Capital One 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

137

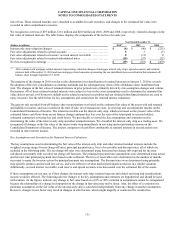

MSR fair value adjustments in 2010 and 2009 included decreases of $28 million and $31 million, respectively, due to run-off and cash

collections, and decreases of $41 million and $6 million, respectively, due to changes in the valuation inputs and assumptions.

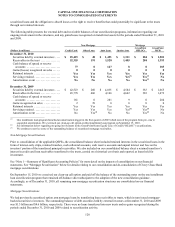

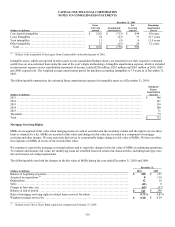

The significant assumptions used in estimating the fair value of the MSRs as of December 31, 2010 and 2009 were as follows:

December 31,

2010 2009

Weighted average prepayment rate (includes default rate) ......................................... 14.25% 17.61%

Weighted average life (in years) ................................................................. 6.07 5.15

Discount rate .................................................................................. 10.23% 11.46%

The decrease in the weighted average prepayment rate and the corresponding increase in weighted average life, were both driven by a

reduction in voluntary attrition due to market conditions.

At December 31, 2010, the sensitivities to immediate 10% and 20% increases in the weighted average prepayment rates would

decrease the fair value of mortgage servicing rights by $6 million and $12 million, respectively.

At December 31, 2010, the sensitivities to immediate 10% and 20% adverse changes in servicing costs would decrease the fair value

of mortgage servicing rights by $11 million and $23 million, respectively.

As of December 31, 2010, our mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid principal

balance of $30.8 billion, of which $20.2 billion was serviced for other investors. As of December 31, 2009, our mortgage loan

servicing portfolio consisted of mortgage loans with an aggregate unpaid principal balance of $43.0 billion, of which $30.3 billion was

serviced for other investors.

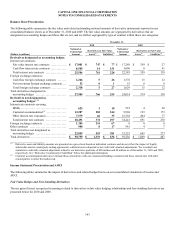

NOTE 9—PREMISES, EQUIPMENT & LEASE COMMITMENTS

Premises and Equipment

Premises and equipment are stated at cost less accumulated depreciation and amortization. We capitalize direct costs (including

external costs for purchased software, contractors, consultants and internal staff costs) for internally developed software projects that

have been identified as being in the application development stage. Depreciation and amortization expenses are computed generally by

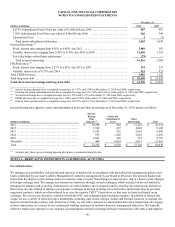

the straight-line method over the estimated useful lives of the assets. Useful lives for premises and equipment are as follows:

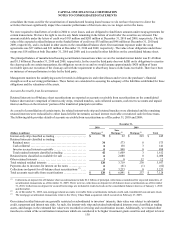

Premises & Equipment Useful Lives

Buildings and improvement ................................................................................ 5-39 years

Furniture and equipment ................................................................................... 3-10 years

Computers and software ................................................................................... 3-7 years

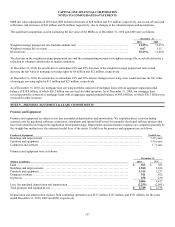

Premises and equipment were as follows:

December 31,

(Dollars in millions) 2010 2009

Land .......................................................................................... $ 562 $ 583

Buildings and improvements .................................................................... 1,948 1,836

Furniture and equipment ........................................................................ 1,315 1,237

Computer software ............................................................................. 921 922

In process ..................................................................................... 258 239

5,004 4,817

Less: Accumulated depreciation and amortization ................................................. (2,255) (2,081)

Total premises and equipment, net ............................................................... $ 2,749 $ 2,736

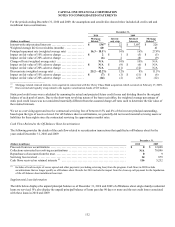

Depreciation and amortization expense from continuing operations was $327 million, $327 million, and $331 million, for the years

ended December 31, 2010, 2009 and 2008, respectively.