Capital One 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

smaller-balance homogenous loans for impairment in accordance with applicable accounting guidance. Held for sale loans are also not

reported as impaired, as these loans are recorded at lower of cost or fair value. Impaired loans also exclude loans acquired from Chevy

Chase Bank because these loans were recorded at fair value upon acquisition and loans held for sale because these loans are recorded

at lower of cost or fair value.

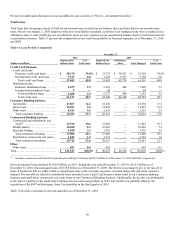

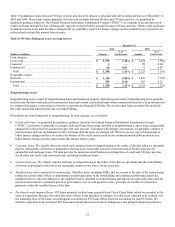

Impaired loans, including TDRs, totaled $1.5 billion as of December 31, 2010, compared with $1.0 billion as of December 31,

2009. TDRs accounted for $1.1 billion and $733 million of impaired loans as of December 31, 2010 and 2009, respectively. We

provide additional information on our impaired loans, including the allowance established for these loans, in “Note 5—Loans” and

“Note 6—Allowance for Loan and Lease Losses.”

Purchased Credit-Impaired Loans

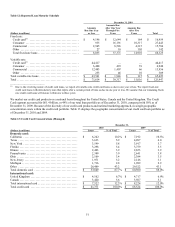

Purchased credit-impaired loans decreased to $4.2 billion as of December 31, 2010, from $5.3 billion as of December 31, 2009. Our

portfolio of purchased credit-impaired loans consists of loans acquired in the Chevy Chase Bank transaction, which were recorded at

fair value at the date of acquisition. The fair value of these loans included an estimate of credit losses expected to be realized over the

remaining lives of the loans. Therefore, no allowance for loan and lease losses was recorded for these loans as of the acquisition date.

However, we regularly update the amount of expected principal and interest to be collected from these loans and evaluate the results

on an aggregated pool basis for loans with common risk characteristics. If we determine that it is probable that the amount of expected

cash flows for any pool is less than our recorded investment, we would recognize impairment through our provision for loan and lease

losses. During 2010, we recorded impairment of $33 million related to certain loan pools. The credit performance of the remaining

pools has generally been in line with or, in some instances, better than we originally expected at the acquisition date. As a result, we

reclassified $311 million from the nonaccretable difference to accretable yield during 2010. This increase in accretable yield will be

recognized in interest income over the remaining life of these loans. We provide additional information on the loans acquired from

Chevy Chase Bank in “Note 5—Loans.”

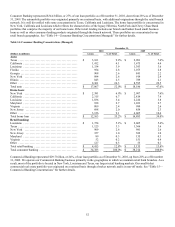

Allowance for Loan and Lease Losses

Our allowance for loan and lease losses represents management’s best estimate of incurred loan and lease credit losses inherent in our

held-for-investment portfolio as of each balance sheet date. We do not maintain an allowance for held-for-sale loans or purchased-

credit impaired loans that are performing in accordance with or better than our expectations as of the date of acquisition, as the fair

values of these loans already reflect a credit component. The allowance for loan and lease losses is increased through the provision for

loan and lease losses and reduced by net charge-offs. The provision for loan and lease losses, which is charged to earnings, reflects

credit losses we believe have been incurred and will eventually be reflected over time in our charge-offs. Charge-offs of uncollectible

amounts are deducted from the allowance and subsequent recoveries are added. We describe our process for determining our

allowance for loan and lease losses in “Note 1—Summary of Significant Accounting Policies.”

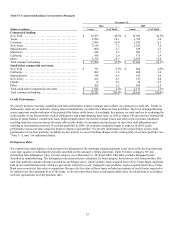

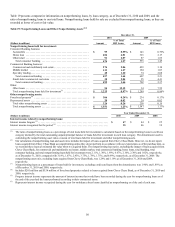

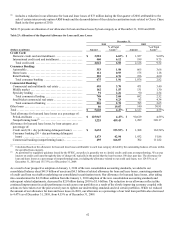

Table 22, which displays changes in our allowance for loan and lease losses for the years ended December 31, 2010, 2009 and 2008,

details, by loan type, the provision for credit losses recognized in our consolidated statements of income each period and the charge-

offs recorded against our allowance for loan and lease losses.