Capital One 2010 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 2

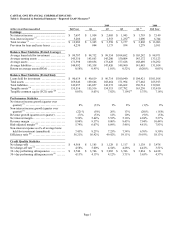

CAPITAL ONE FINANCIAL CORPORATION (COF)

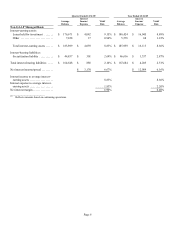

Table 2: Financial & Statistical Summary—Non-GAAP Securitization Reconciliation Adjustments

2009 2008

(dollars in millions)(unaudited) Full Year Q4 Q3 Q2 Q1 Full Year

Earnings

N

et interest income ............................. $ 4,392 $ 1,216 $ 1,207 $ 1,012 $ 957 $ 4,273

N

on-interest income ............................. (539) (213) (180) (42) (104) (1,327)

Total revenue ................................... 3,853 1,003 1,027 970 853 2,946

Provision for loan and lease losses ................ 3,853 1,003 1,027 970 853 2,946

Balance Sheet Statistics (Period Average)

Average loans held for investment ................ $ 43,727 $ 43,452 $ 44,186 $ 43,331 $ 43,940 $ 48,841

Average earning assets .......................... 40,666 40,236 40,594 40,404 41,442 46,264

Average assets .................................. 41,060 40,569 41,227 40,774 41,680 47,262

Average liabilities ............................... 41,060 40,569 41,227 40,774 41,680 47,262

Return on average assets (ROA) .................. (0.12)% (0.18)% (0.20)% (0.10)% 0.04% (0.01)%

Balance Sheet Statistics (Period End)

Loans held for investment ....................... $ 46,184 $ 46,184 $ 44,275 $ 45,177 $ 44,809 $ 45,919

Total assets ..................................... 42,743 42,743 41,219 42,184 42,496 43,962

Total liabilities .................................. 42,767 42,767 41,219 42,184 42,496 43,961

Tangible assets (A) ............................... 42,767 42,767 41,251 42,230 42,526 43,927

Tangible common equity (TCE) ratio (B) .......... (1.73)% (1.73)% (1.65)% (1.50)% (1.19)% (1.61)%

Performance Statistics

N

et interest income growth ...................... (2)% 2% 6%

—

%

—

% (5)%

N

on-interest income growth ...................... 10% (4)% (11)% 8% 3% 10%

Revenue growth ................................ 7%

—

% (1)% 1% 4% 5%

N

et interest margin .............................. 1.20% 1.46% 1.39% 1.03% 0.95% 1.00%

Revenue margin ................................ 0.11% 0.13% 0.07% 0.25% 0.07% (1.05)%

Risk-adjusted margin(C) .......................... (1.26)% (1.33)% (1.46)% (1.15)% (1.07)% (2.02)%

N

on-interest expense as a% of average loans held

for investment (annualized) ...................... (2.26)% (2.59)% (2.23)% (2.15)% (2.02)% (2.75)%

Efficiency ratio (D) ............................... (12.86)% (13.07)% (11.19)% (13.82)% (13.68)% (10.17)%

Credit Quality Statistics

N

et charge-offs ................................. $ 3,853 $ 1,003 $ 1,027 $ 970 $ 853 $ 2,947

N

et charge-off rate .............................. 1.29% 1.33% 1.46% 1.36% 1.00% 0.84%

30+ day performing delinquencies ................ $ 2,719 $ 2,719 $ 2,434 $ 2,241 $ 2,312 $ 2,178

30+ day performing delinquency rate ............. 0.60% 0.60% 0.43% 0.39% 0.45% 0.12%