Capital One 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

104

mortgage securitization trusts because of the combination of our power over the activities that most significantly impact the economic

performance of the trusts through the right to service the securitized loans and our obligation to absorb losses or the right to receive

benefits that could potentially be significant to the trusts through our retained interests. Therefore, effective January 1, 2010, we

consolidated on our balance sheet the underlying assets and liabilities of these trusts. We recorded the assets and liabilities of the

credit card and installment loan securitization trusts at their carrying amounts as of January 1, 2010. We recorded the assets and

liabilities of the mortgage trusts at their unpaid principal balances as of January 1, 2010, with accrued interest, allowance for loan and

lease losses or other-than-temporary impairment recognized as appropriate, using the practical expedient permitted upon adoption

because we determined that calculation of carrying values was not practical.

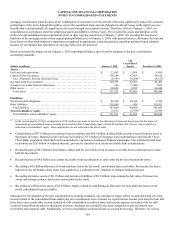

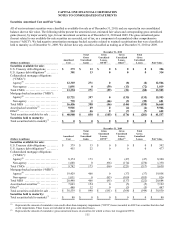

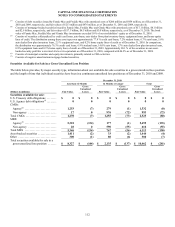

Below we present the impact on our January 1, 2010 consolidated balance sheet from the adoption of the new consolidation

accounting standards:

(Dollars in millions) January 1, 2010

VIE

Consolidation

Impact December 31, 2009

Assets:

Cash and cash equivalents ............................................. $ 12,683 $ 3,998 $ 8,685

Loans held for investment .............................................. 138,184 47,565 90,619

Less: Allowance for loan and lease losses .............................. (8,391) (4,264)(1) (4,127)

N

et loans held for investment ........................................... 129,793 43,301 86,492

Accounts receivable from securitizations ................................. 166 (7,463) 7,629

Other assets .......................................................... 68,869 2,029 66,840

Total assets ........................................................ $ 211,511 $ 41,865 $ 169,646

Liabilities:

Securitized debt obligations ............................................ $ 48,300 $ 44,346 $ 3,954

Other liabilities ....................................................... 139,560 458 139,102

Total liabilities ..................................................... 187,860 44,804 143,056

Total stockholders’ equity ............................................ 23,651 (2,939)(1) 26,590

Total liabilities and stockholders’ equity ............................... $ 211,511 $ 41,865 $ 169,646

________________________

(1) In the second quarter of 2010, an adjustment of $53 million was made to increase the allowance for loan and lease losses for the impact of

impairment on consolidated loans accounted for as troubled debt restructurings, and a related $34 million, net of taxes, was recorded as a

reduction to stockholders’ equity. These adjustments are not reflected in the above table.

• Consolidation of $47.6 billion in securitized loan receivables and $44.3 billion in related debt securities issued from the trusts to

third party investors. Included in the total loan receivables is $1.5 billion of mortgage loan securitizations related to the Chevy

Chase Bank acquisition which had not been included in our historical managed financial statements. Also included in total loan

receivables are $2.6 billion of retained interests, previously classified as accounts receivable from securitizations.

• Reclassification of $0.7 billion of net finance charge and fee receivables from accounts receivable from securitizations to loans

held for investment.

• Reclassification of $4.0 billion in accounts receivable from securitization to cash restricted for securitization investors.

• Recording a $4.3 billion allowance for loan and lease losses for the newly consolidated loan receivables. Previously, the losses

inherent in the off-balance sheet loans were captured as a reduction in the valuation of retained residual interests.

• Recording derivative assets of $0.3 billion and derivative liabilities of $0.5 billion, representing the fair value of interest rate

swaps and foreign currency derivatives entered into by the trusts.

• Recording net deferred tax assets of $1.6 billion, largely related to establishing an allowance for loan and lease losses on the

newly consolidated loan receivables.

Subsequent to the adoption of the new consolidation accounting standards, our earnings no longer reflect securitization and servicing

income related to the consolidated loans underlying our securitization trusts. Instead, we report interest income, provision for loan and

lease losses and certain other income associated with consolidated securitized loans and interest expense associated with the debt

securities issued from the trusts to third party investors. Amounts are recorded in the same categories as non-securitized loan

receivables and corporate debt. Additionally, we treat consolidated securitized loans as secured borrowings. Therefore, we will no