Capital One 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

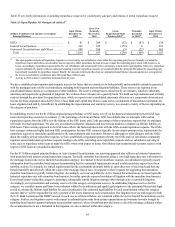

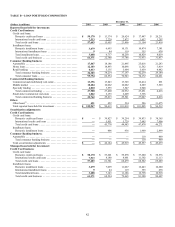

Table 32: Short-Term Borrowings

(Dollars in millions)

Maximum

Outstanding

as of any

Month-End

Outstanding

as of

Year-End Average

Outstanding

Average

Interest

Rate

Year-End

Weighted

Average

Interest

Rate

2010:

Federal funds purchased and resale agreements $ 2,469 $ 1,517 $ 1,731 0.23% 0.13%

2009:

Federal funds purchased and resale agreements . . .

.

$ 3,778 $ 1,140 $ 2,958 0.25% 0.11%

Other Funding Sources

We also access the capital markets to meet our funding needs through loan securitization transactions and the issuance of senior and

subordinated debt. In addition, we utilize advances from the FHLB that are secured by our investment securities, residential home loan

portfolio, multifamily loans, commercial real-estate loans and home equity lines of credit for our funding needs.

We have committed loan securitization conduit lines of $1.3 billion, of which $1.1 billion was outstanding as of December 31, 2010.

Senior and subordinated notes and other borrowings, including FHLB advances, totaled $14.9 billion as of December 31, 2010, down

from $17.1 billion as of December 31, 2009. The $2.1 billion decrease was primarily attributable to a reduction in FHLB advances.

Our FHLB membership is secured by our investment in FHLB stock, which totaled $269 million as of December 31, 2010. We did not

issue any senior or subordinated debt during 2010.

Borrowing Capacity

As of December 31, 2010, we had an effective shelf registration statement filed with the U.S. Securities & Exchange Commission

(“SEC”) under which, from time to time, we may offer and sell an indeterminate aggregate amount of senior or subordinated debt

securities, preferred stock, depository shares representing preferred stock, common stock, purchase contracts, warrants, units, trust

preferred securities, junior subordinated debt securities, guarantees of trust preferred securities and certain back-up obligations. There

is no limit under this shelf registration statement to the amount or number of such securities that we may offer and sell. Under SEC

rules, the shelf registration statement, which we filed in May 2009, expires three years after filing. We did not issue any securities

under the shelf registration statement in 2010.

In addition to issuance capacity under the shelf registration statement, we have access to other borrowing programs. Table 33

summarizes our borrowing capacity as of December 31, 2010.

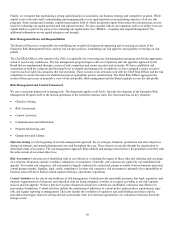

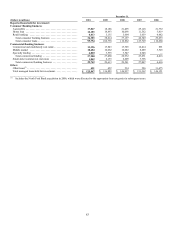

Table 33: Borrowing Capacity

(Dollars or dollar equivalents in millions) Effective

/

Issue Date Capacity(1) Outstanding Availability(1)

Final

Maturity(2)

FHLB Advances and Letters of Credit (3) ..................

—

9,823 1,394 8,429

—

Committed Securitization Conduits(4) .....................

—

1,263 1,056 207 11/11

________________________

(1) All funding sources are non-revolving. Funding availability under all other sources is subject to market conditions. Capacity is the maximum

amount that can be borrowed. Availability is the amount that can still be borrowed against the facility.

(2) Maturity date refers to the date the facility terminates, where applicable.

(3) The ability to draw down funding is based on membership status, and the amount is dependent upon the Banks’ ability to post collateral.

(4) Committed securitization conduits capacity is set at various dates in conjunction with each arrangement, with the last termination scheduled for

November 2011.