Capital One 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

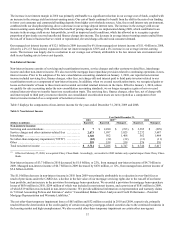

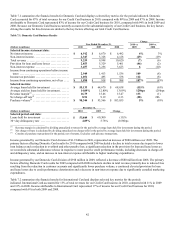

The increase in net interest margin in 2010 was primarily attributable to a significant reduction in our average cost of funds, coupled with

an increase in the average yield on interest-earning assets. Our cost of funds continued to benefit from the shift in the mix of our funding

to lower cost consumer and commercial banking deposits from higher cost wholesale sources. Also, the overall interest rate environment,

combined with our disciplined pricing, drove a decrease in our average deposit interest rates. The increase in the average yield on our

interest-earning assets during 2010 reflected the benefit of pricing changes that we implemented during 2009, which contributed to an

increase in the average yield on our loan portfolio, as well as improved credit conditions, which has allowed us to recognize a greater

proportion of previously reserved uncollected finance charges into income. The decrease in average interest-earning assets resulted from

the run-off of loans in business that we exited or repositioned, elevated charge-offs and weak consumer demand.

Our managed net interest income of $12.1 billion in 2009 increased by 6% from managed net interest income of $11.4 billion in 2008,

driven by a 2% (13 basis points) expansion of our net interest margin to 6.50% and a 4% increase in our average interest-earning

assets. The increase was largely due to a reduction in our average cost of funds, attributable to the low interest rate environment and

shift in our funding mix to lower cost deposits.

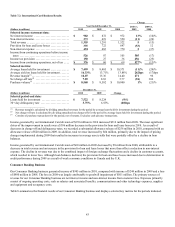

Non-Interest Income

Non-interest income consists of servicing and securitizations income, service charges and other customer-related fees, interchange

income and other non-interest income. We also record the mortgage loan repurchase provision related to continuing operations in non-

interest income. Prior to the adoption of the new consolidation accounting standards on January 1, 2010, our reported non-interest

income included servicing fees, finance charges, other fees, net charge-offs and interest paid to third party investors related to our

securitization trusts as a component of non-interest income. In addition, when we created securitization trusts, we recognized gains or

losses on the transfer of loans to these trusts and recorded our initial retained interests in the trusts. Effective January 1, 2010, unless

we qualify for sale accounting under the new consolidation accounting standards, we no longer recognize a gain or loss or record

retained interests when we transfer loans into securitization trusts. The servicing fees, finance charges, other fees, net of charge-offs

and interest paid to third party investors related to our consolidated securitization trusts are now reported as a component of net

interest income instead of as a component of non-interest income.

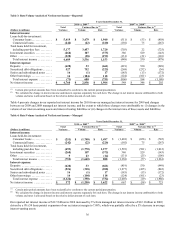

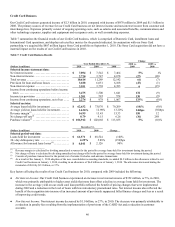

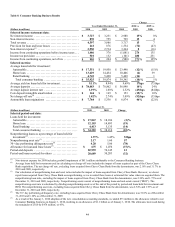

Table 5 displays the components of non-interest income for the years ended December 31, 2010, 2009 and 2008.

Table 5: Non-Interest Income

Year Ended December 31,

2010 2009(1) 2008

(Dollars in millions) Reported Reported Managed Reported Managed

Non-interest income:

Servicing and securitizations ............................. $ 7 $ 2,280 $ (193) $ 3,385 $ (299

)

Service charges and other customer-related fees ........... 2,073 1,997 3,025 2,232 3,687

Interchange ............................................. 1,340 502 1,408 562 1,464

N

et othe

r

-than-temporary impairment (“OTTI”) ........... (65) (32) (32) (11) (11

)

Other .................................................. 359 539 539 576 576

Total non-interest income ................................ $ 3,714 $ 5,286 $ 4,747 $ 6,744 $ 5,417

________________________

(1) Effective February 27, 2009, we acquired Chevy Chase Bank. Accordingly, our results for 2009 include only a partial impact from Chevy Chase

Bank.

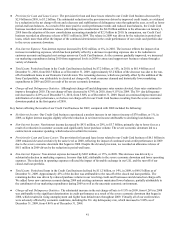

Non-interest income of $3.7 billion in 2010 decreased by $1.0 billion, or 22%, from managed non-interest income of $4.7 billion in

2009. Managed non-interest income of $4.7 billion in 2009 decreased by $670 million, or 12%, from managed non-interest income of

$5.4 billion in 2008.

The $1.0 billion decrease in non-interest income in 2010 from 2009 was primarily attributable to a reduction in over-limit fees as

result of provisions under the CARD Act, a decline in the fair value of our mortgage servicing rights due to the run-off of our home

loan portfolio, and an increase in the provision for mortgage loan repurchases. We recorded a provision for mortgage loan repurchase

losses of $636 million in 2010, $204 million of which was included in non-interest income, and a provision of $181 million in 2009,

of which $19 million was included in non-interest income. We provide additional information on representation and warranty claims

in “Critical Accounting Polices and Estimates” and in “Consolidated Balance Sheet Analysis and Credit Performance—Potential

Mortgage Representation and Warranty Liabilities.”

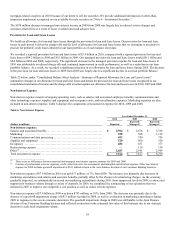

The net other-than-temporary impairment losses of $65 million and $32 million recorded in 2010 and 2009, respectively, primarily

resulted from the deterioration in the credit quality of certain non-agency mortgage-related securities due to the continued weakness in

the housing market and high unemployment. We also recorded other-than-temporary impairment on certain other non-agency