Capital One 2010 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 99.1

CAPITAL ONE FINANCIAL CORPORATION (COF)

Reconciliation of Non-GAAP Measures and Regulatory Capital Measures

We refer to our consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles

(“GAAP”) as our “reported” or GAAP financial statements. Effective January 1, 2010, we prospectively adopted two new

consolidation accounting standards that resulted in the consolidation of the substantial majority of our securitization trusts that had

been previously treated as off-balance sheet. Prior to our adoption of these new consolidation accounting standards, management

evaluated the company’s performance on a non-GAAP “managed” basis, which assumed that securitized loans were not sold and the

earnings from securitized loans were classified in our results of operations in the same manner as the earnings from loans that we

owned. We believed that our managed basis information is useful to investors because it portrays the results of both on- and off-

balance sheet loans that we manage, which enables investors to understand and evaluate the credit risks associated with the portfolio

of loans reported on our consolidated balance sheet and our retained interests in securitized loans. Our non-GAAP managed basis

measures may not be comparable to similarly titled measures used by other companies.

As a result of the January 1, 2010 adoption of the new consolidation accounting standards, the accounting for the loans in our

securitization trusts in our reported GAAP financial statements is similar to how we accounted for these loans on a managed basis

prior to January 1, 2010. Consequently, we believe our managed basis presentations for periods prior to January 1, 2010 are generally

comparable to our reported basis presentations for periods beginning after January 1, 2010. In periods prior to January 1, 2010, certain

of our non-GAAP managed basis measures differed from our comparable reported measures because we assumed, for our managed

basis presentation, that securitized loans that were accounted for as sales in our GAAP financial statements remained on our balance

sheet.

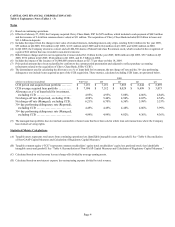

The following tables, which are described below, provide a reconciliation of reported GAAP financial measures to the non-GAAP

managed basis financial measures included in our filing. We also provide the details of the calculation of certain non-GAAP capital

measures that management uses in assessing its capital adequacy.

Page

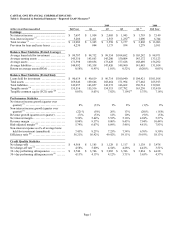

Table 1: Financial & Statistical Summary—Reported

GAAP Measures

— Reflects selected financial measures from our consolidated

GAAP financial statements or metrics calculated based on

our consolidated GAAP financial statements. 1

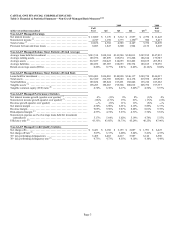

Table 2: Financial & Statistical Summary—Non-

GAAP Securitization Reconciliation Adjustments

— Presents the reconciling differences between our reported

GAAP financial measures and our non-GAAP managed

basis financial measures. These differences include certain

reclassifications that assume loans securitized by Capital

One and accounted for as sales and off-balance sheet

transactions in our GAAP financial statements remain on

our balance sheet. These adjustments do not impact income

from continuing operations reported by our lines of

business or the Company’s consolidated net income. 2

Table 3: Financial & Statistical Summary—Non-

GAAP Managed Basis Measures

— Reflects selected financial measures and related metrics

based on our non-GAAP managed basis results. 3

Table 4: Explanatory Notes (Tables 1 - 3) — Includes explanatory footnotes that provide additional

information for certain financial and statistical measures

presented in Tables 1, 2 and 3. 4

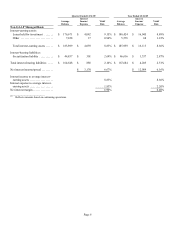

Table 5: Reconciliation of Non-GAAP Average

Balances, Net Interest Income and Net Interest Margin

— Presents a reconciliation of our average balances and net

interest margin on a reported basis to our average balances

and net interest margin on a non-GAAP managed basis. 5

Table 6: Reconciliation of Non-GAAP Capital

Measures and Calculation of Regulatory Capital

Measures

— Presents a reconciliation of our regulatory capital measures

to certain non-GAAP capital measures.

6