Capital One 2010 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 5

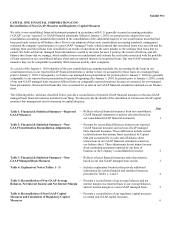

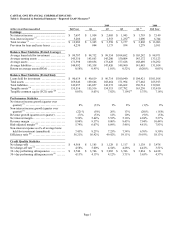

CAPITAL ONE FINANCIAL CORPORATION (COF)

Table 5: Reconciliation of Non-GAAP Average Balances, Net Interest Income and Net Interest Margin(1)

Quarter Ended 12/31/09 Year Ended 12/31/09

(dollars in millions)(unaudited)

Average

Balance

Interest

Income/

Expense

Yield/

Rate

Average

Balance

Interest

Income/

Expense

Yield/

Rate

Reported Basis

Interest-earning assets:

Loans held for investment ........ $ 133,219 $ 2,512 7.54% $ 136,697 $ 10,367 7.58%

Other ........................... 10,444 83 3.18% 8,596 297 3.46%

Total interest-earning assets ....... $ 143,663 $ 2,595 7.23% $ 145,293 $ 10,664 7.34%

Interest-bearing liabilities:

Securitization liability ............ $ 4,249 $ 54 5.08% $ 5,516 $ 282 5.11%

Total interest-bearing liabilities ..... $ 124,060 $ 641 2.07% $ 126,583 $ 2,967 2.34%

N

et interest income/spread .......... $ 1,954 5.16% $ 7,697 5.00%

Interest income to average interest-

earning assets .................... 7.23% 7.34%

Interest expense to average interest-

earning assets .................... 1.78% 2.04%

N

et interest margin ................. 5.45% 5.30%

Quarter Ended 12/31/09 Year Ended 12/31/09

Average

Balance

Interest

Income/

Expense

Yield/

Rate

Average

Balance

Interest

Income/

Expense

Yield/

Rate

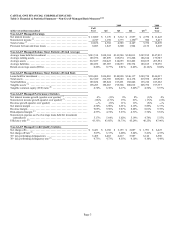

Non-GAAP Securitization

Reconciliation Adjustments

Interest-earning assets:

Loans held for investment ........ $ 43,452 $ 1,530 1.61% $ 43,727 $ 5,678 1.31%

Other ........................... (3,216) (66) (2.24)% (3,061) (229) (2.23)%

Total interest-earning assets ....... $ 40,236 $ 1,464 1.60% $ 40,666 $ 5,449 1.32%

Interest-bearing liabilities:

Securitization liability ............ $ 40,588 $ 247 (2.39)% $ 41,100 $ 1,055 (2.24)%

Total interest-bearing liabilities ..... $ 40,588 $ 247 0.09% $ 41,101 $ 1,238 0.17%

N

et interest income/spread .......... $ 1,216 1.51% $ 4,392 1.16%

Interest income to average interest-

earning assets .................... 1.60% 1.32%

Interest expense to average interest-

earning assets .................... 0.15% 0.22%

N

et interest margin ................. 1.45% 1.10%