Capital One 2010 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

161

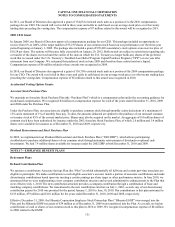

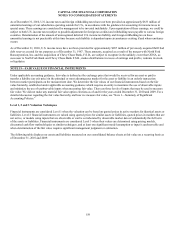

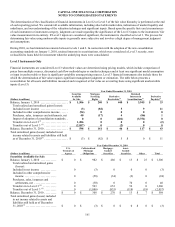

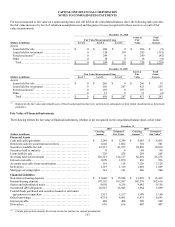

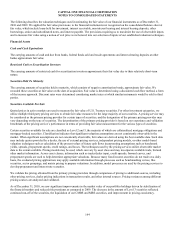

The determination of the classification of financial instruments in Level 2 or Level 3 of the fair value hierarchy is performed at the end

of each reporting period. We consider all available information, including observable market data, indications of market liquidity and

orderliness, and our understanding of the valuation techniques and significant inputs. Based upon the specific facts and circumstances

of each instrument or instrument category, judgments are made regarding the significance of the Level 3 inputs to the instruments’ fair

value measurement in its entirety. If Level 3 inputs are considered significant, the instrument is classified as Level 3. The process for

determining fair value using unobservable inputs is generally more subjective and involves a high degree of management judgment

and assumptions.

During 2010, we had minimal movements between Levels 1 and 2. In connection with the adoption of the new consolidation

accounting standards on January 1, 2010, retained interests in securitizations, which were considered a Level 3 security, were

reclassified to loans held for investment when the underlying trusts were consolidated.

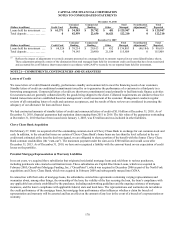

Level 3 Instruments Only

Financial instruments are considered Level 3 when their values are determined using pricing models, which include comparison of

prices from multiple sources, discounted cash flow methodologies or similar techniques and at least one significant model assumption

or input is unobservable or there is significant variability among pricing sources. Level 3 financial instruments also include those for

which the determination of fair value requires significant management judgment or estimation. The table below presents a

reconciliation for all assets and liabilities measured and recognized at fair value on a recurring basis using significant unobservable

inputs (Level 3).

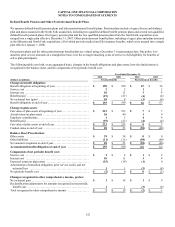

Year Ended December 31, 2010

(Dollars in millions)

Securities

Available

for Sale

Mortgage

Servicing

Rights Derivative

Receivables(2)

Retained

Interests in

Securitizations(3) Derivative

Payables(2)

Balance, January 1, 2010 ...................... $ 1,506 $ 240 $ 440 $ 3,945 $ 33

Total realized and unrealized gains (losses):

Included in net income ...................... (3) (82) 5 9 11

Included in other comprehensive income ...... (94) 0 0 0 0

Purchases, sales, issuances and settlements, net 40 (17) 4 (86) 1

Impact of adoption of consolidation standards . . 0 0 (401) (3,751) 0

Transfers in to Level 3(4) ..................... 1,206 0 0 0 (2)

Transfers out of Level 3 (4) ................... (2,057) 0 (2) 0 0

Balance, December 31, 2010 ................... $ 598 $ 141 $ 46 $ 117 $ 43

Total unrealized gains (losses) included in net

income related to assets and liabilities still held

as of December 31, 2010(5) ................... $ (3) $ (82) $ 5 $ 0 $ 11

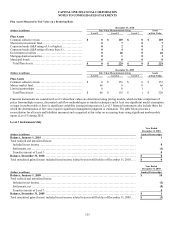

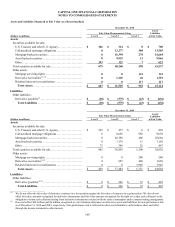

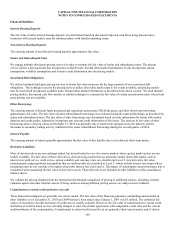

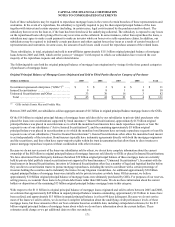

Year Ended December 31, 2010

(Dollars in millions)

U.S.

Treasury &

Agency

Collateralized

Mortgage

Obligations

Mortgage-

backed

Securities

Asset-

backed

Securities Other Total

Securities Available for Sale

Balance, January 1, 2010 ............. $ 0 $ 982 $ 486 $ 13 $ 25 $ 1,506

Total realized and unrealized gains

(losses):

Included in net income ............. 0 (3) 0 0 0 (3)

Included in other comprehensive

income .......................... 0 (58) (34) (2) 0 (94)

Purchases, sales, issuances and

settlements, net .................. 0 (30) 0 70 0 40

Transfers in to Level 3 (4) ........... 0 503 653 50 0 1,206

Transfers out of Level 3 (4) .......... 0 (1,086) (835) (118) (18) (2,057)

Balance, December 31, 2010 .......... $ 0 $ 308 $ 270 $ 13 $ 7 $ 598

Total unrealized gains (losses) included

in net income related to assets and

liabilities still held as of December

31, 2010(5) ......................... $ 0 $ (3) $ 0 $ 0 $ 0 $ (3)