Capital One 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

158

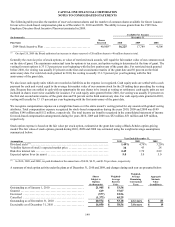

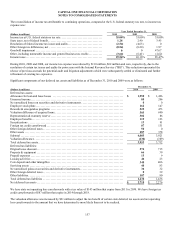

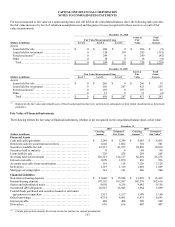

The deferred tax liability for original issue discount represents interchange, late fees, cash advance fees and overlimit fees. These

items are generally treated as original issue discount (“OID”) for tax purposes and recognized over the life of the related credit card

receivables. These items are recognized in the income statement as income in the year earned. For income statement purposes, late

fees are reported as interest income, and interchange, cash advance fees and overlimit fees are reported as non-interest income.

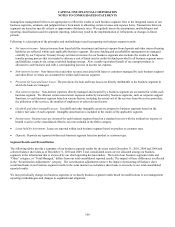

December 31,

(Dollars in millions) 2010 2009

Original Issue discount:

OID—late fees ............................................................................ $ 387 $ 512

OID—all other ............................................................................ 1,192 1,461

Gross original issue discount ............................................................... 1,579 1,973

N

et deferred tax liability ................................................................... $ 574 $ 715

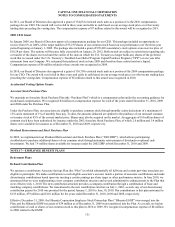

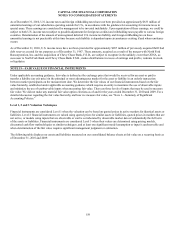

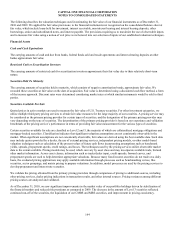

The accounting guidance for income taxes clarifies the accounting for uncertainty in income taxes, and prescribes a recognition

threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be

taken in a tax return. The guidance also provides rules on derecognition, classification, interest and penalties, accounting in interim

periods, disclosure, and transition.

We recognize accrued interest and penalties related to unrecognized tax benefits as a component of income tax expense. During 2010,

2009 and 2008, $(62) million, $(7) million and $30 million, respectively, of net interest and penalties was included in income tax

expense. The accrued balance of interest and penalties related to unrecognized tax benefits is presented in the table below.

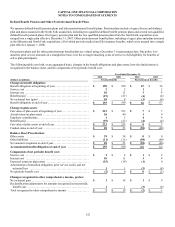

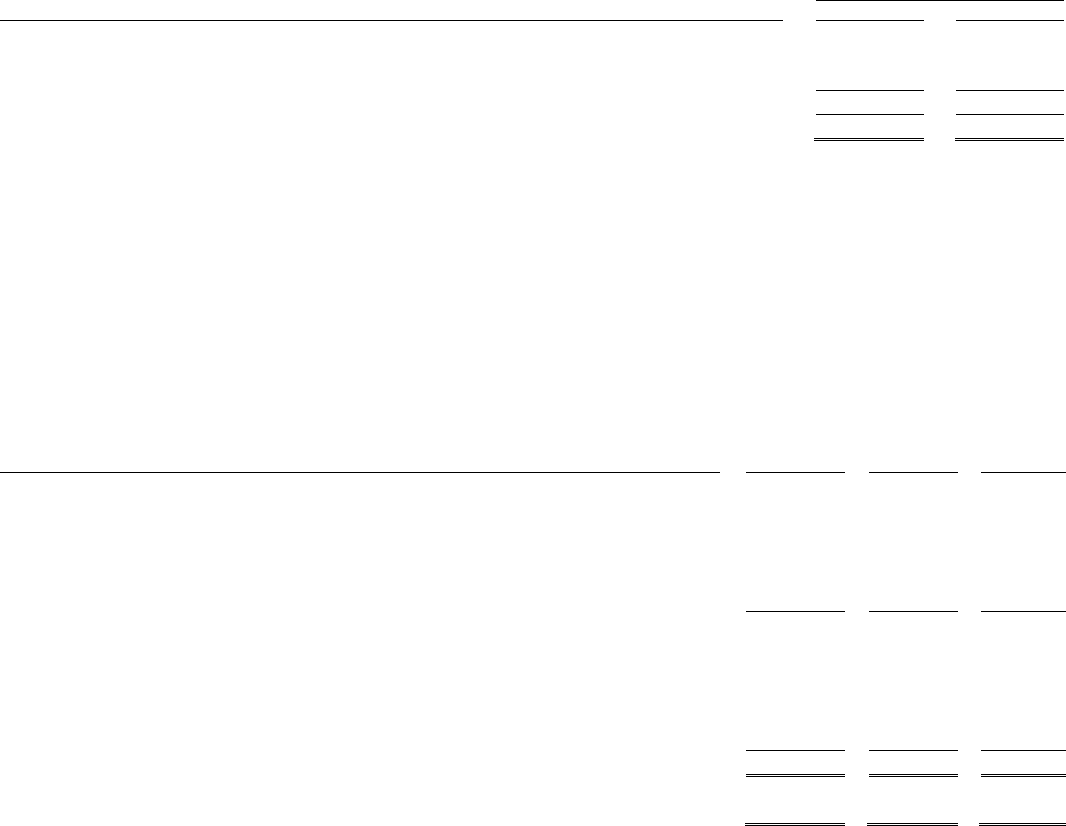

A reconciliation of the change in unrecognized tax benefits from January 1, 2009 to December 31, 2010 is as follows:

(Dollars in millions)

Gross

Unrecognized

Tax Benefits

Accrued

Interest and

Penalties

Gross Tax,

Interest and

Penalties

Balance at January 1, 2009 .......................................................... $ 561 $ 176 $ 737

Additions for tax positions related to the current year .................................. 8 0 8

Additions for tax positions related to prior years ....................................... 43 35 78

Reductions for tax positions related to prior years due to IRS and other settlements....... (255 ) (110) (365)

Additions for tax positions related to acquired entities in prior years, offset to goodwill ... 7 1 8

Other reductions for tax positions related to prior years ................................ (5 ) (2) (7)

Balance at December 31, 2009 ....................................................... 359 100 459

Additions for tax positions related to the current year .................................. 0 0 0

Additions for tax positions related to prior years ....................................... 0 8 8

Reductions for tax positions related to prior years due to IRS and other settlements....... (72 ) (43) (115)

Additions for tax positions related to acquired entities in prior years, offset to goodwill ... 0 0 0

Other reductions for tax positions related to prior years ................................ (2 ) 0 (2)

Balance at December 31, 2010 ....................................................... $ 285 $ 65 $ 350

Portion of balance at December 31, 2010 that, if recognized, would impact the effective

income tax rate ................................................................... $ 108 $ 42 $ 150

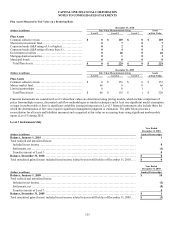

We are subject to examination by the IRS and other tax authorities in certain countries and states in which we have significant

business operations. The tax years subject to examination vary by jurisdiction. The IRS is currently examining our federal income tax

returns for the years 2007 and 2008. During 2009, we made cash payments to the IRS related to concluded examinations for 2005 and

2006, which resulted in a reduction of approximately $195 million in the balance of net unrecognized tax benefits. During 2010, no

payments were made to the IRS to reduce the balance of net unrecognized tax benefits.

On April 9, 2010, the U.S. Tax Court entered a decision in our pending case with respect to certain tax issues for the years 1995 to

1999, with both parties prevailing on certain issues. On July 6, 2010, we appealed two issues to the Fourth Circuit Court of Appeals.

The IRS prevailed on these issues in the Tax Court. The IRS did not appeal the two issues for which the Tax Court ruled in our favor

and the Tax Court’s decision on those issues is final. As a result of the non-appeal by the IRS, we reduced the amount of unrecognized

tax benefits with respect to these issues by approximately $56 million. With respect to the issues still pending on appeal, the ultimate

outcome remains uncertain and may also impact tax years after 1999. It is reasonably possible that a settlement related to these timing

issues may be made within twelve months of the reporting date. At this time, an estimate of the potential change to the amount of

unrecognized tax benefits resulting from such a settlement cannot be made.