Capital One 2010 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

149

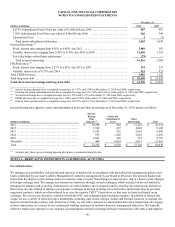

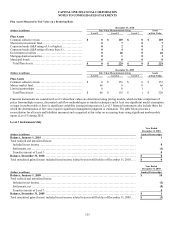

The following table provides the number of reserved common shares and the number of common shares available for future issuance

for our active stock-based compensation plan as of December 31, 2010 and 2009. The ability to issue grants from the 1999 Non-

Employee Directors Stock Incentive Plan was terminated in 2009.

Available For Issuance

(In thousands) December 31

Plan Name

Shares

Reserved 2010 2009 2008

2004 Stock Incentive Plan ..................................... 40,000(1) 16,225 17,789 4,506

________________________

(1) On April 20, 2009 the Board authorized an increase in shares reserved of 20 million shares to 40 million shares in total.

Generally the exercise price of stock options, or value of restricted stock awards, will equal the fair market value of our common stock

on the date of grant. The maximum contractual term for options is ten years, and option vesting is determined at the time of grant. The

vesting for most options is 33 1/3 percent per year beginning with the first anniversary of the grant date. For restricted stock granted

before 2010, the vesting was usually 25 percent on the first and second anniversaries of the grant date and 50 percent on the third

anniversary date. For restricted stock granted in 2010, the vesting is usually 33 1/3 percent per year beginning with the first

anniversary of the grant date.

We also issue cash equity units which are recorded as liabilities as the expense is recognized. Cash equity units are settled with a cash

payment for each unit vested equal to the average fair market value of our common stock for the 20 trading days preceding the vesting

date. Because they are settled in cash with no opportunity for any shares to be issued at vesting or settlement, cash equity units are not

included in shares reserved or available for issuance. For cash equity units granted before 2010, the vesting was usually 25 percent on

the first and second anniversaries of the grant date and 50 percent on the third anniversary date. For cash equity units granted in 2010,

vesting will usually be 33 1/3 percent per year beginning with the first anniversary of the grant date.

We recognize compensation expense on a straight line basis over the entire award’s vesting period for any awards with graded vesting

attributes. Total compensation expense recognized for stock-based compensation during the years 2010, 2009 and 2008 was $149

million, $146 million and $112 million, respectively. The total income tax benefit recognized in the consolidated statement of income

for stock-based compensation arrangements during the years 2010, 2009 and 2008 was $52 million, $51 million and $39 million,

respectively.

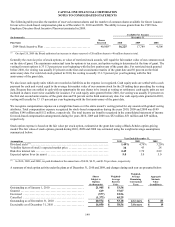

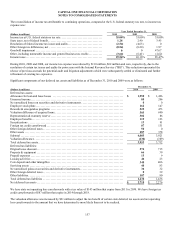

Stock option expense is based on the fair value per stock option, estimated at the grant date using a Black-Scholes option-pricing

model. The fair value of stock options granted during 2010, 2009 and 2008 was estimated using the weighted average assumptions

summarized below:

Year Ended December 31,

Assumptions 2010 2009 2008

Dividend yield (1) ..............................................................

.

1.49% 4.79% 3.20%

Volatility factors of stock’s expected market price ...............................

.

38 43 28

Risk-free interest rate ..........................................................

.

2.49 1.79 2.89

Expected option lives (in years) ................................................

.

5.0 5.0 5.0

________________________

(1) In 2010, 2009, and 2008, we paid dividends at the annual rate of $0.20, $0.53, and $1.50 per share, respectively.

A summary of stock option activity under the plans as of December 31, 2010 and 2009, and changes during each year are presented below:

Shares

Subject to

Options

(in thousands)

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(in millions)

Outstanding as of January 1, 2010 ........................... 21,905 $ 53.58

Granted ................................................... 619 37.07

Exercised ................................................. (577) 22.56

Cancelled ................................................. (1,373) 65.29

Outstanding as of December 31, 2010 ....................... 20,574 $ 53.18 4.6 years $ 83

Exercisable as of December 31, 2010 ........................ 16,050 $ 58.56 3.8 years $ 19