upon retirement, these awards will continue to vest in accordance

with the original vesting schedule. Compensation expense of $12 million related to these awards will be recognized in 2011.

2010 CEO Grant

In January 2010, our Board of Directors approved a compensation package for our CEO. This package included an opportunity to receive

from 0% to 200% of the target number of 88,920 shares of our common stock based on our performance over the three-year period

beginning on January 1, 2010. The package also included a grant of 559,333 nonstatutory stock options at an exercise price of $36.55 per

share. The options will become fully exercisable on January 27, 2013. Upon retirement, these awards will continue to vest in accordance

with the original vesting schedule. Compensation expense of $10 million related to these awards was recognized in 2010.