Capital One 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

109

Scope Exception for Embedded Credit Derivatives

In March 2010, the FASB issued new accounting guidance on embedded credit derivatives. This new accounting guidance clarifies the

scope exception for embedded credit derivatives and defines which embedded credit derivatives are required to be evaluated for

bifurcation and separate accounting. The guidance is effective on the first day of the first fiscal quarter beginning after June 15, 2010.

In the third quarter, we recorded a cumulative effect adjustment to beginning retained earnings of $16 million, related to the adoption

of this accounting guidance.

Fair Value Measurements and Disclosures—Improving Disclosures about Fair Value Measurements

In January 2010, the FASB issued new accounting guidance on improving disclosures about fair value measurements which amends

the guidance for fair value measurements and disclosures. The new guidance requires disclosure of significant transfers between Level

1 and Level 2 of the fair value hierarchy for fiscal years beginning after December 15, 2009 and requires separate disclosures be

presented for the gross amount of Level 3 activity for purchases, sales, issuances and settlements for fiscal years beginning December

15, 2010. The adoption of this new accounting guidance to disclose significant transfers between Level 1 and Level 2 and activity

in Level 3 of the fair value hierarchy did not have a material impact on our consolidated financial statements.

Accounting for Transfers of Financial Assets and Consolidation of VIEs

In June 2009, the FASB issued two new accounting standards that amended guidance applicable to the accounting for transfers of

financial assets and the consolidation of VIEs. The guidance in these standards was effective for fiscal years beginning after

November 15, 2009. The accounting standard for transfers of financial assets was applicable on a prospective basis to new transfers,

while the accounting standard relating to consolidation of VIEs was required to be applied prospectively to all entities within its scope

as of the date of adoption. Effective January 1, 2010, we prospectively adopted these new accounting standards. As shown above

under “Special Purpose Entities and Variable Interest Entities,” the adoption of these new consolidation accounting standards on

January 1, 2010 resulted in a cumulative effect after-tax charge to retained earnings of $2.9 billion.

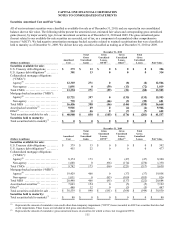

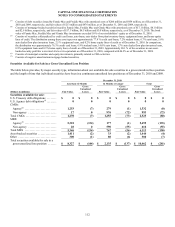

NOTE 2—ACQUISITIONS AND RESTRUCTURING ACTIVITIES

Acquisitions

On February 27, 2009, we acquired all of the outstanding common stock of Chevy Chase Bank in exchange for our common stock and

cash with a total value of $476 million. Under the terms of the stock purchase agreement, Chevy Chase Bank common stockholders

received $445 million in cash and 2.56 million shares of our common stock. In addition, to the extent that losses on certain of Chevy

Chase Bank’s mortgage loans are less than the level reflected in the net expected principal losses estimated at the time the deal was

signed, we will share a portion of the benefit with the former Chevy Chase Bank common stockholders (the “earn-out”). The

maximum payment under the earn-out is $300 million and would occur after December 31, 2013. We have not recognized a liability

related to this earn-out as of December 31, 2010 or 2009, and we currently do not expect to make any payments associated with the

earn-out based on estimated credit losses related to this portfolio. Subsequent to the closing of the acquisition all of the outstanding

shares of preferred stock of a wholly-owned subsidiary of Chevy Chase Bank and the subordinated debt of its wholly-owned REIT

(Real Estate Investment Trust) subsidiary, were redeemed. Subsequent to acquisition, Chevy Chase Bank’s results of operations are

reflected in our consolidated financial statements.

Restructuring Activities

In 2009, we completed the broad-based initiative started in 2007 to reduce expenses and improve our competitive cost position.

Restructuring initiatives leveraged the capabilities of infrastructure projects in several of our businesses. The scope and timing of the

cost reductions were the result of an ongoing, comprehensive review of operations within and across our businesses.

Total incurred charges exceeded the original estimate of $300 million by $63 million. The increase occurred because we extended the

initiative past the original timeline due to the continued economic deterioration. Approximately half of these charges were related to

severance benefits, while the remaining charges were associated with items such as contract and lease terminations and consolidation

of facilities and infrastructure. We recognized restructuring expense of $119 million and $134 million in 2009 and 2008, respectively.

We did not recognize any restructuring expense in 2010.