Capital One 2010 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

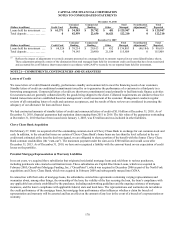

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

160

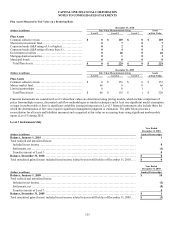

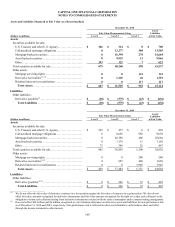

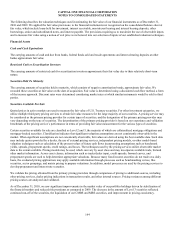

Assets and Liabilities Measured at Fair Value on a Recurring Basis

December 31, 2010

Fair Value Measurements Using

Assets/

Liabilities

at Fair Value

(Dollars in millions) Level 1 Level 2 Level 3

Assets

Securities available for sale:

U.S. Treasury and other U.S. Agency ...................

.

$ 386 $ 314 $ 0 $ 700

Collateralized mortgage obligations ....................

.

0 13,277 308 13,585

Mortgage-backed securities ............................

.

0 16,394 270 16,664

Asset-backed securities ...............................

.

0 9,953 13 9,966

Other ................................................

.

293 322 7 622

Total securities available for sale .........................

.

679 40,260 598 41,537

Other assets:

Mortgage servicing rights .............................

.

0 0 141 141

Derivative receivables(1) (2) ............................

.

8 1,265 46 1,319

Retained interests in securitization .....................

.

0 0 117 117

Total Assets .......................................

.

$ 687 $ 41,525 $ 902 $ 43,114

Liabilities

Other liabilities:

Derivative payables(1) .................................

.

$ (18) $ (575) $ (43) $ (636)

Total Liabilities ...................................

.

$ (18) $ (575) $ (43) $ (636)

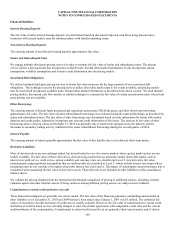

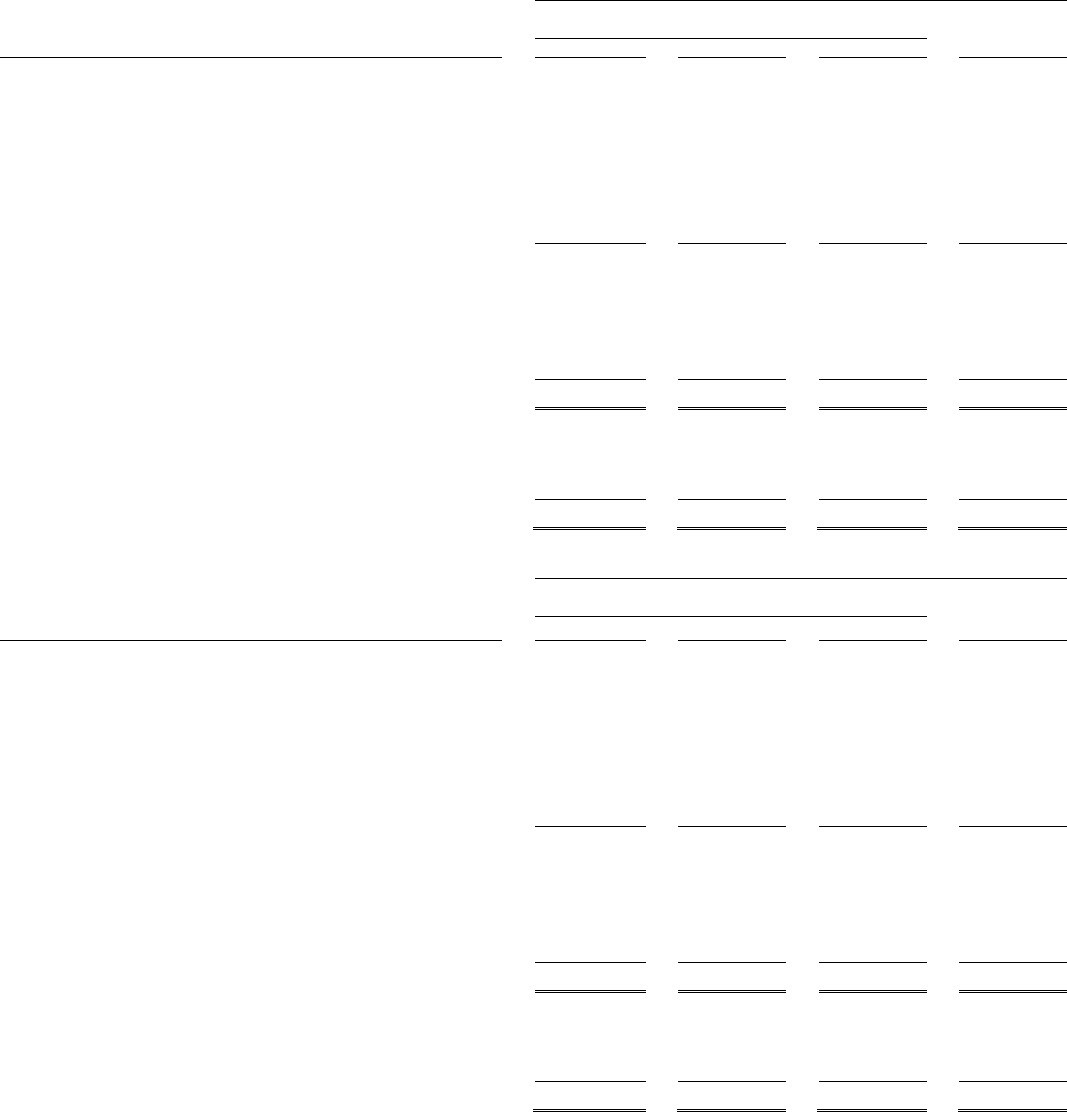

December 31, 2009

Fair Value Measurements Using Assets/

Liabilities

at Fair Value

(Dollars in millions) Level 1 Level 2 Level 3

Assets

Securities available for sale:

U.S. Treasury and other U.S. Agency ...................

.

$ 392 $ 477 $ 0 $ 869

Collateralized mortgage obligations ....................

.

0 8,656 982 9,638

Mortgage-backed securities ............................

.

0 20,198 486 20,684

Asset-backed securities ...............................

.

0 7,179 13 7,192

Other ................................................

.

73 349 25 447

Total securities available for sale .........................

.

465 36,859 1,506 38,830

Other assets:

Mortgage servicing rights .............................

.

0 0 240 240

Derivative receivables(1)(2) .............................

.

4 625 440 1,069

Retained interests in securitizations ....................

.

0 0 3,945 3,945

Total Assets .......................................

.

$ 469 $ 37,484 $ 6,131 $ 44,084

Liabilities

Other liabilities:

Derivative payables(1) (2) ...............................

.

$ 8 $ 366 $ 33 $ 407

Total Liabilities ...................................

.

$ 8 $ 366 $ 33 $ 407

________________________

(1) We do not offset the fair value of derivative contracts in a loss position against the fair value of contracts in a gain position. We also do not

offset fair value amounts recognized for derivative instruments and fair value amounts recognized for the right to reclaim cash collateral or the

obligation to return cash collateral arising from derivative instruments executed with the same counterparty under a master netting arrangement.

(2) Does not reflect $20 million and $4 million recognized as a net valuation allowance on derivative assets and liabilities for non-performance risk

as of December 31, 2010 and 2009, respectively. Non-performance risk is reflected in other assets/liabilities on the balance sheet and offset

through the income statement in other income.